-

The investment managers new deal launches into a healthy aircraft market.

1h ago -

Many credit drivers are stable; agencies are being vigilant about several macroeconomic factors that might destabilize borrowers' ability to keep servicing their auto loan debt. One is student loan debt.

5h ago -

MBS buying has become the near-term focus but a 2026 offering is still possible, Federal Housing Finance Agency official Bill Pulte told Fox Business.

February 26 -

First liens and junior liens account for 197 and 1,755 of the pool, respectively, DBRS said. They have unpaid balances of $30.5 million and $217 million, with FICO scores of 747 and 740 on a WA basis.

February 26 -

The Loan Store originated the largest portion of mortgages in the pool, 10.3%, according to Fitch, while an array of other lenders accounted for the rest.

February 25 -

Underwriting relied heavily on alternative documentation, led by debt-service coverage ratios (35.7%) and bank statements ranging from 12-23 months (28.2%) and longer than 24 months (4.6%).

February 25 -

At press time no injuries were reported, but exhibitors were relocated to satellite booths throughout the venue, the Aria Resort & Casino.

February 24 -

Federal Reserve Gov. Lisa Cook said AI could boost productivity, but warned the transition may raise unemployment and force difficult tradeoffs between inflation and jobs.

February 24 -

After closing, which is expected on February 27, coupons are expected to pay coupons of 4.83% on the notes rated AAA and 5.04% on the AAA-rated A1LCF.

February 24 -

The index will provide market professionals with consistent, transparent and dependable methods of evaluating performance and risk across the securitized credit markets.

February 23 -

Gatti will be based in the firm's Washington, D.C. office, where he focuses on structuring and executing asset-backed securities deals and other structured finance transactions.

February 23 -

Customers with a FICO of at least 700 accounted for about 75.3% of the PV systems by the aggregate discounted solar asset balance (ADSAB).

February 23 -

GSMBS 2026-PJ2's losses are based on a senior-subordinate, shifting-interest structure and Fitch expects a 10.3% final probability of default in the AAA rating stress.

February 20 -

Interest payments on the class B notes might be deferred to allow the interest and principal on the class A notes if a sequential interest amortization period is in effect.

February 19 -

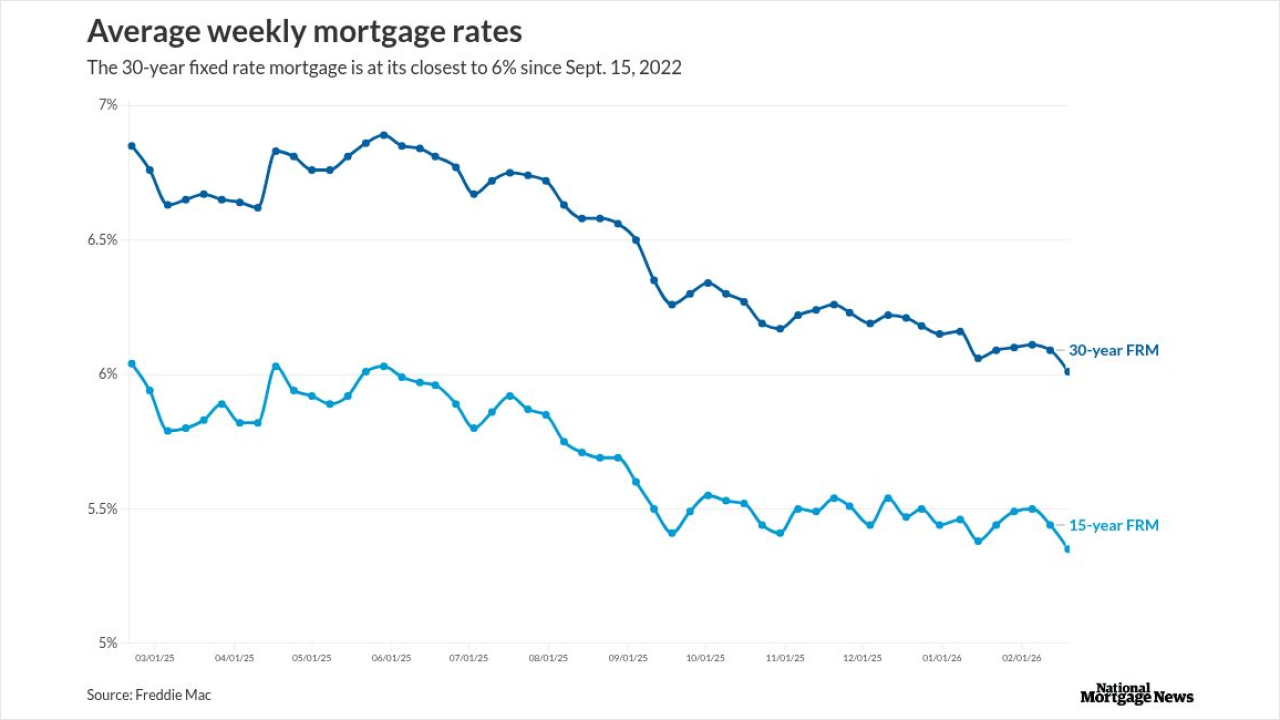

While the Freddie Mac survey recorded a weekly decline, the benchmark 10-year Treasury yield had moved back up by 6 basis points around midday on Thursday.

February 19 -

As finance chiefs feel the pressure to include AI in business models and work flows, the ABS industry is responding with leaner internal operations and reduced human errors.

February 19 -

Bergman sees record-pace changes in capital markets, as reforms fuel securitization growth.

February 18 -

In a speech Tuesday, Federal Reserve Gov. Michael Barr said it was possible that artificial intelligence will boost productivity in an undisruptive way. But he said policymakers should also be wary of a financial crash if those gains are not realized or a rapid adoption that could lead to labor displacement.

February 17 -

If the senior leverage ratio is between 4.00x and 4.50x, then the transaction will pay down all outstanding class A2 note principal with 40% of all excess cash flows.

February 17 -

The deal is the cell tower sector's largest-ever securitization and features its first single-B rated tranche.

February 13