-

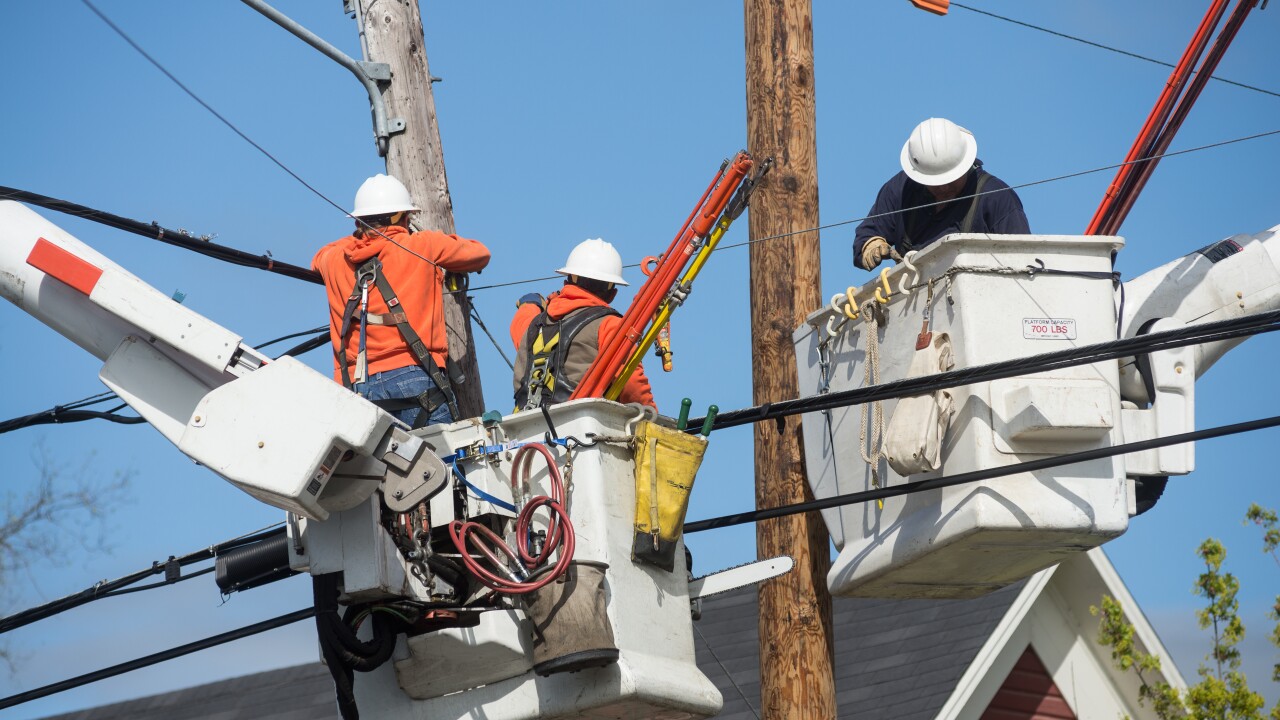

RG&E, series 2025-A, is the second utility cost recovery securitization this week, and is another first-time issuer.

February 6 -

Both forward-flow agreements and the larger asset-backed securitization market are becoming more popular, as consumer debt is growing.

February 5 -

Portfolio enhancements and diversifications cushion the impact of the L.A. wildfires from RMBS losses.

February 5 -

The GMALT 2025-1 securitization has just 24.4% of contracts with original leases longer than 36 months. It's the lowest level for the platform, a credit positive.

February 5 -

Tenants also have a high average credit quality, with 75.9% of them having at least an investment grade rating, and lease assets underlying the class A notes have a loan-to-value (LTV) ratio limited to 70%.

February 4 -

The riskiest portion of the securitization, known as the equity, was placed with investors including sovereign wealth funds, pension funds and family offices

February 4 -

Residential customers made up 70.1% of NYSEG's sales revenue, while commercial and industrial customers account for the other 30% of sales. The latter is a relatively high exposure for such deals.

February 4 -

Unlike previous FIGRE deals where overcollateralization provided credit support to the notes, FIGRE Trust 2025-HE1 has a class G composed of principal-only notes that provide the credit support.

February 3 -

Debt service coverage ratio triggers, including cash trapping and rapid amortization, will provide much of the credit enhancements to the notes.

February 3 -

The deal has a step-up coupon feature that calls for the fixed rates on classes A1, A2 and A3 to increase by 100 basis points, subject to the net weighted average coupon (WAC) after four years.

January 31 -

The multifamily property securities market is expected to stay resilient, despite weaknesses in certain markets due to cooling rent growth, higher vacancy, or oversupply.

January 31 -

Called collateral from various series increased to 6.0%, from 4.0%, while weighted average seasoning increased to 3.15 months from 2.82 months.

January 30 -

Collateralized loan obligation activity should increase despite higher-for-longer rates and liability management exercises.

January 30 -

Stability in mortgage rates may be key to unlocking pent-up demand during the upcoming spring homebuying season, but with loans still expensive and prices continuing to rise, affordability remains a hurdle.

January 30 -

The deal includes a minimum assets test, requiring the issuers to own at least 10 assets at the end of the nine-month delivery period, or seven assets after the delivery period.

January 30 -

Like other recent pools of securitized mortgages located in the Los Angeles County area, any loans that exhibited material damage from the fires were removed from the pool before closing.

January 29 -

Mortgage experts were expecting the first FOMC meeting under President Trump would have more significance in the long run than short-term, with some wild cards.

January 29 -

The A2B notes in TAOT 2025-A will make up 75% of total class A2 notes, a much higher percentage of floating-rate A2B notes than recent deals.

January 29 -

The legendary investor weighed in on the "irrationality of markets" during the recent AI-fueled rally.

January 28 -

Deal production has been a bright spot, but delinquencies could soon reach record highs, especially for office CMBS.

January 28