Black borrowers applying to refinance their home loans receive slightly undervalued appraisals, while those for white consumers tended to get overvalued, a new Fannie Mae working paper found.

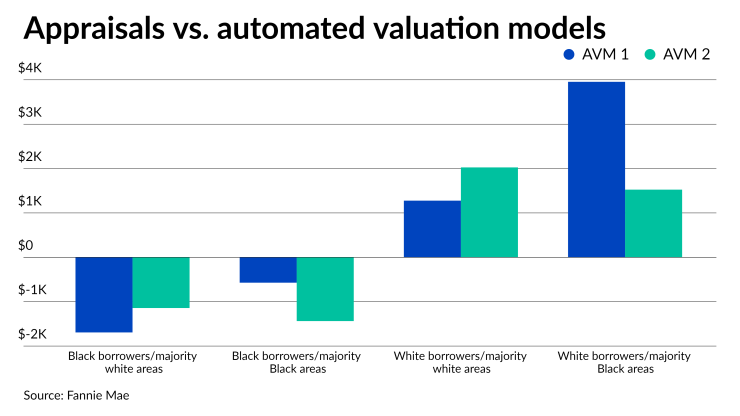

Fannie reported that some gaps relative to automated valuation models approached -1% for Black consumers, and 2% for white ones. The government-sponsored enterprise, which is a major buyer of loans in the United States, also discovered that those variations were more pronounced in areas where the majority population’s race differed from the borrower’s.

The findings are in line with an earlier assessment by Fannie’s competitor, Freddie Mac, which found directionally similar patterns when it

Fannie’s paper showing gaps between two proprietary AVMs and appraisals may not reflect racial discrimination but suggests the potential for it, according to authors Jake Williamson, Fannie’s senior vice president of single-family collateral risk management, and Mark Palim, deputy chief economist and vice president.

“There are many possible reasons why an appraisal would be either overvalued or undervalued. Fannie Mae and its industry partners should continue to take concrete actions to minimize the chances that the race of a borrower or homeowner is one of those reasons,” Williamson and Palim said in the report.

While the median differences reported in the paper reflect relatively small percentages, the researchers found in tests that they were statistically significant. They analyzed 1.8 million appraisals from 2019 and 2020 to come to their conclusions.

Homes of Black residents in majority white areas were valued $1,693 or 58 basis points lower than one proprietary AVM, Palim and Williamson found. Appraisals done for these borrowers also were found to be $1,143 or 39 basis points lower when compared against another valuation model.

For white borrowers in majority Black areas, appraisals were $3,955 or 1.84% higher when compared to the one AVM. Comparisons to a second AVM for these borrowers came in $1,525 or 63 basis points higher.

In cases where the majority population and the borrower were white, appraisals were higher by $1,277 or 42 basis points for the first AVM. The comparable numbers for the second AVM were $2,026 or 65 basis points.

For areas where the majority population and the borrower were Black, appraisals were lower by $572 or 25 basis points in the first case. They were lower by $1,437 or 63 basis points in the second.

Appraisal organizations took note of the report and said they’d be doubling down on efforts like

“While we’re analyzing the findings from Fannie Mae’s report, what we can say with absolute certainty is that bias has no place in appraisal,” said Appraisal Institute President Jody Bishop in an email. ”The Appraisal Institute takes its responsibility to help ensure equity and fairness in valuation seriously now and will continue to do so in the future.”