Four years after it was spun off from Sallie Mae, Navient Corp. has been freed from restrictions on competing with its former parent.

On Wednesday, the student loan servicer made it official, announcing plans to go head-to-head against Sallie Mae by originating private student loans to borrowers who are still in school. The initial target is modest: just $300 million for the first academic year. Still, the move has the potential to change the competitive dynamics in a market that, since the financial crisis, has been dominated by four players. Together, Sallie Mae, Discover Financial Services, Wells Fargo and Citizens Financial Group account for about 85% of private loans to current students.

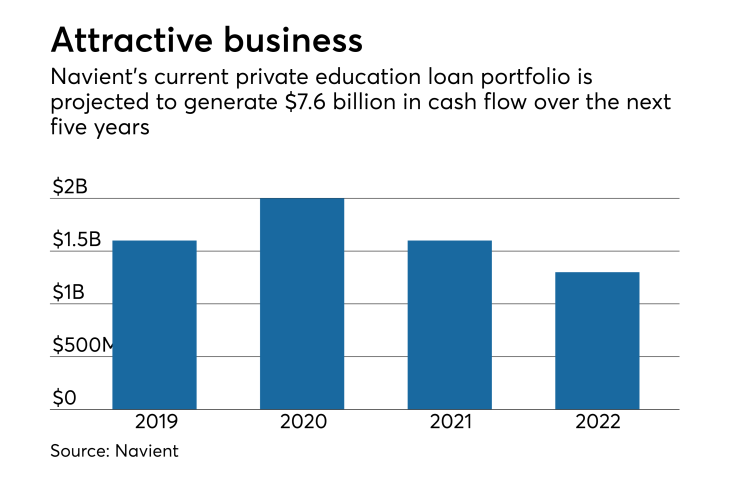

“In-school lending is an attractive opportunity and we have credit expertise and unique marketing insights that should generate access and deliver return on equity in the mid- to high teens,” Navient CEO Jack Remondi said on a conference call Wednesday following the release of fourth-quarter financial results.

Remondi offered few details about the product, except to say that it will be “a highly competitive offering that promotes responsible borrowing.”

Navient will focus on first-time borrowers, since the company expects many students and families who are already borrowing in the private market will return to their existing lenders, the CEO said. The company expects to disperse $150 million in the third quarter of 2019, which represents half of target originations; the second half would be disbursed in early 2020.

Michael Tarkan, an an analyst at Compass Point Research & Trading, said it makes sense for Navient to start off with a conservative origination target, given how mature the market is. Industry wide, originations run at $10 billion to $12 billion annually.

The expiration of Navient’s noncompete agreement also provides the company with the opportunity to market refinance loans to borrowers with loans held by Sallie Mae. Remondi said the company was already seeing the benefit of this. “January is shaping up to be the best month ever” at Earnest, the online refinance lender it acquired in 2017, he said. Navient expects to make $3 billion of refinance loans this year.

A spokesman for Sallie Mae declined to comment; however, the company is likely to field questions on Navient's plans during its own earnings conference call on Thursday.

Unlike the four biggest private student lenders, Navient cannot rely on cheap deposits for funding. However, it does have access to competitive financing in the securitization market, where it is a regular issuer of bonds backed by Federal Family Education Plan Loans and private refinance loans. With current industrywide private student loan yields in the 8%-9% range, Tarkan expects Navient may be able to pick up share through lower borrower rates.

Navient isn't alone; other firms with deep knowledge of the student loan market, including Nelnet and the Pennsylvania Higher Education Assistance Authority, plan to offer private loans to students still in school.

On Dec. 17, Nelnet officially relaunched an in-school private student loan offering under the U-Fi brand, in conjunction with Union Bank & Trust. According to the website, the product will offer undergraduate, graduate, MBA, law and health professions loans, with variable and fixed rates starting at 4.37% and 5.74%, respectively, Nelnet had previously announced plans to enter the in-school private student loan market through an industrial loan company charter, but the company withdrew its application in September.

The Pennsylvania Higher Education Assistance Agency is also preparing to launch an in-school offering, according to information posted on its website.