Finch Investment Group, a company that has been investing in tax liens since 2013, is tapping the securitization market for the first time.

The $209.7 million FCI Funding 2019-1, features unusually high exposure, 13.9%, to vacant land, which is generally considered to be a riskier asset than residential and commercial property, according to Kroll Bond Rating Agency. Even more unusual is the inclusion of liens on properties subject to a bankruptcy, which represent 0.27% of the portfolio.

Two tranches of rated notes will be issued in the transaction: a $199 million of Class A tranche are rated AAA by Kroll and $10.7 million of Class B notes are rated A.

MUFG Securities Americas and Capital One Securities are the initial purchasers.

The initial collateral in the transaction includes approximately $179.3 million of liens, or the bulk of the $200 million that Finch currently owns. The transaction also includes an additional tax lien account, not funded at closing, that may be used to purchase additional liens up to approximately 21% of the initial note balance. An additional $31.5 million of proceeds will be deposited in an account and can be used to purchase subsequent tax liens on properties related to either tax liens in the initial pool or tax liens purchased from the additional tax lien account.

The initial credit enhancement for the notes will consist of a $3 million reserve account, subsequent tax lien account, additional tax lien account, excess spread on the tax lien assets and in the case of the Class A notes, subordination of the Class B notes.

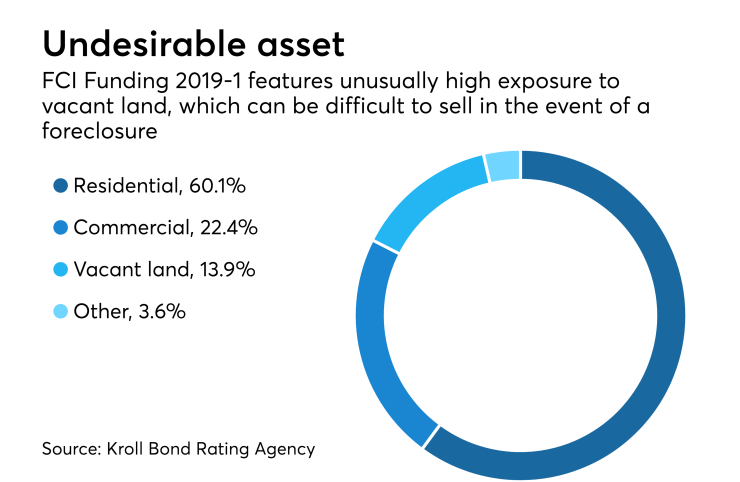

As of Jan. 31, the weighted average age of the initial collateral pool was approximately 14.2 months. The property types related to the initial portfolio consist of residential (60.1% by redemptive value), commercial (22.4%), vacant land (13.9%) and other (3.6%). Approximately 50.6% of the initial portfolio by redemptive value consists of tax lien assets within Florida, while 31.4% and 9.5% are located within New Jersey and Colorado, respectively.

The initial exposure to vacant land properties of $27 million, or 13.9% by redemptive value, as well as the maximum permissible amount of 20% are higher than in precedent property tax lien transactions, according to Kroll. And nearly half (46.1%) of the tax liens related to vacant land is zoned as non-residential, which includes commercial, agricultural, and industrial properties.

In its presale report, Kroll said it views this property type as weaker than residential and commercial properties, “primarily due to the uncertainty regarding redemptions, assessed values, and marketability in the event of foreclosure.”

The liens on these properties in bankruptcy have a weighted average LTV of approximately 16.7% and a weighted average seasoning of 33.5 months. Kroll views this negatively because of the increased risk of the property becoming repossessed and added costs associated with foreclosure.

Finch was founded in 2013; over the past five years it has purchased, managed and serviced over 300,000 tax liens with an aggregate tax redemptive value of over $700 million; as of Jan. 31, it had approximately $200 million of assets under management relating to 11 states.