For the first time since the pandemic began, delinquencies among loans included in commercial mortgage-backed securities declined on a month-to-month basis, according to a Fitch Ratings analysis of its August data.

But that good news was tempered by worrisome developments: a significant number of loans were classified as newly delinquent, and a large number of mortgages continue to be sent to a special servicer since they defaulted or have the potential to do so.

August's overall delinquency rate of 4.76% was a 22-basis-point decline from

Separately, among the deals covered by DBRS Morningstar, the delinquency rate fell to 5.22%, down 34 basis points. This was the second consecutive month in which the rate declined, according to the firm.

More than $7 billion in loans cured in August against nearly $5 billion of newly delinquent loans, according to DBRS Morningstar.

"Some of the cured loans have been granted some sort of relief, which may include reduced or deferred monthly debt service payments, or the authorized use of reserves to bring the loan current," said Steve Jellinek, vice president and head of research, North American CMBS at DBRS Morningstar.

"Many of these are short-term remedies, however. Given the high likelihood that the pandemic's effects will likely continue into 2021, lenders may have to

Among the deals that Fitch rates, about $2.9 billion in delinquent commercial mortgages resolved in August. That included $1.9 billion in loans previously 60 days or more delinquent that are now classified as current.

But Fitch also stated that $2.5 billion in new delinquencies were reported last month. And 1,217 loans with an unpaid principal balance of approximately $29 billion were in special servicing at the end of August, up from 1,131 loans with a UPB of $26.1 billion.

The UPB on loans reported as 30 days delinquent fell to $5.2 billion (290 loans) in August from $6.9 billion (373 loans) in July and a peak of $15.7 billion in June.

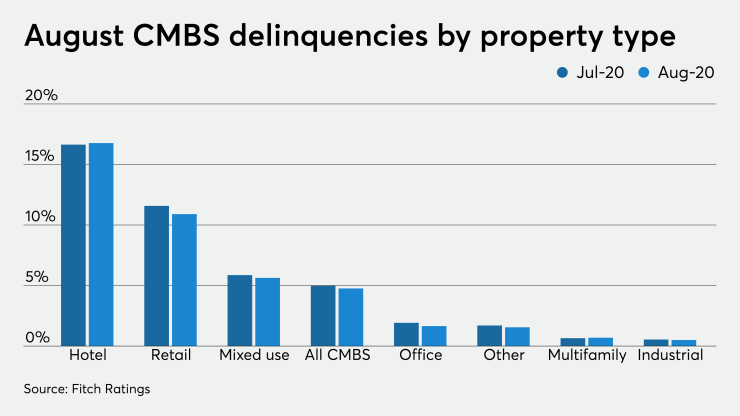

Commercial mortgages by property type

The two most affected property types during the pandemic so far — hotel and retail — comprised 42% ($2.2 billion) and 36% ($1.9 billion), respectively, of the total in August, according to Fitch.

During August, retail delinquencies fell 58 basis points from July — the most among all the property types by far — to 10.9%; the regional mall subcategory had a 90-basis-point decline, but is still extraordinarily high at 19%.

Hotel delinquencies rose by 13 bps to 16.77%. The only other property type in Fitch-rated deals to have increased delinquencies is multifamily, up by 4 bps, but still relatively low at 0.69%.

DBRS Morningstar reported that the UPB on delinquent hotel and retail properties in its rated deals fell under $20 billion in August. Delinquencies in hotel CMBS fell 113 bps from July to 22.43%, while for retail, it was down 78 bps to 15.32%.

Multifamily delinquencies were down 11 bps to 0.87%.

The multifamily defaults remain low for now, but the Center for Disease Control's

"Rental assistance is a major tool that should be used to keep families in their homes, while also protecting the safety and soundness of the entire multifamily finance market," Broeksmit said.

The delinquency trends are emerging a few months after a report from research firm Real Capital Analytics that looked at whether delinquency trends might bring about a distressed-debt feeding frenzy, a la the Great Recession in 2008-2009. But the study by Real Capital indicated most investors would come up short in this downturn if they went looking for bargains among CMBS assets.

Its study of CMBS 2.0 pools found that only 21% of commercial mortgage debt in 2019 was financed through CMBS, substantially lower than 2007, when the ratio was 64%, according to a June analysis from Real Capital Analytics.

The previous commercial real estate downturn and recovery shifted financing from overwhelmingly private-label to a more diverse mix of agencies, banks and insurance companies, according to Nitin Bhasin, senior managing director and co-head of CMBS ratings for Kroll Bond Rating Agency. Banks – regional, national and international – moved their shares to about 43 percent, up from 27 percent, and insurance companies also participated more, accounting for about 15 percent, up from around six percent in the previous business cycle.

In terms of underlying loan quality, loan-to-value ratios today are close to 60 percent now, compared with 70 percent before, Bhasin said.

(Additional reporting from Donna Mitchell)