-

The German automaker continues to reduce its reliance on asset-backed financing as fallout from an emissions scandal fades.

December 7 -

The €173.3 million deal is backed by loans originated by the former Catalunya Banc, which were purchased at discount by the Blackstone Group in 2014.

December 6 -

Carlyle Euro CLO 2017-3 is the latest under its new shelf managed by affiliate CELF Advisors, with a AAA coupon of just 75 basis points over three-month Euribor.

November 28 -

Fino 1 is backed by collections on more than €5.34 billion in bad loans originated by the Italian banking giant. Most were issued between 2010-2017.

November 28 -

The €309 million Orbita Funding 2017-1 plc follows a 2016 transaction by the venerable British bank.

November 26 -

Collateral for the deal, which is structured as a master trust, can reach €30B of loans originated by the bank's building-savings affiliate, its retail operations and its private-bank unit.

November 21 -

The Spanish bank's German retail lending unit is securitizing a fifth pool of mostly unsecured personal loans from an €83.5 billion portfolio.

November 20 -

The aerospace components manufacturer, one of the largest-held obligors in U.S. CLOs, is consolidating loans and tightening coupon spreads from 300 to 275 basis points over Libor.

November 10 -

Deal volume of $95 billion through 10 months is at a pace that would make 2017 the second-busiest year for post-crisis CLO issuance; AAA spreads, meanwhile, have reached three-year tights.

November 7 -

The loans are part of a €1.8 billion bad-loan purchase that Mars Capital, an Oaktree "vulture fund," made of high-risk mortgages from Irish banking authorities in 2014.

November 6 -

The deal, DLL Securitization Trust 2017-A, is unusual in that it is backed almost entirely by agricultural equipment; other lessors such as CNH and John Deere securitize a mix of agricultural and construction equipment.

November 6 -

In addition to insurance premiums, borrowers in the pool use the loans for annual membership fees of sport or leisure facilities or professional bodies.

October 30 -

British regulators are touting the success of their so-called regulatory sandbox. Their American counterparts have been unable to agree on a comprehensive scheme to foster innovation.

October 23 -

Over 80% of the cars are diesel-engine vehicles, bringing potential volatility to the portfolio cash flows given the public debate over potential panning such cars in several European urban centers.

October 11 -

A wave of corporate loan refinancings is putting collateralized loan obligations afoul of a covenant designed to safeguard their own investors.

October 11 -

Belmont Green Finance, which began originating loans in late 2016, has gathered up its first round of originations through 3Q2017 in a transaction that will issue up to £230.6 million in notes.

October 6 -

The French specialty lender, owned by a consortium of mutual insurers, is pooling over 54,000 loans it originated and services for clients of its shareholders.

October 4 -

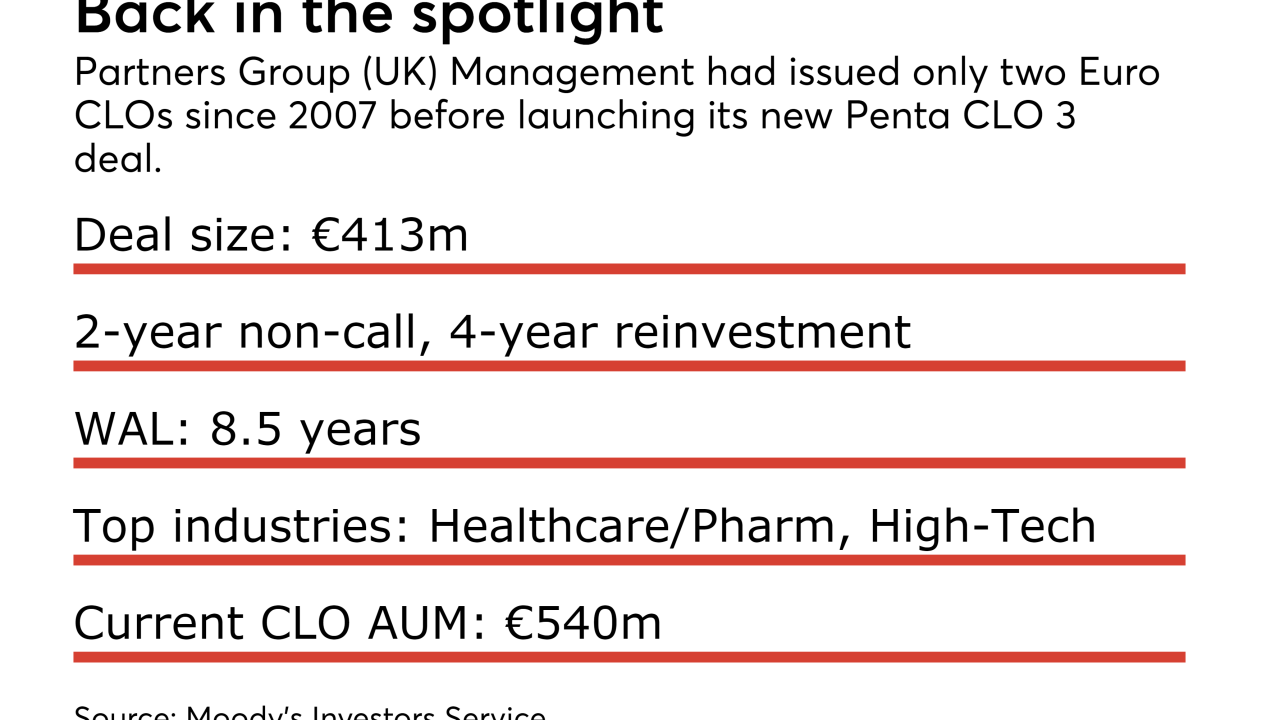

Penta CLO 3 is the first CLO since 2015 for the UK subsidiary of Swiss global asset management Partners Group Holdings AG.

October 2 -

The deal, Sunrise SPV 20 S.r.l., is collateralized by more than 120,000 auto, furniture and personal loans originated by the Italian lender.

September 28 -

Most of the 181 jets used as collateral were acquired from GE Capital Corp. in 2015; proceeds from prepayments and liquidations can be used to acquire additional aircraft.

September 27