-

The deal, DLL Securitization Trust 2017-A, is unusual in that it is backed almost entirely by agricultural equipment; other lessors such as CNH and John Deere securitize a mix of agricultural and construction equipment.

November 6 -

In addition to insurance premiums, borrowers in the pool use the loans for annual membership fees of sport or leisure facilities or professional bodies.

October 30 -

British regulators are touting the success of their so-called regulatory sandbox. Their American counterparts have been unable to agree on a comprehensive scheme to foster innovation.

October 23 -

Over 80% of the cars are diesel-engine vehicles, bringing potential volatility to the portfolio cash flows given the public debate over potential panning such cars in several European urban centers.

October 11 -

A wave of corporate loan refinancings is putting collateralized loan obligations afoul of a covenant designed to safeguard their own investors.

October 11 -

Belmont Green Finance, which began originating loans in late 2016, has gathered up its first round of originations through 3Q2017 in a transaction that will issue up to £230.6 million in notes.

October 6 -

The French specialty lender, owned by a consortium of mutual insurers, is pooling over 54,000 loans it originated and services for clients of its shareholders.

October 4 -

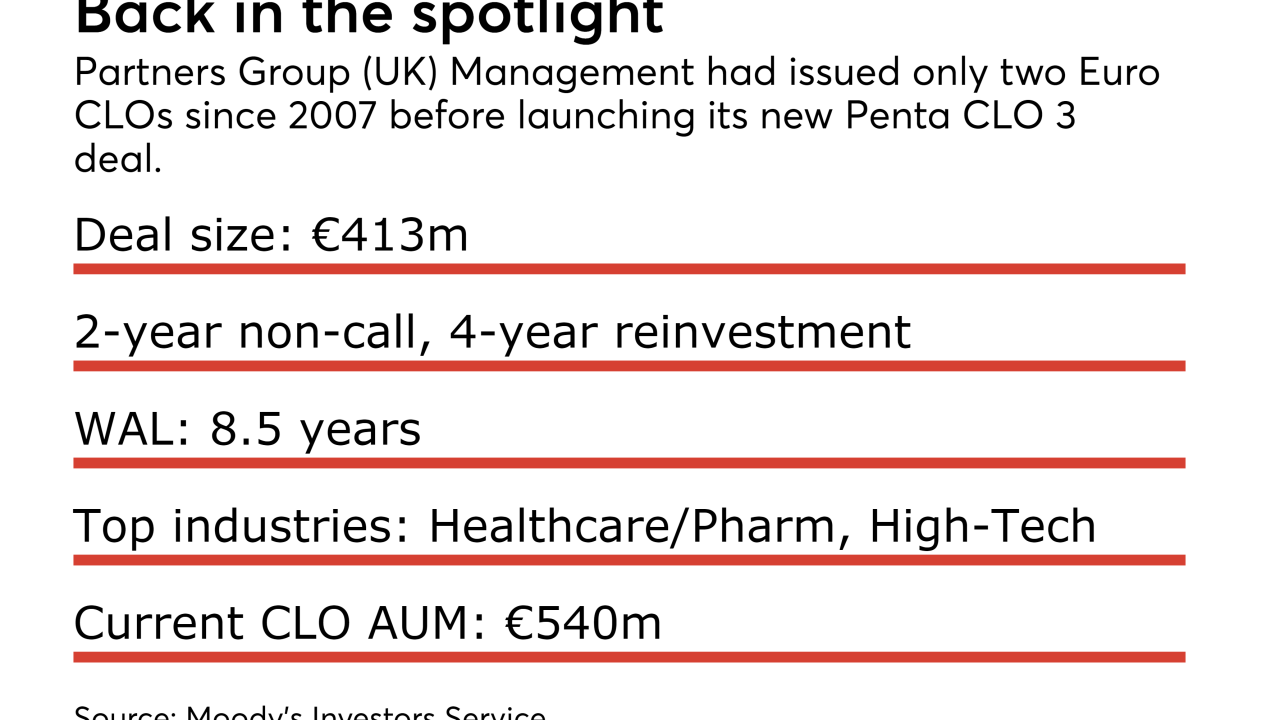

Penta CLO 3 is the first CLO since 2015 for the UK subsidiary of Swiss global asset management Partners Group Holdings AG.

October 2 -

The deal, Sunrise SPV 20 S.r.l., is collateralized by more than 120,000 auto, furniture and personal loans originated by the Italian lender.

September 28 -

Most of the 181 jets used as collateral were acquired from GE Capital Corp. in 2015; proceeds from prepayments and liquidations can be used to acquire additional aircraft.

September 27 -

The loans have an average balance of €18.5k (US$22.1k) and went to 39,698 borrowers; they are secured by a pool of new (46.8%) and used (53.2%) cars, according to Moody's Investors Service.

September 24 -

The €684.8 million transaction is backed primarily by new-car leases to German prime borrowers. It's the 21st German securitization by FCE Bank, Ford's UK-based captive finance arm.

September 13 -

New issuance of U.S. collateralized loan obligations reached $11.9 billion across 24 deals, taking year-to-date volume past $72.3 billion, according to Thomson Reuters LPC. The eight-month total is higher than the total issuance for all of 2016.

September 10 -

The proceeds will be used to repay three existing bonds series, as well as pay down commercial paper and credit line debt of the real estate investment trust, formerly known as Land Securities.

September 7 -

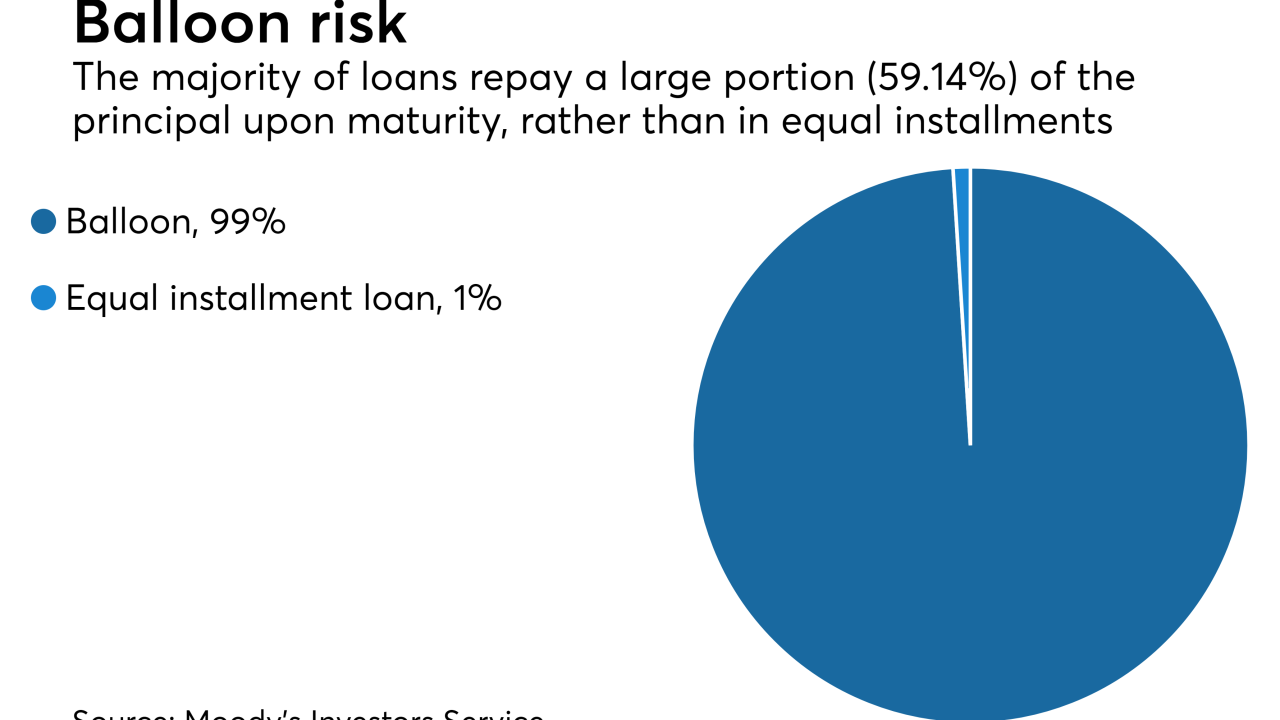

S&P says exclusion of the value of "personal contract purchase" balloon payments from Santander's Motor 2017-2 transaction will benefit the deal through excess spread and recoveries from contract defaults.

September 4 -

CVC Cordatus Loan Fund IX is CVC's ninth overall Euro-denominated CLO, and only the second that will price since early June, according to Thomson Reuters LPC.

September 1 -

The size of the two classes of notes on Volkswagen Financial Services' Compartment Driver UK SK deal is to be determined; they will be backed by receivables on 24,238 prime retail customer lessors.

August 29 -

The prime mortgage securitization is the fourth by Bank Nagelmackers, a small player on the Belgian mortgage scene that is owned by a Chinese insurance group comglomerate.

August 29 -

The pricing of BlueMountain Fuji's second-ever transaction pushed the monthly new issuance total to $10.1 billion - only the third time since last November the market has eclipsed the $10 billion barrier.

August 27 -

The diverse mix of collateral ranges from vehicles and medical equipment to high-end fitness machines and tanning beds that Abcfinance provides for German SMEs and entrepreneurs.

August 18