-

Caliber Home Loans settled a grievance with the Massachusetts attorney general over allegations of providing distressed borrowers with unaffordable loan modifications.

April 11 -

The bank agreed to modify loans to struggling U.S. borrowers as part of a 2017 settlement. Instead, it’s receiving credit for financing new mortgages that likely would have been made anyway.

April 8 -

The moves are part of an ongoing effort by the Seattle bank to largely exit mortgage lending.

April 8 -

Controlling classes of investors in commercial mortgage-backed securitizations can replace a special servicer, but before they do, they should make sure the long and potentially expensive process is worth it.

April 3 Alston & Bird

Alston & Bird -

Now that Ocwen settled the servicing practices lawsuit brought by the Massachusetts attorney general, just two outstanding complaints remain from the 30 filed nearly two years ago.

April 1 -

Freddie Mac exchanged existing bonds from its portfolio for mirror certificates for the first time, completing a key test that is central to the creation of a uniform mortgage-backed security.

March 28 -

In a unanimous ruling, the court placed new limits on the ability of consumers to sue law firms that handle foreclosures on behalf of mortgage servicers.

March 20 -

Two Harbors Investment Corp., which grew its servicing portfolio by 22% in the fourth quarter, priced a common stock offering to raise funds to buy more rights as well as mortgage-backed securities.

March 19 -

Ginnie Mae could limit how much servicing income mortgage lenders can sell off through a transaction if they don't establish a minimum 25-basis-point spread at the portfolio level by next year.

March 8 -

Fewer mortgage borrowers are falling behind on their payments, and consumers' broader borrowing habits indicate an increased willingness to turn to nontraditional sources like fintechs for their lending needs, according to TransUnion.

February 22 -

The company disclosed that it paid $146 million for servicing rights associated with $13 billion in mortgages.

February 21 -

New Residential priced its second stock offering in four months, looking for gross proceeds of nearly $665 million.

February 20 -

HomeStreet Bank will attempt to sell its stand-alone mortgage business and portfolio of servicing rights, a move that comes amid growing pressure from an activist investor to exit home lending and concerns about declining demand and regulatory challenges.

February 15 -

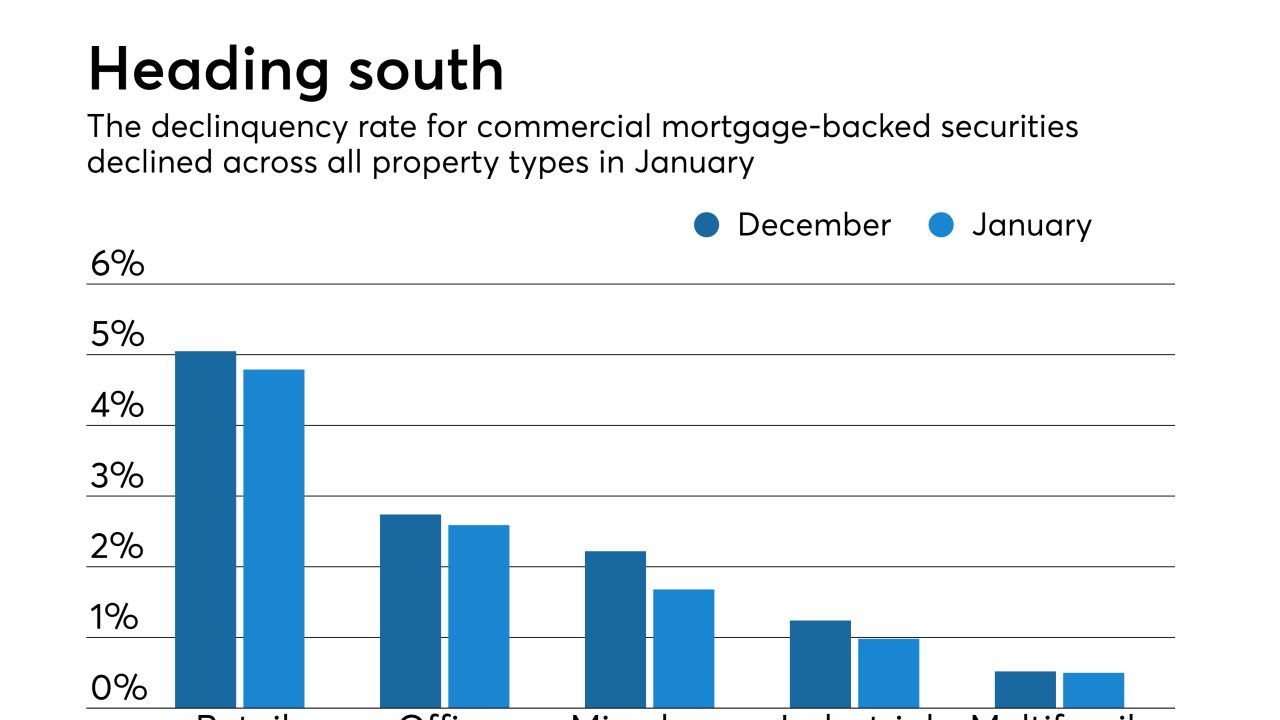

Late payments on loans backing commercial mortgage bonds continued falling at the start of the year, due to strong new issuance volume and continued resolutions for precrisis loans by special servicers, according to Fitch Ratings.

February 11 -

Och-Ziff Capital is suing BNY Mellon, as trustee, to compel it to calculate interest in a way that is more favorable to the class of securities it holds.

February 6 -

Plans to begin rating securitizations backed by fix-and-flip mortgages may help lenders create new capacity and satisfy growing demand for short-term financing of house flipping projects.

January 25 -

Loans in commercial mortgage-backed securities originated after 2009 by nonbank lenders have a significantly higher default rate than those originated by banks, a Fitch Ratings report said.

January 14 -

As the government shutdown enters its third week, mortgage servicers are activating the response plans they normally use during hurricanes and wildfires to assist federal workers who may have trouble paying their mortgages.

January 4 -

Mr. Cooper Group is buying servicing rights on $24 billion in mortgages, a subservicing contract for an additional $24 billion in home loans and the Seterus platform from IBM.

January 3 -

Nonbank lenders are gearing up for new secondary market requirements and must make some difficult choices about whether to buy, sell or hold mortgage servicing rights, says Ruth Lee, the executive vice president of MorVest Capital.

December 28