-

Kansas City Federal Reserve President Jeffrey Schmid and Chicago Fed President Austan Goolsbee said in statements Friday that their dissents from this week's interest rate decision were spurred by inflation concerns and a lack of sufficient economic data.

December 12 -

The trustee asked a Dallas federal judge to limit Chu's access to $15 million worth of insurance that normally kicks in when directors and officers of a company are facing legal problems related to their corporate duties.

December 12 -

Most of Merchant's Fleet Funding 2025-1's underlying leases are open-end, and the underlying assets have limited residual value risk.

December 11 -

After the end of the draw periods that range from two to five years, the amortization begins, during which borrowers have a repayment period ranging from three to 25 years.

December 11 -

This year Point has funded more than $2 billion in home equity investments to more than 20,000 homeowners nationwide.

December 10 -

Fed Chair Jerome Powell, speaking at a press conference after the December FOMC meeting, said the central bank is holding interest rates steady until it gets more clarity on the economy.

December 10 -

The terms of NRMLT 2025-NQM7 will not allow it to advance principal and interest on loans that are delinquent by 180 days or more.

December 10 -

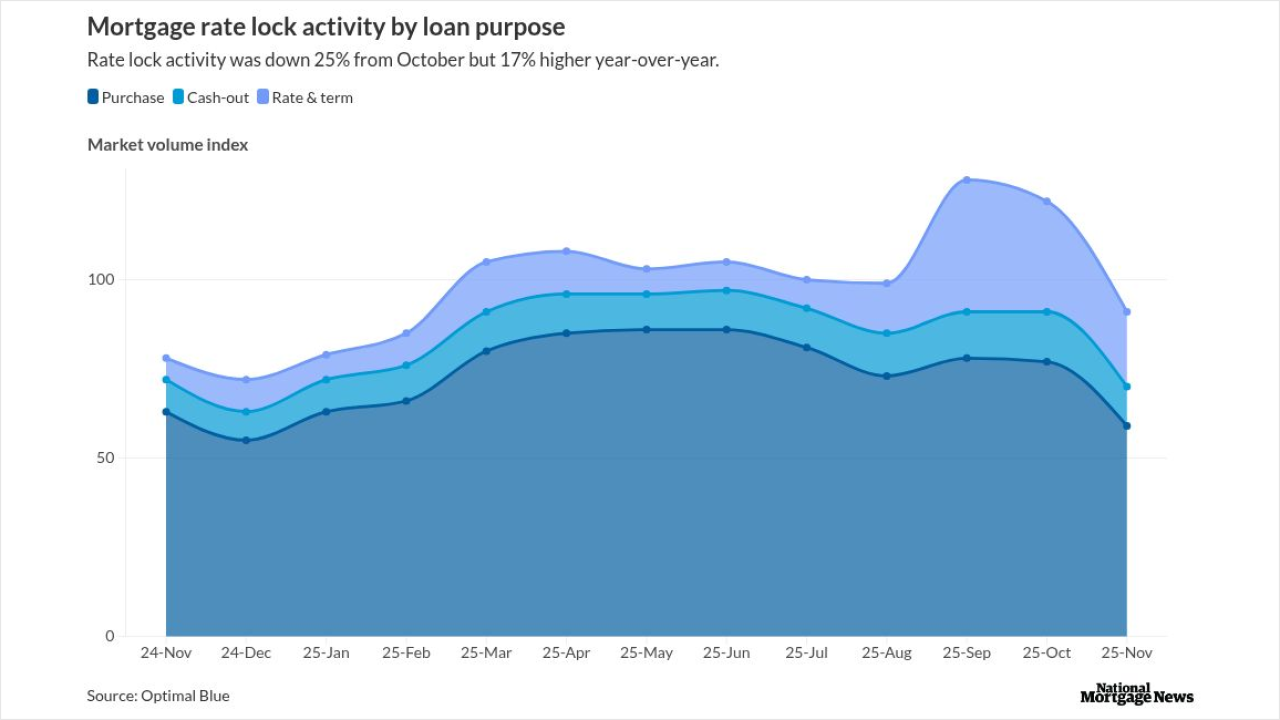

November rate locks fell seasonally but hit their strongest level since 2021, led by refis, while lenders shifted more loans to the GSE cash window.

December 10 -

The home equity investment provider first approached the securitization market in July 2024 to raise $217 million.

December 9 -

Hahn's experience includes innovative retail structures for conglomerates, holding companies, private funds and private real estate investment trusts.

December 8 -

Hildene, which partners with Crosscountry Mortgage for non-QM securitizations, is doing this deal as part of its buy of an annuity provider, SILAC.

December 8 -

Dext ABS 2025-2 includes a prefunding account with an amount of $65 million, or 15.0% of the collateral's total combined balance.

December 8 -

Federal Reserve watchers expect a board of governors vote in February to reappoint the 12 regional Fed bank presidents — which is typically treated as a formality — to be the next flashpoint in the White House's effort to bring the central bank to heel.

December 8 -

Merchant's notes have several key credit strengths, including that vehicle fleet lease securitization pools have had very low delinquencies and losses historically.

December 5 -

No subordinate notes—the class M notes, essentially—will receive any principal payments until the senior class A notes have been paid down to zero.

December 5 -

Enpal issues the first European public securitization for heat pumps and solar panels.

December 4 -

Delinquency trends split in Q3, with securitized and agency loans showing more strain while banks and life companies saw small improvements amid uneven vacancy and rent conditions.

December 4 -

Levkowitz is known in the capital markets for founding Signal Hill Holdings, and as managing partner of Penn Properties, a real estate investment firm.

December 4 -

The European Banking Federation and the Association for Financial Markets in Europe said the planned tweaks risk "curtailing the utility of securitization."

December 4 -

After the prefunding period, up to 7.50% of the total pool balance will consist of collateral from earlier transactions or newly acquired assets, timeshare loans.

December 3