GoodGreen Trust 2021-1 is preparing $345.5 million in property-assessed clean energy (PACE) bonds, largely secured by voluntary assessments on commercial and residential properties. Florida accounts for the largest percent of the initial principal balance on the underlying assets.

It is the 10th deal overall from the Ygrene Energy Fund, one of the leading PACE financing companies. Ygrene was also the first to complete a PACE securitization that combined assessments from commercial and residential properties on properties in two states, according to green technology industry press reports.

The PACE bonds from GoodGreen 2021-1 are secured by 9,246 voluntary assessments on 9,084 residential and 162 commercial properties, according to Morningstar|DBRS.

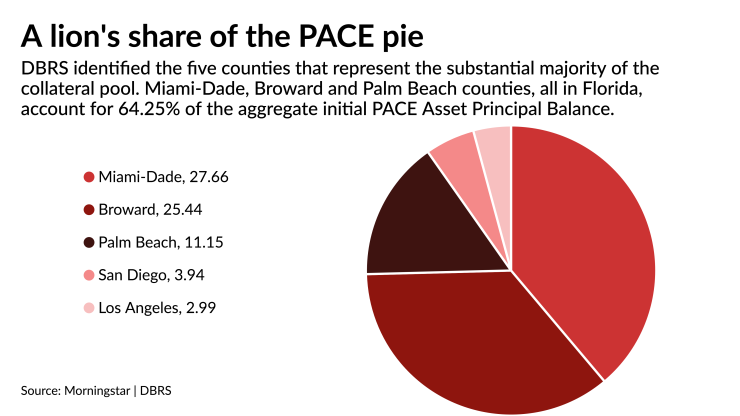

The properties are highly concentrated in 61 counties in California, Florida and Missouri. Florida’s Miami-Dade County accounts for the highest concentration of properties at 27.6%.

The PACE assets have an average balance of approximately $24,895, with a weighted annual interest rate of 7.16%, and original term of 24 and a half years.

Subordination and an interest reserve account — particularly on the Class A notes — provides initial credit enhancement on the securitization notes, which are slated to mature in October 2056. The interest account is funded to $5 million once the deal is closed, and the proceeds can be used to compensate for any potential shortfalls in cashflow to classes A, B and C after remittances are exhausted, according to DBRS.

For the Class A notes, DBRS announced a rating of ‘AAA.’ The Class B notes received a rating of ‘AA’ from the agency.