-

The share of borrowers seeking payment relief rose more than tenfold as COVID-19 concerns grew and authorities encouraged the practice, according to the Mortgage Bankers Association.

April 7 -

Ginnie Mae and the FHA provided temporary liquidity relief for mortgage servicers bracing for higher delinquencies, but the industry continues to pressure Treasury and the Fed to provide more comprehensive support.

April 6 -

With economists fearing high unemployment stemming from the pandemic, the housing finance system is grappling with how it will recoup lost revenue from delinquencies, forbearance plans and other tremors.

March 24 -

The Federal Housing Finance Agency plans to increase liquidity standards for nonbank conforming loan servicers, and at the same time raise the net worth requirements for those that also perform the function for Ginnie Mae.

February 5 -

Nationstar’s next securitization of defaulted or inactive home equity conversion mortgages will have a higher-than-average exposure to properties with steep leverage, as well as ties to judicial foreclosure states.

November 21 -

The dollar volume of mortgages guaranteed by the Department of Veterans Affairs rose nearly 9% in the past fiscal year as interest-rate reduction refinancing loans surged nearly 75%.

November 11 -

Eric Blankenstein, who resigned from the Consumer Financial Protection Bureau in May after the discovery of his racially charged writings, was named acting executive vice president of Ginnie Mae.

November 8 -

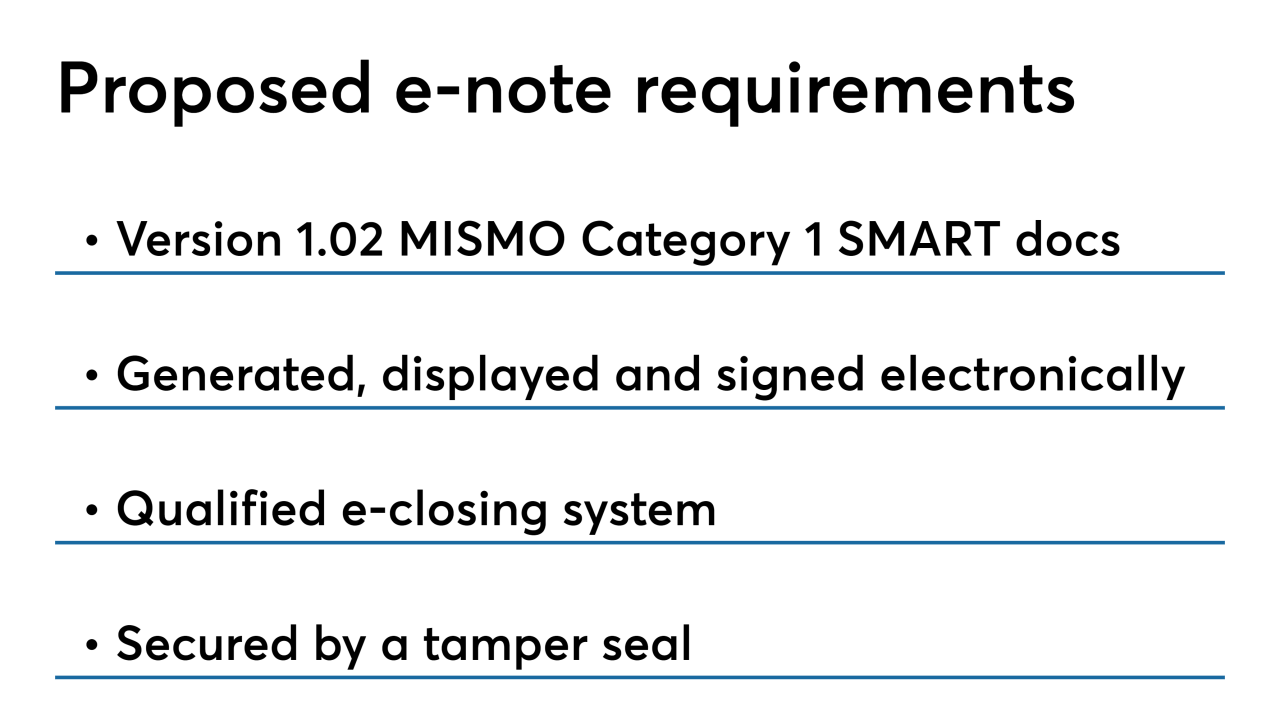

Ginnie Mae is looking for input on its proposed guidelines for electronic promissory notes and other mortgage documents that it plans to test through a digital collateral pilot.

October 28 -

The Treasury Department made clear in a much-anticipated report that it prefers Congress take up reform of the government-sponsored enterprises, but it also recommended steps that federal agencies could take without legislation.

September 5 -

Ginnie Mae followed through with plans to look more closely at secured debt ratios in its latest round of new and revised issuer requirements.

August 23 -

Increased consumer debt and the threat of an economic downturn increase the default risk for government-sponsored enterprise mortgages during the first quarter, according to Milliman.

August 7 -

The Federal Housing Administration is aiming to limit the share of borrowers who have been withdrawing money from the value of their homes.

August 1 -

President Trump has signed the Protecting Affordable Mortgages for Veterans Act, which aims to address concerns that rules around certain VA refinances were impeding those loans' inclusion in secondary market pools.

July 26 -

Ginnie Mae is requesting feedback on a new proposed stress test for mortgage-backed securities issuers that would take into account the government agency's increased nonbank counterparty risk.

July 24 -

The more than $44 billion in new Ginnie Mae mortgage-backed securities that came to market in June marked the strongest month for the government bond insurer in more than two years.

July 11 -

The mortgage agency has hired Eric Blankenstein, who sparked controversy while at the consumer bureau over past revelations of racially charged writings.

June 19 -

Prepayments tied to repeated VA loan refinancing activity have had an adverse effect on Ginnie’s mortgage securities that persists despite countermeasures. The government bond issuer is making new plans to address the impact.

May 21 -

The Government Accountability Office called on Ginnie Mae to undertake four reforms to its operations, citing concerns regarding the ongoing shift in size and capitalization of mortgage-backed securities issuers.

May 10 -

Alarmed about continued high nonmarket-based prepayment rates, Ginnie Mae is requesting input from lenders on how to make the mortgage-backed securities it guarantees fairer to investors without hurting borrowers.

May 3 -

Ginnie Mae could limit how much servicing income mortgage lenders can sell off through a transaction if they don't establish a minimum 25-basis-point spread at the portfolio level by next year.

March 8