-

The government-sponsored enterprises have set new temporary limits on mortgage sales while extending processing flexibilities related to COVID-19.

May 6 -

The other parts of the Day 1 Certainty program regarding income and asset verifications remain in effect.

May 6 -

Some benefits are materializing from Fannie Mae's pledge to limit servicers' exposure to principal-and-interest advances the way Freddie Mac does, but counterparties of both GSEs remain exposed to other concerns.

May 6 -

While Freddie Mac stabilized liquidity in mortgage markets, coronavirus-related credit losses drove the GSE's income down in the first quarter of 2020.

April 30 -

The Consumer Financial Protection Bureau's chief operating officer will take a similar position at the Federal Housing Finance Agency, fulfilling one of the multiple recruiting goals the FHFA announced in January.

April 28 -

The government-sponsored enterprises are focusing on how loans can be repaid after the federal forbearance period ends, and projections for loan modification volumes suggest the larger industry should, too.

April 28 -

Fannie Mae and Freddie Mac are now able to buy loans in forbearance to alleviate pressure on the sector, but the fees charged by the mortgage giants to assume more risk could turn away some originators.

April 28 -

Correspondent loan sellers are hoping the new GSE purchases will help to open a market frozen by coronavirus-related risk — but the prices offered so far aren't too promising.

April 24 -

The policy move will allow small institutions participating in the Paycheck Protection Program to pledge business loans as collateral to obtain advances.

April 23 -

The FHFA will allow Fannie Mae and Freddie Mac, for a limited time, to purchase loans for which the borrower has sought to postpone payments because of the economic effects of the coronavirus.

April 22 -

Efforts to calm lenders’ fears about coronavirus-related forbearance may not offset tightening standards, and the FHA is less likely to boost volume than it was during the financial crisis.

April 21 -

The agency said it is aligning policies for Fannie Mae- and Freddie Mac-backed loans in forbearance so that servicers are only responsible for advancing four months of missed payments.

April 21 -

Surging unemployment from COVID-19 shutdowns brought a rapidly rising tide of forbearance requests, according to the Mortgage Bankers Association.

April 20 -

The Borrower Protection Program enables the two agencies to exchange information about loss mitigation efforts and consumer complaints regarding specific servicers.

April 15 -

The volume of COVID-19 forbearance requests has risen rapidly as operational processing has improved and hold times have contracted, according to the Mortgage Bankers Association.

April 14 -

Lenders that split their sales of loans and servicing between two different investors may be facing yet another challenge due to the coronavirus outbreak.

April 13 -

A bipartisan group of lawmakers wrote in a letter to the Treasury secretary that the Financial Stability Oversight Council should create a liquidity facility to deal with a flood of forbearance requests brought on by the coronavirus pandemic.

April 8 -

Mark Calabria needs to be working to secure a Fed facility for servicer advances and to support, not denigrate, smaller servicers, the Mortgage Bankers Association said.

April 8 -

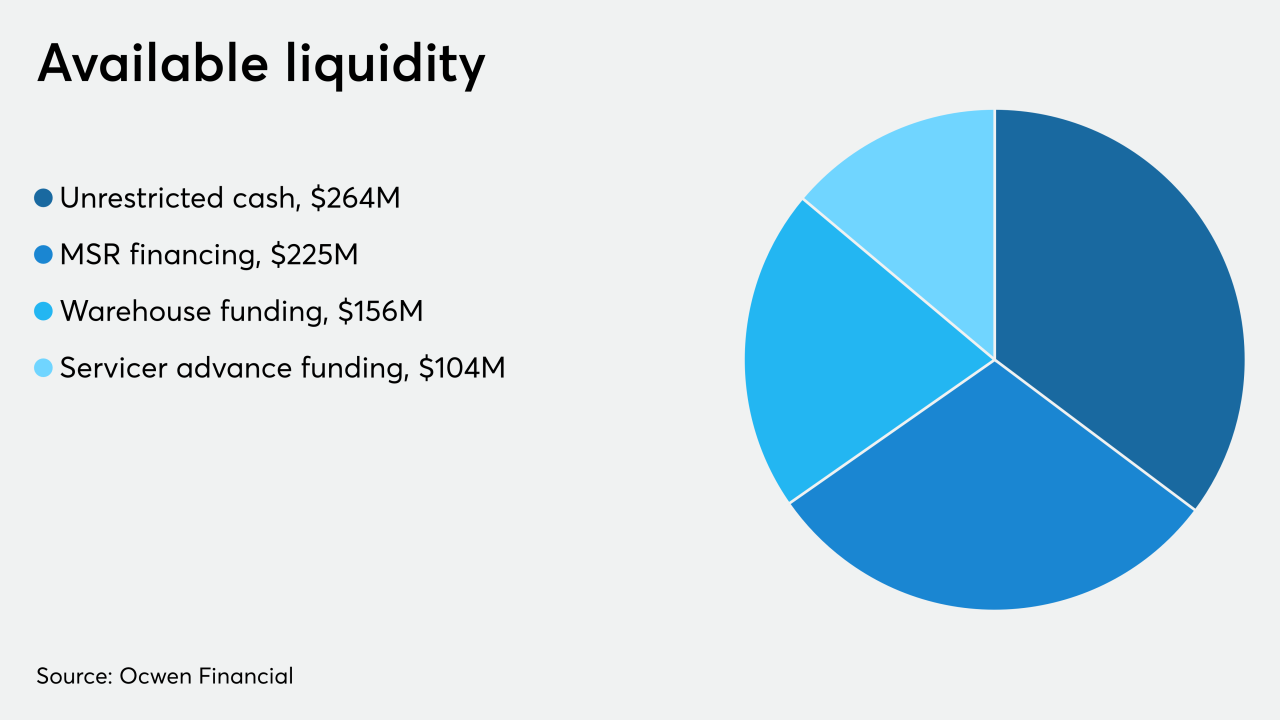

Ocwen Financial has approximately $749 million of liquidity from various sources to deal with servicing issues arising from the coronavirus, a company press release said.

April 3 -

Mortgage servicers need direction from federal agencies on how to implement the forbearance plans called for in the CARES Act, according to the Community Home Lenders Association.

March 31