-

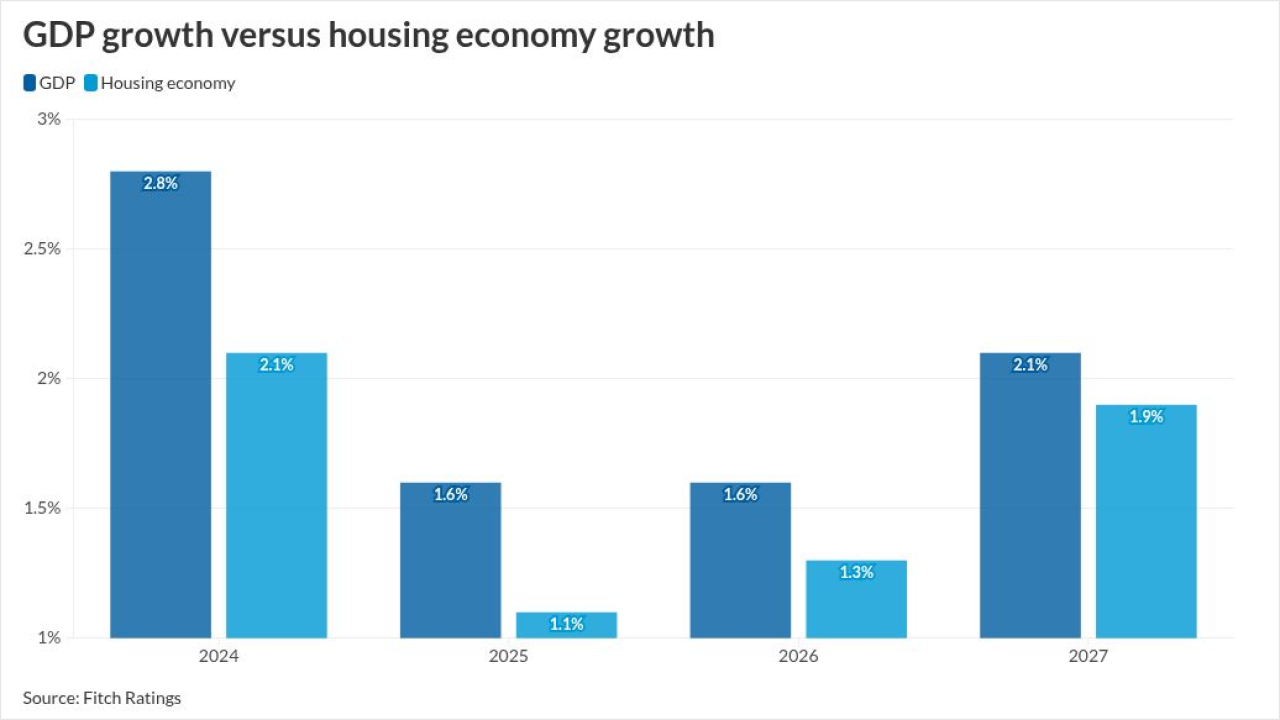

While Fitch and Kroll have differing views on mortgage rates next year, both are looking for mortgage delinquencies to rise in their rated portfolios.

November 14 -

Since introducing the Upstart Macro Index to address increasing delinquency rates in previous years, the changes to its underwriting and credit models have improved future vintages' performances.

November 14 -

Loan sizes are only $477.50 on average, while borrowers attached to the contracts have weighted average FICO scores of 727.

November 13 -

The proceeds from the deal will recoup costs for repairs on energy infrastructure damaged after Hurricane Helene in 2024.

November 13 -

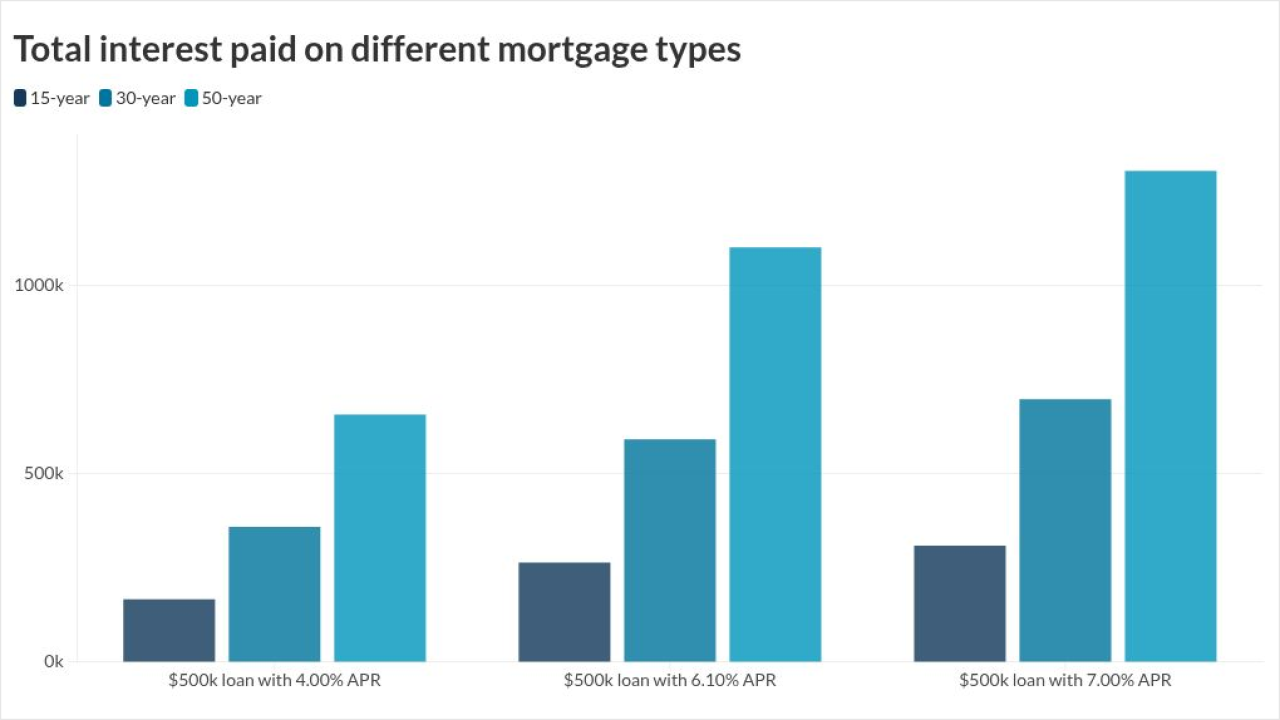

A 50-year mortgage would make borrowers susceptible to higher interest rates, significantly more payable interest and slower equity gains, LendingTree analysis showed.

November 13 -

The securities will mainly hold dollar-denominated floating-rate loans made to US companies. The unit aims to launch the fund in January.

November 13 -

Fed Gov. Stephan Miran has spent his short tenure at the central bank arguing that disinflation in housing and immigration reforms will tamp down inflation in the near term. But other economists say the timing, degree and context of those effects is very much in question.

November 13 -

SEMT 2025-12's collateral profile is slightly weaker compared with the prior transaction, with a slightly lower weighted average FICO score.

November 12 -

The Consumer Financial Protection Bureau Thursday will publish a revamped version of its Section 1071 small business data collection rule, dramatically scaling back the data to be collected and the number of lenders who must comply.

November 12 -

MP 2025-1's loan-to-value ratio will not exceed 70% of aggregate appraised value. To maintain this leverage level, the deal will also collect supplemental principal payments.

November 12