-

The price increase illustrates the extent to which federal rescue programs and a supply-demand imbalance have been counterweights to economic pressures from the pandemic.

November 24 -

With a dearth of inventory, September generated the largest price growth in the housing market since May 2014, according to CoreLogic.

November 3 -

Low mortgage rates and strained supply drove the housing market price growth to a 26-month high in August, according to CoreLogic.

October 6 -

More defaults will lead to an increase in distressed sales, and that will drive down prices, CoreLogic said.

September 21 -

Potential sales last month rose compared with April as homes became more affordable due to low mortgage rates.

June 18 -

A Clever Real Estate survey found a significant share of new borrowers are not making their full payment.

June 15 -

Some cities saw drops in annual housing supply nearing 40% in early May, according to Zillow.

May 26 -

The S&P CoreLogic Case-Shiller home price index hasn't yet reflected the impact of the coronavirus, but an independent market maker has some thoughts on how it might.

April 30 -

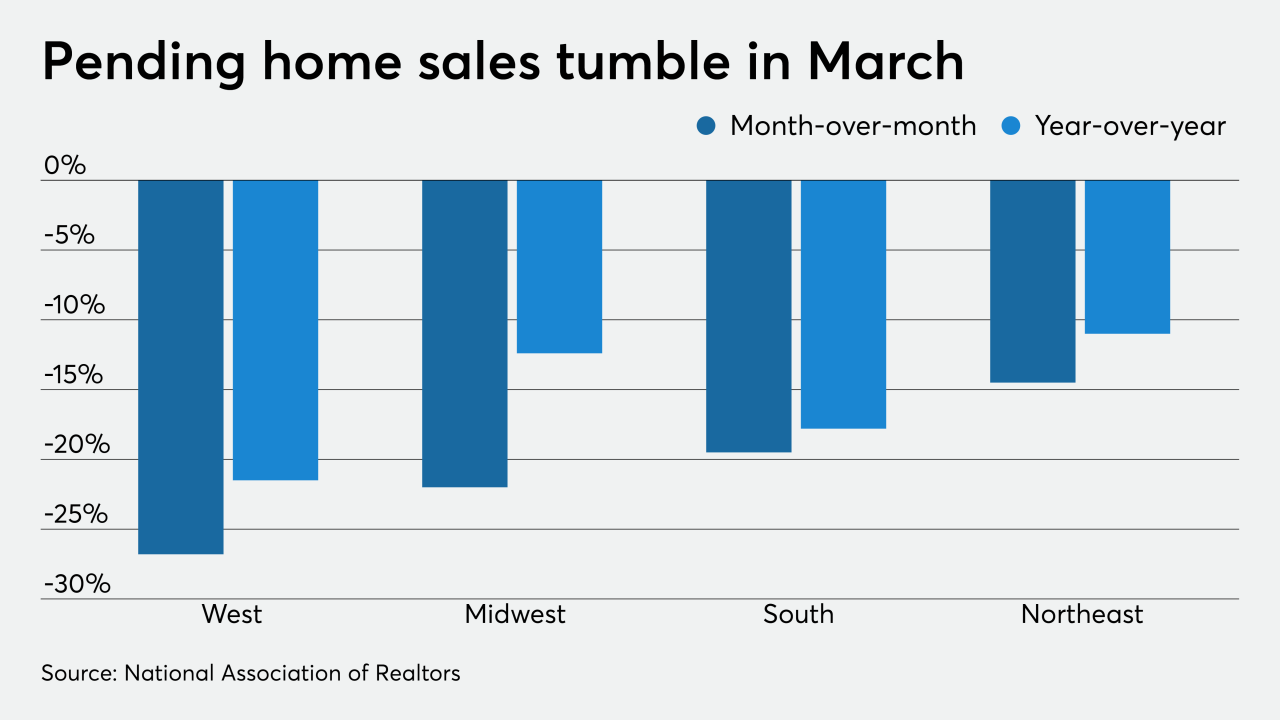

The coronavirus disruption caused March's pending home sales to fall and the losses will reverberate through the rest of 2020, according to the National Association of Realtors.

April 29 -

Is JPMorgan Chase an outlier or the canary in the coal mine when it comes to home equity lending during the coronavirus spread?

April 28 -

Consumer sentiment about purchasing a home nears its record high as almost half of those surveyed said mortgage rates will stay at the current low levels, according to Fannie Mae.

February 10 -

More than half of the third quarter refinance activity was the cash-out variety, with borrowers removing the most total equity from their homes in nearly 12 years, according to Black Knight.

December 9 -

Loan limits for most mortgages Fannie Mae and Freddie Mac buy will exceed $500,000 for the first time ever next year, and the maximum for most high-cost areas will be $765,000.

November 27 -

Mortgage debt climbed to a new peak of $9.4 trillion in the second quarter and the distribution across the U.S. varies greatly.

August 29 -

While talks of an impending recession pick up steam, the housing market remains fairly stalwart and won't be to blame this time around, according to Zillow.

August 16 -

While mortgage rate optimism kept consumer confidence about the home purchase market high in June, affordability worries pulled overall sentiment lower, a Fannie Mae survey said.

July 8 -

Despite a lower rate of increase, 2019 equity gains could pull 350,000 households from being underwater on mortgages, according to CoreLogic.

March 7 -

Plans to begin rating securitizations backed by fix-and-flip mortgages may help lenders create new capacity and satisfy growing demand for short-term financing of house flipping projects.

January 25 -

Average mortgage rates plunged after the United Kingdom first voted to leave the European Union. With uncertainty now growing about how Brexit will actually happen, here's a look at the implications for the housing market and mortgage lending.

December 12 -

As home value appreciation slowed, gains in home equity for the third quarter fell to the lowest level in two years, according to CoreLogic's homeowner equity report.

December 6