Fannie Mae and Freddie Mac will be providing new loan-level disclosures about interest-rate buydowns in mortgage-backed securities this spring to address investor interest in tracking their use, which can impact prepayments.

The new disclosures applicable at the government-sponsored enterprises that buy many lenders' loans become effective April 20 for MBS issued on or after May 1, according to Fannie's capital markets division.

The move follows other actions taken at both enterprises and

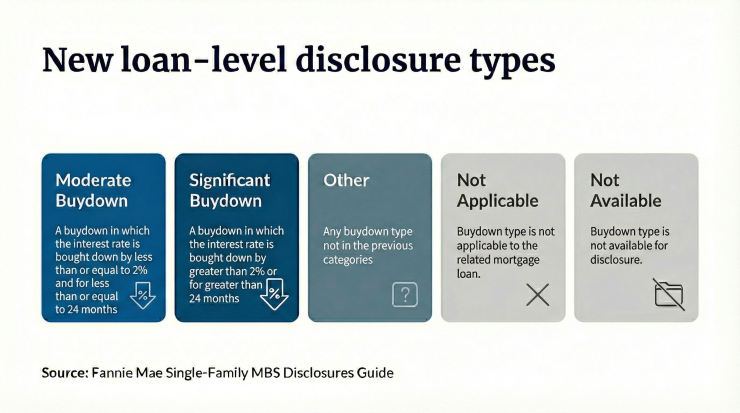

How the new disclosures will categorize loans

The new disclosures aim to increase the detail available around information previously only available at the securities level as a new loan-level attribute designated as L-117. Loans will be put into one of five different categories, according to Fannie:

- moderate buydowns that reduce the interest rate by 2% or less for up to 24 months

- significant buydown that cut the mortgage's rate by more than 2% for greater than 24 months,

- other buydowns that do not fit in either of the aforementioned categories,

- a "not applicable" designation for loans without buydowns, or

- a "not available" designation for mortgages that lack information about buydown status.

Freddie will have the same disclosures but use different terminology for the first two categories calling them temporary and extended buydowns, respectively. Identifiers for these loan types will be MT for the first category, SE for the second, O for the third, 7 for the fourth and 9 for the fifth.

There will be retroactive availability of some buydown information in monthly MBS security factor files starting on May 6 for bonds issued before January 2022. MBS issued before that time will be put in the "not available" category designed with 9 as an identifier.

Expanding interest in tracking buydown information

Investors may be interested in tracking buydowns because temporary ones can make borrowers more prone to refinance loans before payments adjust upward. That may elevate MBS prepayments and create a need for investors to reinvest principal at a lower market interest rate.

Also Bill Pulte, director of the agency that serves as the GSEs' government conservator and regulator has expressed concern about

President Trump has directed Pulte to work with the enterprises in ways that compel builders to offer more affordable new housing units. Pulte has said he is tracking builder-related loan data to that end and is in the process of

Fannie and Freddie have been in government conservatorship since the Great Financial Crisis in 2008, but have since enjoyed a long run of profitability. The Trump administration