-

The Federal Housing Finance Agency authorized the government-sponsored enterprises to lend additional support to the mortgage-backed securities market and temporarily allow some flexibility in lending requirements to address coronavirus-related concerns.

March 23 -

The Federal Reserve committed Monday to conducting more asset purchases of Treasury securities and mortgage-backed securities and announced $300 billion in new financing for credit facilities.

March 23 -

Additional mortgage-backed securities purchases by the Federal Reserve Bank of New York will address private investor skittishness about the asset class, but it will not necessarily lower rates.

March 20 -

Not so long after Treasury bond yields experienced an unprecedented drop, the average 30-year mortgage rate rose, reflecting volatility related to the coronavirus as well as capacity issues on multiple levels.

March 12 -

Terry Wakefield, a technology consultant who helped launch Fannie Mae's mortgage-backed securities business and form Prudential Home Mortgage, has died. He was 70.

March 11 -

The $400 million Toorak Mortgage Trust 2020-1 is the largest securitization to date for Toorak, which provides short-term institutional capital for individual and corporate real estate developers.

March 9 -

FirstKey Mortgage is sponsoring a rare pooling of manufactured housing loans in a $507.1 million securitization.

March 5 -

The properties have a combined broker-price opinion value of $530.7 million, which is a 27.4% increase for the properties in their original respective securitizations in 2015 and 2016.

March 3 -

Most of the pool is made up of office-property loans, but also includes a sizeable exposure to hotel and retail properties.

February 27 -

The data management and analytics firm has tapped Craig Phillips, a former top aide to U.S. Treasury Secretary Steven Mnuchin, as a senior adviser for the five-year-old firm’s business and product development activities in the mortgage loan space.

February 3 -

Trade associations representing mortgage lenders and securities market participants are asking the Federal Housing Finance Agency to rethink a plan to restrict pooling options for loans sold into uniform mortgage-backed securities.

January 23 -

Macro factors point to a solid year in the securitization market but wild cards abound, many of them political.

January 13 -

As the 2020s begin, perhaps it’s best to borrow a page from the Fed’s 2019 playbook: Take your best shot at forecasting the road ahead, but don’t hesitate to react to important new information.

January 1 -

The Federal Housing Finance Agency is seeking comment on a proposal that could pave the way for potential Fannie Mae and Freddie Mac competitors to use the uniform mortgage-backed security structure.

November 4 -

Pepper Residential Securities Trust No. 25 is relying on rigorous servicing to ensure the performance of its collateral of low-doc, high-loan-to-value loans made to borrowers with unfavorable credit records, according to details from an S&P Global presale report.

October 29 -

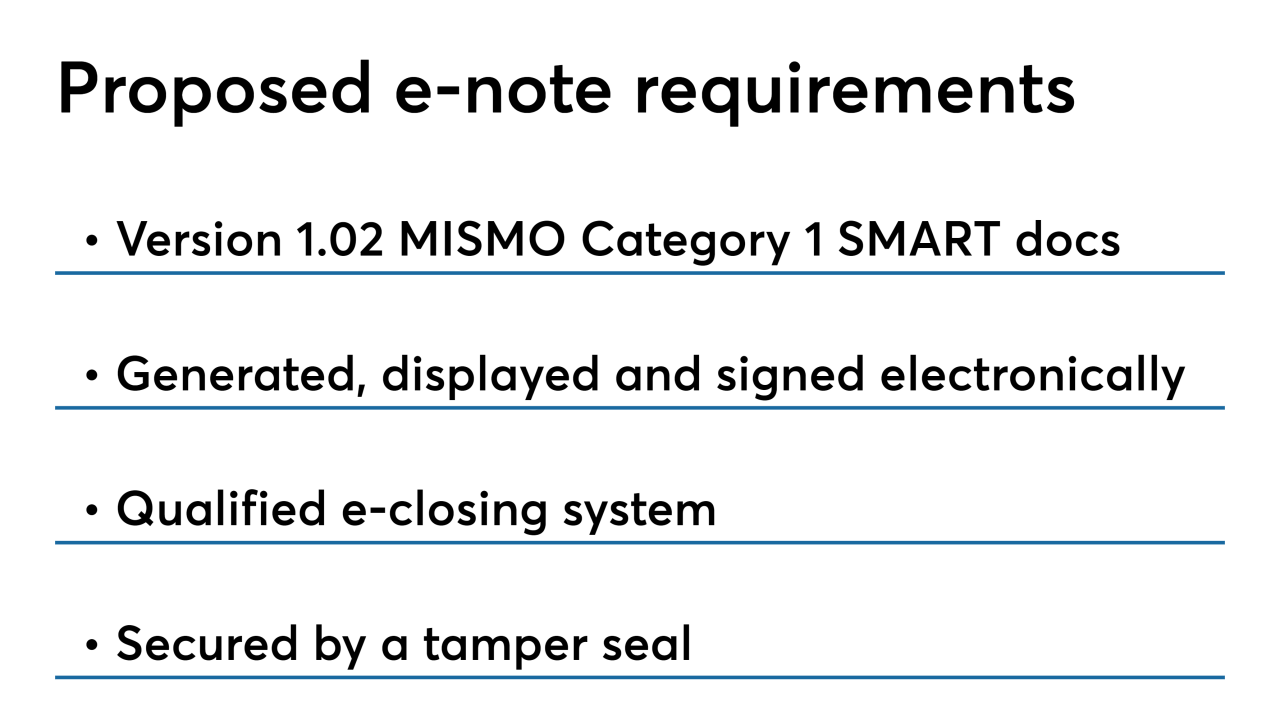

Ginnie Mae is looking for input on its proposed guidelines for electronic promissory notes and other mortgage documents that it plans to test through a digital collateral pilot.

October 28 -

The loans underlying the $465 million securitization that OBX 2019-EXP3 Trust is launching will provide a test of the market’s willingness to accept concentration risk in a high-quality pool of mortgages.

October 25 -

The end of the qualified mortgage patch should further accelerate non-QM origination growth, but is the mortgage industry ready?

October 8 -

Live Well Financial CEO Michael Hild has been charged with misrepresenting the value of a bond portfolio in parallel actions by the U.S. Attorney's Office and the Securities and Exchange Commission.

August 30 -

The bank started buying more Treasurys and mortgage-backeds over a year ago, long before talk about rate cuts. What did it know that its rivals didn't?

August 25