EJF Capital is sponsoring its second securitization this year, and 10th overall since 2015, of legacy trust-preferred securities and other debt from U.S. community banks and insurance companies.

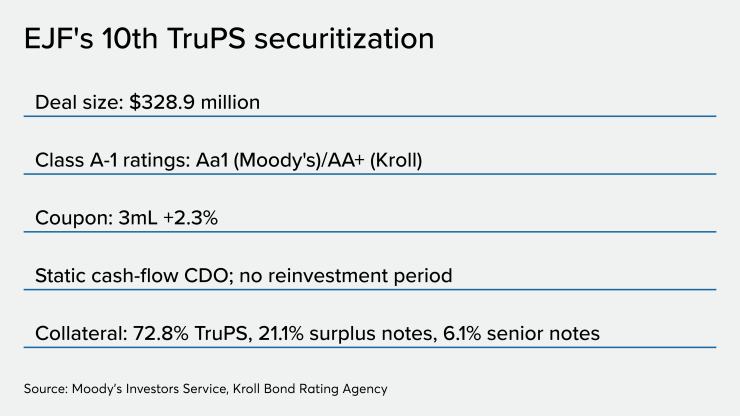

According to presale reports, EJF will market $328.9 million in bonds backed by a pool of TruPS, senior notes and insurance firm surplus notes that have been issued by both rated and unrated institutions.

The transaction’s capital stack includes a $203 million Class A-1 note tranche, with preliminary ratings of Aa1 from Moody’s Investors Service and AA+ from Kroll Bond Rating Agency. Also being sold are $30.5 million in Class A-2 notes (rated Ba2/BB) and $47.3 million in Class B notes (rated Ba2/BB).

EJF will retain $48.1 million of preferred shares, which will provide compliance with both U.S. and European risk-retention regulations.

The deal will be a static cash-flow collateralized debt obligation, meaning the manager will not be permitted to reinvest new assets in the pool, which is expected to be sized at $338.4 million when the transaction closes.

The notes will have an expected coupon of 2.3% plus three-month Libor. (For the first time in the 10 TruPS securitizations it has issued since 2015, EJF will is including Libor-replacement fallback terms to the deal to account for the likely elimination of the London interbank offered rate after 2021.)

The deal includes subordinate debt issued by a number of bank holding companies with “significant amounts” of other debt on their balance sheets, according to Moody’s in its report. Moody’s analysts also believe the deal is “moderately” concentrated, including nine issuers that make up about 2.8%-2.9%, and four are not publicly rated.

“Any moderate levels of prepayments in the portfolio are likely to push the size of any one of these assets to over 3% relative to par and hence be subject to a two-notch downgrade of its credit estimates.”

The pool consists of 72.8% (or $246.4 million) of trust-preferred securities, a hybrid stock and debt vehicle that were regularly issued pre-crisis by institutions. TruPS were sold as preferred stock shares in the sponsoring trust, and issued with long-term maturities that are non-callable for five-to-10-year non-call periods and can defer interest payments for up to five years.

TruPS fell out of favor in the post-crisis era when they were phased out as an option for shoring up Tier 1 capital ratios for large banks after the passage of the Dodd-Frank Act in 2010. Community banks have turned to issuing subordinated debt with much shorter duration obligations (typically five years of average life within a 10-year maturity) and used in supplementing only Tier 2 capital.

The deal also includes 21.1% of surplus notes, a type of highly subordinated debt issued by insurance firms. Both the TruPS and surplus notes are beyond their non-call periods.

EJF is based in Arlington, Va., and manages $7.6 billion of assets.