-

There is also a class N tranche of notes that make payment to those noteholders if funds are available after the overcollateralization.

November 24 -

The transaction uses a shifting interest repayment structure, and its lockout that is subject to performance triggers.

November 24 -

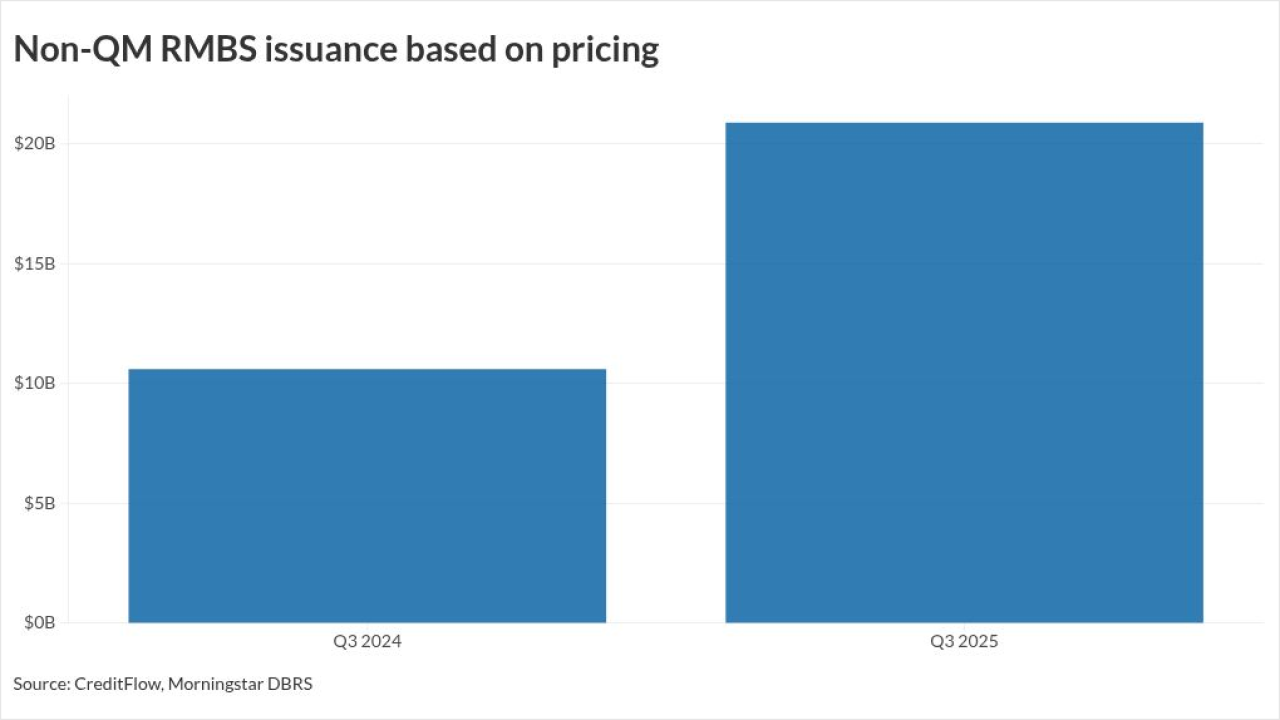

New private-label bonds collateralized by loans made outside the qualified mortgage definition hit highs for the month, quarter and year, CreditFlow data shows.

November 24 -

On a weighted average (WA) basis, the collateral mortgages have a slightly higher leverage level than previous transactions, although moderate, with an original loan-to-value (LTV) ratio of 71.9%.

November 21 -

Private-label CMBS loan delinquencies are rising, but ample liquidity is making 2025 issuance volume the highest since 2007.

November 21 -

The capital structure for Volkswagen Auto Loan Enhanced Trust, series 2025-2, will remain the same, even though the deal can potentially be upsized to $1 billion.

November 20 -

A large majority of the pool assets, 86.2%, are second-lien home equity investment contracts that have a weighted average (WA) multiple share rate of 2.00x.

November 19 -

NSLT 2025-D comes to market as the private student loan sector is seeing increased issuance. Two of the program's deals, series 2025-B and 2025-C, accounted for $4 billion of issuance, almost half the sector's production.

November 19 -

Although the deal, which closes on November 26, is the first securitization from Ansley Park, its owned portfolio since January 2024 has had strong performances with no losses to date.

November 18 -

The billionaire and legacy government-sponsored enterprise investor says there is a quick interim fix and they should eventually leave conservatorship.

November 18 -

GDLP 2025-3 has a so-called vertical risk retention structure, where 95% of the collateral balance is allocated to the noteholders, while retained interest noteholders will hold the rest.

November 18 -

The Structured Finance Association is adding its weight to recent support for a Securities and Exchange Commission action that could modernize Reg AB II.

November 18 -

Spread premiums on esoteric ABS attract new types of investors, including those managing insurers' assets.

November 18 -

If class A notes fail a credit enhancement rest, a cumulative default ratio amortization event occurs, or the pool balance is 10% or less, then GSKY 2025-3 will move to a sequential pay structure.

November 17 -

Policy reviews of GSEs and Basel rules could reshape the MSR market, opening opportunities for banks and altering Fannie, Freddie MBS dynamics.

November 17 -

Since introducing the Upstart Macro Index to address increasing delinquency rates in previous years, the changes to its underwriting and credit models have improved future vintages' performances.

November 14 -

Loan sizes are only $477.50 on average, while borrowers attached to the contracts have weighted average FICO scores of 727.

November 13 -

The proceeds from the deal will recoup costs for repairs on energy infrastructure damaged after Hurricane Helene in 2024.

November 13 -

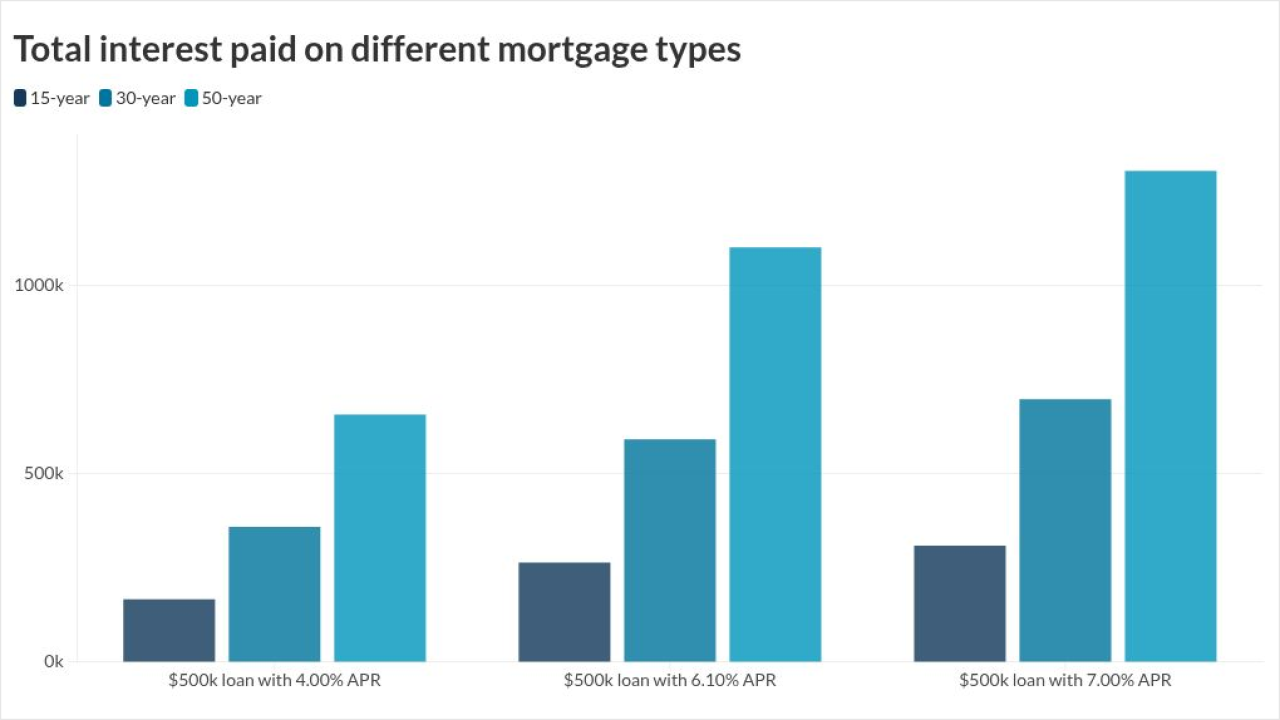

A 50-year mortgage would make borrowers susceptible to higher interest rates, significantly more payable interest and slower equity gains, LendingTree analysis showed.

November 13 -

The securities will mainly hold dollar-denominated floating-rate loans made to US companies. The unit aims to launch the fund in January.

November 13