Marlette Funding is introducing nonprime originations to its next pool of unsecured online consumer loans, resulting in a small rise in loss expectations for its second asset-backed deal of 2019.

But any credit-quality deterioration with High Yield Prime borrowers is offset by Marlette's ongoing effort to expand pools of higher-scoring FICO borrowers, as well.

According to Kroll Bond Rating Agency, the $329.05 million Marlette 2019-2 transaction is the first of Marlette’s 11 asset-backed transactions to include loans from its High Yield Prime program initiated in 2017 to serve borrowers who don’t qualify for Marlette’s standard loan offerings.

HYP loans make up 3.5% of the new collateral pool of loans totaling $365.8 million, and for the first time lowers the minimum FICO threshold to below 640 for a Marlette deal.

Based on the resulting cash-flow analysis, Kroll is projecting net losses of between 6.9%-8.9% for the life of the next transaction, compared to the prior deal’s 6.75%-8.75% cumulative net loss range.

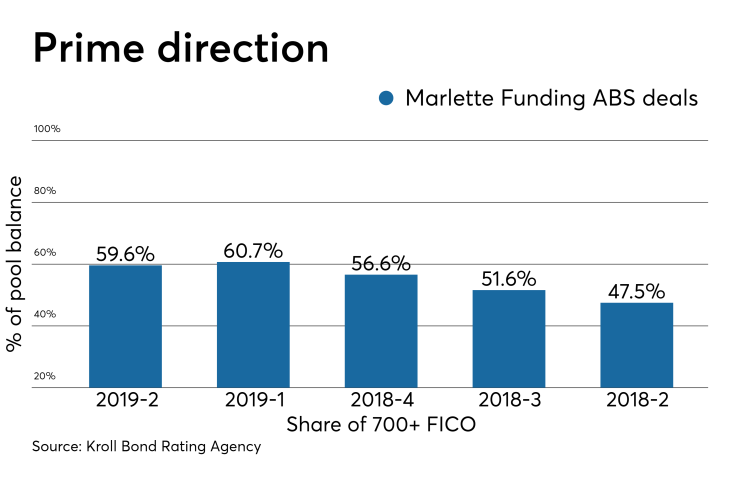

Even with the HYP loans included and a slightly lower weighted average FICO from Marlette 2019-1 (716 from 718), the new transaction still affirms the company’s tilt toward ABS pools of higher-scoring originations since last year. Nearly 60% of the loans were issued to prime borrowers with FICO scores over 700, compared to a range of 52%-57% range for Marlette’s two asset-backed issues in the latter half of last year.

Prior deals included loans from borrowers with scores as low as 640, but those borrowers were underwritten through Marlette’s prime-loan platform. The new deal includes a 0.44% share of borrowers with scores between 620 and 639.

HYP loans are limited to 36 months, and have totaled only $133 million in originations since the second quarter of 2017. (Marlette has issued $7 billion in total loans since 2013.)

Marlette 2019-2 has a preliminary AA rating from Kroll Bond Rating Agency for the $271.6 million in Class A notes. That falls short of the triple-A securitization rating attained by consumer-lending competitors like Sofi, but the 2019-2 senior-note rating is equal to Marlette’s recent deals. The credit enhancement level of 26.2% for the AA-rated class is slightly lower than the prior deal (26.6%).

The Class B notes totaling $27.8 million are rated A and the $29.6 million in Class C notes are rated BBB-.

The note proceeds will be used to pay a portion of the purchase price for the loans as well as fund a reserve account of 0.5% of the of the note balance as of the closing date.

The 27,188 loans in the pool have an average loan balance of $13,455, at an interest rate of 12.69% – levels similar to Marlette’s three prior asset-backed transactions dating back to July 2018.

The loans are split between three-year and five-year terms, with balances on the 36-month loans making up 58% of the collateral pool balance. Marlette also offers two-year and seven-year loans, but those were not included in the 2019-2 transaction. The loans have an average seasoning of three months.

Marlette, based in Wilmington, Del., issues loans that are underwritten by partner Cross River Bank, a New Jersey-chartered commercial bank. While Cross River maintains oversight of the Best Egg lending platform, the loan servicing and sales is outsourced by Marlette. (Marlette is expanding in-house servicing capabilities in a new operations center to be opened in San Antonio by the end of the third quarter.)

Marlette’s loans are exclusively funded and held by institutional investors, and a portion of the assets retained by Marlette and Cross River. Marlette had $160 million in loans on its balance sheet as of March 31.

Marlette limits loans in the pool that could expose the deal to added regulatory risk. For instance, it excludes loans from Colorado in the 2019-2 pool to shield investors from potential litigation by state regulators against Marlette over alleged excess charges to borrowers – complaints that were

Marlette also caps the interest rates on loans to borrowers in New York, Connecticut and Vermont to abide by usury caps in those states. Those three states were involved in a 2017 U.S. Second Circuit court decision (Madden v. Midland Funding) that limited federal pre-emption of state usury laws in its region. Elsewhere, loans that Marlette issues will carry the rate at origination via Cross River.

Marlette originated $2.4 billion in loans last year, including $625 million in the fourth quarter. The latter figure was up 35% year over year, according to Kroll. The privately held company

Marlette has has issued 10 prior securitizations on unsecured consumer loans (including the former Citi Held for Asset Issuance platform).