-

The CEOs of Fannie Mae and Freddie Mac are stepping down because the job they were hired to do — return the GSEs to profitability — is done. But attracting top-flight candidates to lead the mortgage giants into a new phase may not be easy.

September 24 -

A new financial technology company called Scratch is planning to use a new web-based platform along with an alternative pricing model to compete with companies that service mortgages and other consumer loans.

September 20 -

Commercial mortgage-backed securities delinquency rates are likely to continue to decrease for the rest of the year, as new issuances outpace maturing loans and precrisis loans continued to get resolved by special servicers, Fitch Ratings said.

September 17 -

While the severity of Florence was reduced prior to Friday morning's landfall, mortgage servicers are taking proactive steps in addressing the emergency situation.

September 14 -

Fund manager Varde Partners wants to grow its partnerships with lenders and servicers interested in selling off their excess mortgage servicing rights.

September 11 -

The 30-day delinquency rate dropped to a low not seen in over a decade in July, but foreclosure starts also increased to a three-month high.

August 24 -

Intensifying margin pressure could spur another wave of cost-cutting at nonbank mortgage lenders, unless other strategies, like consolidation or a mortgage servicing book that could increase in value, offset it.

August 23 -

MountainView Financial Solutions is brokering a more than $3 billion package of Fannie Mae and government mortgage servicing rights originated primarily through third-party origination channels.

August 17 -

The new policy, meant to assist borrowers in Puerto Rico and the U.S. Virgin Islands, will let servicers evaluate borrowers using pre-disaster payment information.

August 16 -

AmeriHome GMSR Issuer Trust, consists of $155 million of fixed-rate, five-year notes and $500 million of two-year variable funding notes; it is modeled on deals by PennyMac.

August 8 -

The company is marketing another $550 million of bonds backed by MSRs; proceeds will be used to repay the remaining $500 million of notes issued last year at wider spreads.

August 6 -

Nonbank mortgage-backed securities servicers increase their exposure to agency loans as the housing market distances itself from last decade's crash, according to Fitch Ratings.

July 24 -

Fannie Mae and Freddie Mac may need to tap into U.S. Treasury funds when they adopt CECL, a new accounting rule that makes companies set aside money upfront for expected loan losses.

July 12 -

The deal is designed to improve capital ratios and reduce risk at the Seattle company.

July 3 -

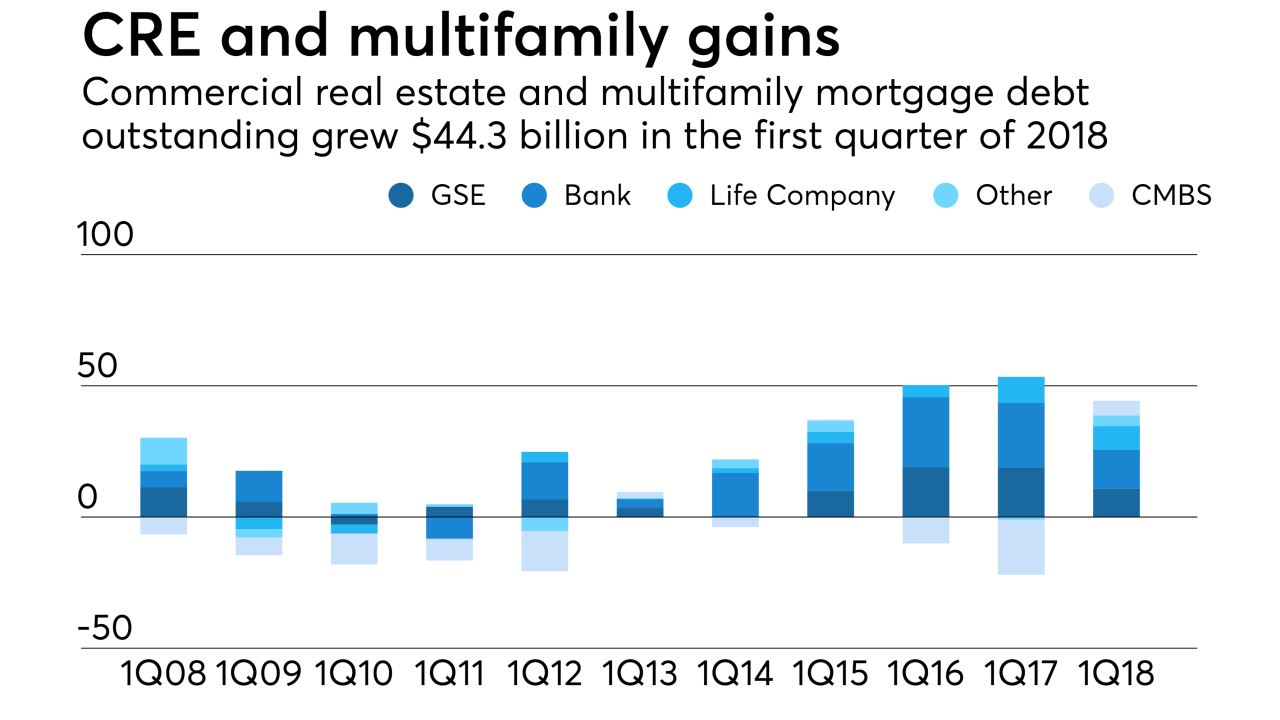

Commercial and multifamily mortgage debt outstanding grew $44.3 billion during the first three months of 2018, the largest first-quarter gain since before the Great Recession, according to the Mortgage Bankers Association.

July 2 -

Ginnie Mae is looking to start a pilot program to securitize digital mortgages as early as 2019, but issuers would not be able to commingle loans using traditional paper files in those deals.

June 20 -

Robert Broeksmit, a career mortgage industry executive, will succeed David Stevens as the president and CEO of the Mortgage Bankers Association.

June 7 -

Blame the decline in the oil and gas industry; many 2014 vintage deals have exposure to a number of multifamily and hotel properties in North Dakota and Texas, according to Fitch.

June 5 -

There are almost 7 million coastal homes facing more than $1.6 trillion in potential storm-surge reconstruction expenses this year, representing a 6.6% cost increase from last year's hurricane season.

May 31 -

Government-sponsored enterprises Fannie Mae and Freddie Mac are in a race to offer services and technology that help mortgage bankers raise cash from mortgage servicing rights.

May 23