Arch Capital has obtained a second credit rating for its next offering of notes linked to the performance of mortgages that it insures. The $653 million transaction, which serves as a form of reinsurance, is being rated by both Fitch Ratings and Morningstar Credit Ratings.

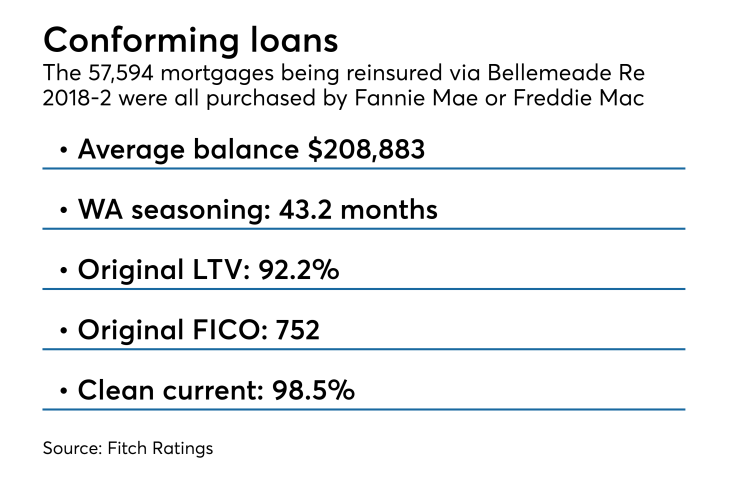

Fitch, however, still isn’t as comfortable with this new asset class as Morningstar is, and is rating the transaction several notches lower, despite the fact that the 57,594 mortgages being reinsured are less risky than those in Arch’s two previous rated deals.

Bellemeade Re 2018-2 will issue six tranches of notes; Arch is holding on to the most subordinate tranche of notes, which is unrated and represents the first loss position. The next two tranches of notes, $32 million of B1 notes and $160 million of M1C notes, are rated A by Morningstar and BBB by Fitch. The next most senior tranche, $224 million of M1B notes, is rated AA/A1 and the $237 million M1A tranche is rated AAA/A+. The most senior tranche of notes is being retained by Arch.

Proceeds from issuance of the notes will be deposited into a trust and will be available to reimburse Arch for losses covered by the insurance policies; if any funds are withdrawn, the balance of most junior notes outstanding will be written down by a corresponding amount.

Interest payments on the notes will be funded through insurance coverage premiums collected by Arch from the borrowers. If the coverage premium is not paid, Arch will have one month to remedy the missed payment. If the missed payment remains unremedied, it will trigger a mandatory termination event, where principal and interest will be due on the notes. The counterparty risk is mitigated by the premium deposit account established and fully funded with 70 days of coverage premium payments at deal close.

Fitch notes in its presale report that the premium deposit account includes an additional 25 basis points to account for Fitch’s A+ interest rate stress assumption for Libor during the two-month period.

The loans being reinsured were originated 42 months ago, on a weighted average basis, and the borrowers have demonstrated their ability to repay the loans, as 98.2% of the loans have never been delinquent, only 0.05% has been modified. That's significantly more seasoning that the collateral for Arch's two previous deals, which were rated by Morningstar alone, which were only seasoned by a few months.

The collateral for the Bellemeade Re 2018-2 also benefits from strong price appreciation, 21.8%, according to Morningstar, since the loans were made between April 2013 and December 2015. This means the borrowers more equity in their homes. Morningstar calculates that the current weighted average loan-to-value ratio is 8 percentage points lower than that of the two prior deals.

The strong seasoning also means that the private mortgage insurance Arch provides, which is only in force for borrowers with less than 20% equity in their homes, is likely to be terminated earlier.

Fitch notes in its presale report that the expected mortgage insurance exposure for Bellemeade Re II is lower than it would have been for Arch's two previous deals, due to the seasoning of the collateral. "The pool is benefiting from strong payment history, which is resulting in lower projected defaults while also benefiting from the shorter window until expected" mortgage insurance, the report states.

Moreover, since mortgage insurance on the loans is likely to be terminated sooner, there is a shorter window for potential claims, which ultimately lowers projected claims payout exposure, per Fitch.

The rating agency does not indicate how it would have rated those two prior deals.