Problems at Honor Finance highlighted the risks of granting too many extensions to subprime auto lenders. Losses on its 2016 securitization are piling up after it granted as many as 22% of borrowers extended payment holidays.

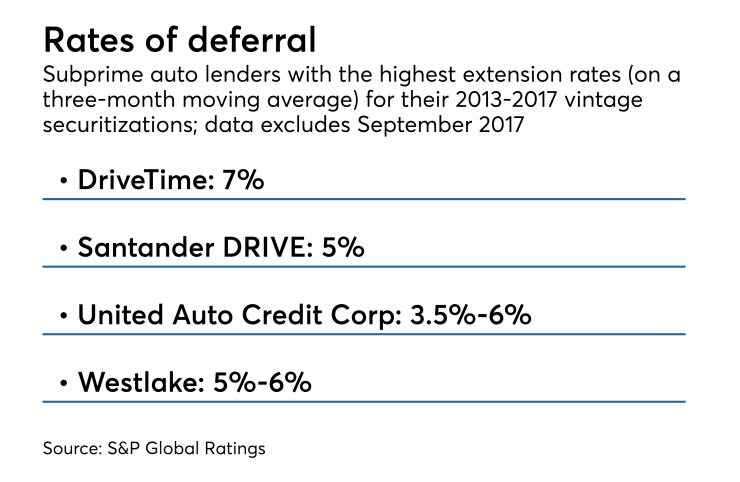

Honor isn’t alone in using this practice however; analysis by S&P Global Ratings indicates that extension rates at a number of other subprime auto lenders are creeping higher.

Though none are nearly as high as those of Honor, it’s a trend that bears watching, particularly for holders of the riskiest securities issued in subprime auto securitizations.

In a report published last week, S&P said that subprime auto lenders have employed this practice, selectively, for many years, and it believes that it has been an effective loss-mitigating tool, “when used prudently and to a modest degree.”

Extensions are usually granted no earlier than six months into the life of a loan, with typically six to 12 months between extensions, up to a maximum of anywhere between four and eight extensions over the life of the loan. However, there are differences among the securitization sponsors and how these limitations are incorporated in their transaction documents.

“Investors may want to reacquaint themselves with these provisions, as they've evolved over time,” the report states.

Most auto loans are simple interest contracts, so while interest does not capitalize during the extension period, it does continue to accrue, result in higher overall debt payments for the borrower.

The rating agency’s analysis shows that most issuers’ extension rates are within historical levels and well below Honor’s level. That said, some are allowing extensions at a “slightly higher rate,” despite the benign economic environment.

“Considering this, we believe that ongoing monitoring of extensions and modifications in this higher-risk segment of the auto ABS market is warranted, especially for the most subordinated noteholders, those rated BB or even B," the report states. "In addition to being riskier, these bonds are outstanding longer than higher-rated bonds, and so are most exposed to a shift in the composition of the pool to include a higher percentage of loans that have been modified or extended multiple times."

While subordinated classes have credit enhancement in the form of overcollateralization and a reserve account, those could be eroded quickly in a high-loss scenario, as happened with Honor’s 2016

In addition, if sponsors don't exercise their cleanup calls (when rating new transactions, we assume that they don't), the subordinated bondholders' exposure to extension risk will be exacerbated.

Furthermore, when payments are deferred on an auto loan and added to the back of the obligor's loan term, after making the requisite number of payments, the obligor will generally still have an outstanding balance due. This is attributable to the interest that accrued during the extension period.

If the servicer hasn't adequately explained this risk to the obligor, the recoupment of the remaining balance will be at greater risk of nonpayment.

The month in which servicers are required to purchase receivables extended beyond the allowable date varies. In general, though, they are usually required to purchase the affected receivables within 30-75 days of identifying them. However, S&P is aware of at least one issuer whose documents require only that the servicer purchase the affected contracts as of the month prior to the final bond payment date.