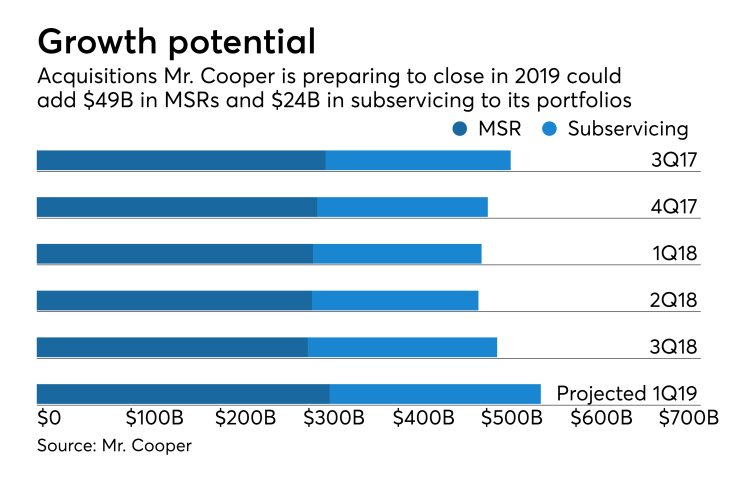

Mr. Cooper Group is buying servicing rights on $24 billion in mortgages, a subservicing contract for an additional $24 billion in home loans and the Seterus platform from IBM.

Terms of the transaction were not disclosed.

"We are excited to welcome more than 300,000 customers and the Seterus team to the Mr. Cooper Group family," said Jay Bray, chairman and CEO in a press release. "We are confident our new team will be energized by our people-first culture, and our new customers will benefit from our user-friendly mobile and online tools designed to help them manage their home finances. This transaction is consistent with our outlook for profitability targets and portfolio growth."

The deal is scheduled to close in the first quarter, subject to regulatory approvals.

"IBM acquired Seterus in the wake of the 2008 financial crisis to help a client manage a portfolio of distressed loans. We were successful in this mortgage servicing work and the portfolio is now much more stable. The time is now right to divest this business, which is no longer core to IBM’s portfolio, to a mortgage servicing specialist whose domain expertise and scale can further advance this business," said Jay Bellissimo, a general manager at IBM Global Business Services, in the press release.

Mr. Cooper also plans to close on its purchase of

Mr. Cooper was formed from Washington Mutual successor