-

An uptick in pandemic-related payment suspensions reflecting new or restarted plan activity previously occurred as the omicron variant spread, but activity has since subsided.

February 7 -

Three housing finance organizations asked for an interactive process similar to that used previously for originations and said they preferred less reliance on life-of-loan indemnification as a remedy.

January 31 -

The change aims to streamline the processing of certain pandemic-related loan options that accommodate lower monthly payment amounts for borrowers with long-term economic hardships.

January 24 -

The Federal Housing Administration has released a statement indicating it’s reviewing allegations by a group of 21 attorneys general that some mortgage companies failed to offer a modification option as required.

January 11 -

Mortgage performance in November was improving, coming close to crossing a key threshold for pandemic-era recovery, but Omicron raises questions about whether that trend will continue.

January 3 -

However, the serious delinquency rate dropped to a point significantly below the market-wide average, and much of the foreclosure activity allowed to proceed did so with new consumer protections in place.

December 22 -

With resources provided through the Homeowner Assistance Fund, the $1 billion plan will help cover homeowners’ past-due payments and comes after New York unveiled a similar assistance package earlier this month.

December 21 -

However, the seven institutions in the Office of the Comptroller of the Currency study service 13% fewer loans compared with the third quarter of last year.

December 10 -

While over 112,000 loans exited plans in the past week, there is only a modest opportunity for continued improvement in the near term, Black Knight said.

December 10 -

Axylyum, which recently released information about its first named client, offers an alternative to other forms of risk sharing for private companies originating income-producing mortgages.

December 2 -

Like the stock market rout around news of the Omicron variant, the recent increase in payment suspensions suggests financial troubles associated with the pandemic may not be over.

November 29 -

However, the median monthly expense associated with financing is still lower than that for a lease.

November 24 -

The decline in late payments recorded in a trade group survey raise hope that many servicers will bear up under a wave of tighter enforcement coming from regulators.

November 10 -

The number of plans is less than one-fourth of what it was at its pandemic peak, and many are expiring, so the group will replace the weekly measure with a monthly one.

November 8 -

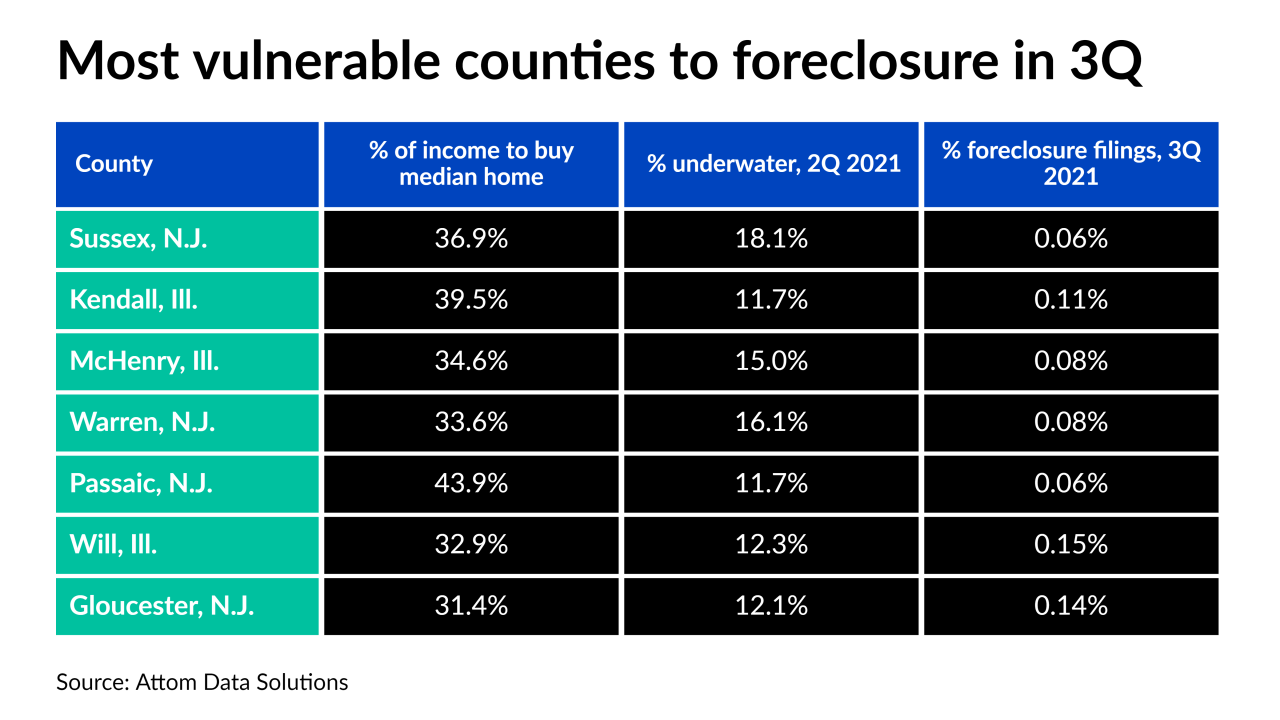

Counties in the West faced the least risk from pandemic distress in the third quarter, according to Attom Data Solutions.

October 21 -

The drop over the 30-day period was in line with a large number of plan expiration dates, and occurred despite the extension of an initial filing deadline for government loans.

October 15 -

Following the federal moratorium’s end, the number jumped, marking the highest quarterly growth on record, according to Attom Data Solutions.

October 14 -

Two Wall Street firms and a single-family rental investor have purchased portions of the government-sponsored enterprise's latest nonperforming loan package.

October 12 -

Those leaving forbearance or other relief plans generally had higher credit utilization rates, were more likely to have mortgages, and experienced lower levels of bank card delinquencies, according to TransUnion.

October 7 -

Common Securitization Solutions has disbanded a group of independent board members originally brought on in early 2020 to look into using the government-sponsored enterprises’ platform to serve a broader market.

October 6