ICON Realty Management is tapping the commercial mortgage bond market for a cashout refinancing of a portfolio of 18 apartment buildings in New York City.

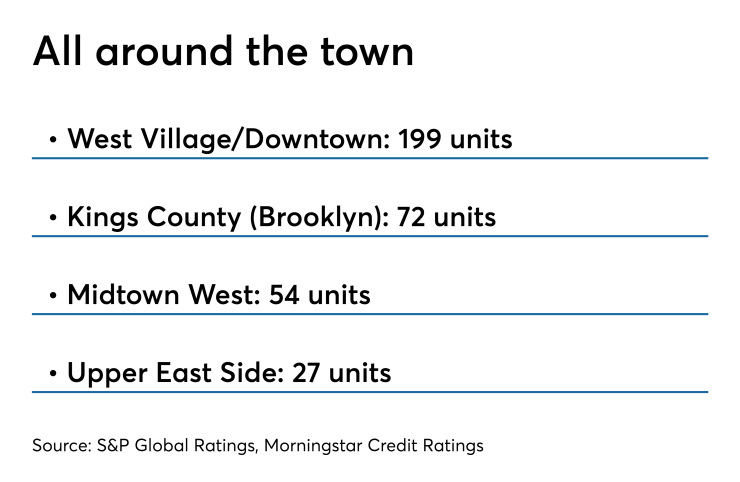

The sponsor acquired the buildings, with a mix of 352 rent-controlled, rent-stabilized and market-rate units and 16,700 square feet of commercial space, over the past 12 years for a total of $160.5 million. It subsequently invested $55.6 million upgrading 16 rent-stabilized apartments that became vacant, bringing its cost basis to $216 million.

As of December 2018, the portfolio of properties includes 243 market-rate units, 99 rent-stabilized units, 10 rent-controlled units, and 17 commercial units.

Now the company has obtained a mortgage on each of the buildings from JPMorgan Chase for a total of $174.7 million. Proceeds were used to repay $148.9 million of debt, pay approximately $6.6 million in closing costs, and cash out $18.9 million of equity, leaving ICON with $41.3 million of equity remaining in the properties, according to S&P Global Ratings.

The new loans, which pay a fixed rate of interest, and no principal, for their entire terms of five years, are being bundled into collateral for a transaction called JPMCC Mortgage Securities Trust 2019-ICON, according to rating agency presale reports.

All the mortgage loans were split into two senior notes (A-1 and A-2 notes) that rank pari passu (on equal basis) and a subordinated note (B notes). The transaction will securitize the 18 A-2 notes (totaling $60.8 million) and the 18 B notes (totaling $83.9 million). The remaining 18 A-1 notes (totaling $30 million), which rank pari passu with the A-2 notes, will not be securitized in this transaction.

The loans are not cross-collateralized, meaning one loan cannot serve as collateral for another loan. They are also not cross-defaulted, meaning a default on one loan will not trigger a default on the rest.

Among the strengths of the deal, according to both S&P and Morningstar, is the buildings' location, typically in established or desirable residential neighborhoods with strong demand characteristics, and generally within walking distance of public transportation nodes.

“Based on the land value alone, without giving any credit to the income producing improvements, the weighted average mortgage loan to land value is 114.6%, a strong reflection of the desirable locations of the properties,” S&P states in its presale report.

While the buildings' ages vary, their respective quality and condition range from average to excellent according to the appraiser. Newly renovated units include renovated kitchens with wood cabinets, granite or Caesar stone countertops, hardwood flooring, stainless steel appliances, microwaves and dishwashers. Renovated bathrooms include ceramic tile flooring and walls, porcelain sinks atop a wood vanity and porcelain tubs with chrome fixtures.

The portfolio is 99.1% occupied, based on net lettable area (inclusive of 12 units that were under renovation as of December 2018, all of which were subsequently completed and marketed for lease to market-rate tenants). According to CBRE-EA, the New York market vacancy declined to 3.2% in fourth-quarter 2018. S&P expect the strong rental demand for the portfolio units to continue.

However, Morningstar notes that all 18 properties were constructed before 1930 and require higher levels of maintenance than properties with modern structures and mechanical systems. And 109 residential units (31% of the total) are still subject to New York City’s apartment rent restrictions which limits the amount of rent that landlords can charge as long as the current tenants remain in residence. The 99 rent-stabilized units have an average rent of $1,093 per month, less than one-fourth of the $4,372-per-month rent of the market-rate apartments.

While ICON has plans to renovate rent-controlled and rent-stabilized apartments as they become vacant, Morningstar did not take this into account in calculating stabilized net cash flow for the portfolio. In its presale report, the rating agency noted that conversion of such units to market rate “does not come without legal and political risks.”

Another risk is the fact that the pool of mortgages is highly leveraged; S&P put the weighted average loan-to-value ratio at 107.3% based on its own valuations, which is 43.3% lower than that of the appraiser. The individual LTV ratios range from 96.5% to 138.4%, according to S&P.

The pool of mortgage loans has a “weak” weighted average debt service coverage ratio of 1.17x based on the rating agency’s measure of in-place net cash flows, which is 4.4% lower than that of the issuer's.

Both S&P and Morningstar expect to assign a triple-A rating to the senior tranche of notes to be issued in the transaction. S&P puts credit enhancement for these notes at 63.9%; Morningstar calculates it to be 47%.