-

Discrepancies were ultimately flagged not by regulators or auditors, but by a junior analyst at Waterfall Asset Management, one of Tricolor's lenders

December 18 -

PMT 2025-CNF2 is not required to provide advances of schedule interest and principal on loans that are delinquent by 120 days or more.

December 17 -

The indictment accuses Daniel Chu and other executives who had worked at Tricolor of operating the company through "systemic fraud."

December 17 -

The acquisition forms the eighth largest mortgage servicer nationwide, with a combined $400 billion in mortgage servicing rights.

December 17 -

For the trailing 12-month period that ended in October 2025, La Quinta Resort had an occupancy of 59.2%, and a revenue per available room $230.83.

December 16 -

Michael Hutchins, the two-time interim chief executive at the government-sponsored enterprise, will remain with the company in his role as president.

December 16 -

The investment bank, which focuses on community banks across the US, launched a new unit, PTUK Limited, last week, according to Eric Brown, president of Performance Trust's institutional group.

December 16 -

The senior notes will build hard credit enhancement levels over time because classes B through G will be locked out of principal payments for eight months.

December 15 -

The government-backed housing-finance giants increased their retained portfolios by more than 25% in the five months through October, according to the latest figures.

December 15 -

The deal includes debt service coverage ratio (DSCR) triggers, where a cash trap event will occur on any payment date if the DSCR falls below 1.15x.

December 12 -

Kansas City Federal Reserve President Jeffrey Schmid and Chicago Fed President Austan Goolsbee said in statements Friday that their dissents from this week's interest rate decision were spurred by inflation concerns and a lack of sufficient economic data.

December 12 -

The trustee asked a Dallas federal judge to limit Chu's access to $15 million worth of insurance that normally kicks in when directors and officers of a company are facing legal problems related to their corporate duties.

December 12 -

Most of Merchant's Fleet Funding 2025-1's underlying leases are open-end, and the underlying assets have limited residual value risk.

December 11 -

After the end of the draw periods that range from two to five years, the amortization begins, during which borrowers have a repayment period ranging from three to 25 years.

December 11 -

This year Point has funded more than $2 billion in home equity investments to more than 20,000 homeowners nationwide.

December 10 -

Fed Chair Jerome Powell, speaking at a press conference after the December FOMC meeting, said the central bank is holding interest rates steady until it gets more clarity on the economy.

December 10 -

The terms of NRMLT 2025-NQM7 will not allow it to advance principal and interest on loans that are delinquent by 180 days or more.

December 10 -

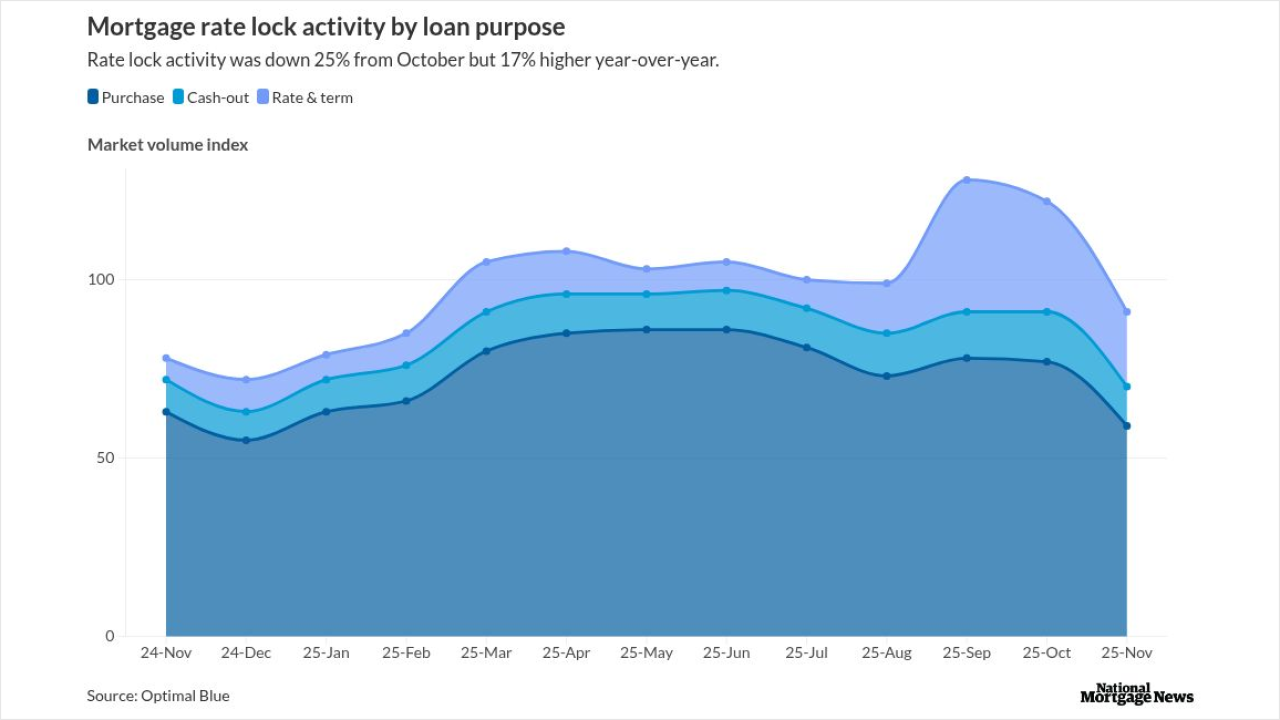

November rate locks fell seasonally but hit their strongest level since 2021, led by refis, while lenders shifted more loans to the GSE cash window.

December 10 -

The home equity investment provider first approached the securitization market in July 2024 to raise $217 million.

December 9 -

Hahn's experience includes innovative retail structures for conglomerates, holding companies, private funds and private real estate investment trusts.

December 8