Mortgage bond investors and commercial banks typically compete to finance commercial property such as multifamily complexes, retail and office buildings. But in an unusual twist, Bancorp Bank, a Delaware state chartered commercial bank, is securitizing 30 commercial mortgages on its books.

The $304.3 million transaction, The Bancorp Commercial Mortgage 2018-CRE3 Trust, is backed by a pool of 30 floating-rate loans secured by 35 commercial properties, according to credit rating agency presale reports.

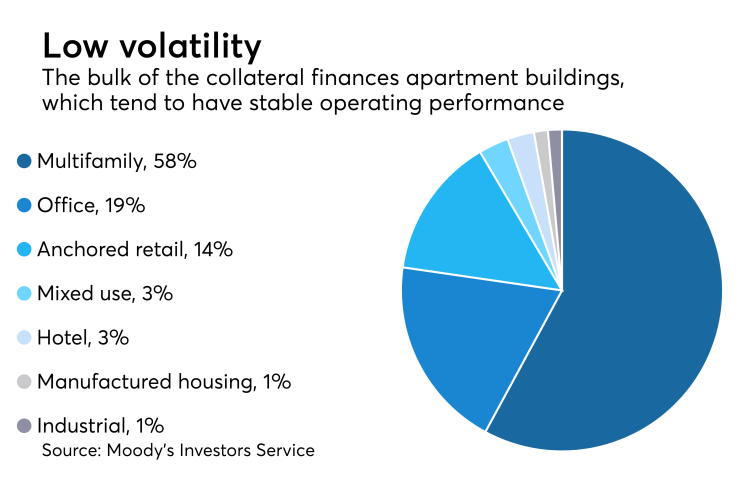

While many of the properties being financed are in a state of transition, neither Moody’s Investors Service nor DBRS is calling the transaction a commercial real estate collateralized loan obligation. CRE-CLOs have become a popular vehicle for nonbanks to finance short-term lending to properties undergoing renovation or being transitioned from one kind of use to another.

The largest loan is $34.1 million or 11.2% of the pool balance, and the 10 largest loans represent 58.7% of the pool balance.

One loan in the pool (0.6% of the pool balance) represents pari passu components of a larger first mortgage.

Among the strengths of the deal, according to Moody’s, is the fact that two loans representing 6% of the pool balance, while not rated, have credit characteristics consistent with an investment grade rating. They are Butterfield Village Apartments (3.2% of pool balance), a loan secured by a 236-unit, garden-style apartment community in Memphis, Tenn.; and Staybridge Suites Conversion (2.7% of pool balance), a loan secured by a 224-room extended- stay hotel in Kissimmee, Fla.

Another strength: Loans representing 80.1% of the pool balance were issued for the primary purpose of acquiring the subject property. Appraisal values associated with property acquisitions tend to be more robust as they coincide with a third-party trade. Acquisition loans are also more likely to be combined with fresh equity.

Also, four loans (13.4% of the pool balance) are secured by multiple properties, which benefit from greater cash flow stability and lower severity (compared to loans of equal size) given each loan's respective pooling of equity.

Major risks include the fact that many of the properties are operating at below-market occupancy, are under renovation, or have suffered due to lack of financial strength of previous ownership. “Given these circumstances, we believe there is an increased risk that these properties will not achieve healthy stabilized cash flow levels relative to what is secured in other previously rated large loan transactions,” the presale report states.

Also, Moody’s considers the transaction to be highly leveraged; it puts the loan-to-value ratio at 107.8%. After taking into account future funding commitments on the properties and debt secured by the properties that is held outside the securitization trust, the LTV rises to 119.2%.

Both Moody’s and DBRS expect to assign a triple-A rating to the senior tranche of notes to be issued, which benefits from 46% credit enhancement. DBRS has provisionally assigned ratings to five subordinate tranches ranging from AA to B.