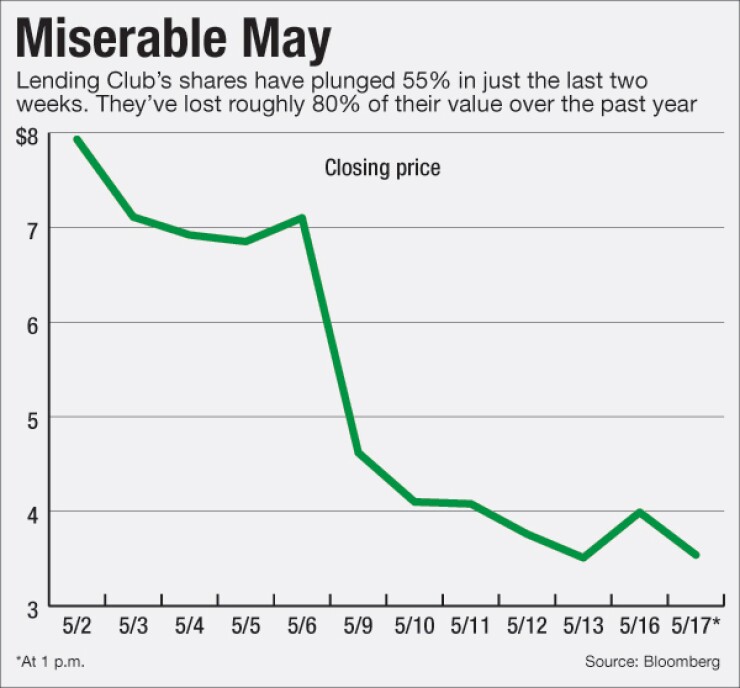

After enduring a nightmarish week in which its chief executive was ousted, its funding began drying up and the Justice Department served it with a subpoena, Lending Club now finds itself contemplating emergency maneuvers that would have been unimaginable at the start of the month.

The world's biggest marketplace lender, whose business model depends on it quickly selling its loans to investors so it can originate new ones, disclosed in a regulatory filing late Monday that it is now considering using more of its own capital to fund loans.

Over the past week, Goldman Sachs, Jefferies and other investors have reportedly stopped buying its loans, at least temporarily. "It is possible that these investors may not resume investing through our platform," Lending Club warned in the Securities and Exchange Commission filing.

The company also stated that it may need to offer "significant inducements" to loan buyers in order to lure them back to its platform. Those sweeteners could include offers of equity in Lending Club, which would dilute existing shareholders, the company stated.

It remains to be seen whether those steps will be enough to assuage loan buyers who were rattled by the May 9 ouster of founder and CEO Renaud Laplanche, as well as the company's disclosure that it discovered changes to loan data in order to fit a buyer's specifications.

The most recent disclosures show how precarious Lending Club's position is today. Lending Club acknowledged Monday that it may not be able to reach agreements with its skittish institutional loan buyers. And even if it does, the agreements will assuredly be on terms that are less favorable to Lending Club.

For years, industry critics have been arguing that a heavy reliance on continuing loan growth is a key flaw in marketplace lenders' business model. But few expected Lending Club, which was long the industry's undisputed leader, to be among the first companies to expose it.

Until quite recently, the idea of funding loans on its own was anathema at Lending Club, which long argued that its marketplace lending model is more efficient than balance-sheet lending. "We are a technology company that happens to provide a financial service," Laplanche told American Banker last year.

But Lending Club is now in survival mode. And in order to meet the meet the demand from borrowers, who often use personal loans from Lending Club to consolidate credit card debt, the company may have no choice but to turn to its own balance sheet.

As of March 31, Lending Club had $868 million in cash, cash equivalents and securities available for sale. That compared to $2.75 billion in loan originations during the first quarter.

Another potential option for Lending Club is to raise the interest rates it charges borrowers. That would suppress loan demand and while providing higher margins for investors. Lending Club has already raised its rates three times since December.