-

Senate Majority Leader Chuck Schumer, D-N.Y., said that he would like to examine the proposed acquisition on "narrower bases."

April 8 -

Series 2024-2 can be upsized to $1.5 billion from the base pool amount, but regardless of the increase, pricing guidance, total credit enhancements and legal final maturities are expected to remain the same.

April 8 -

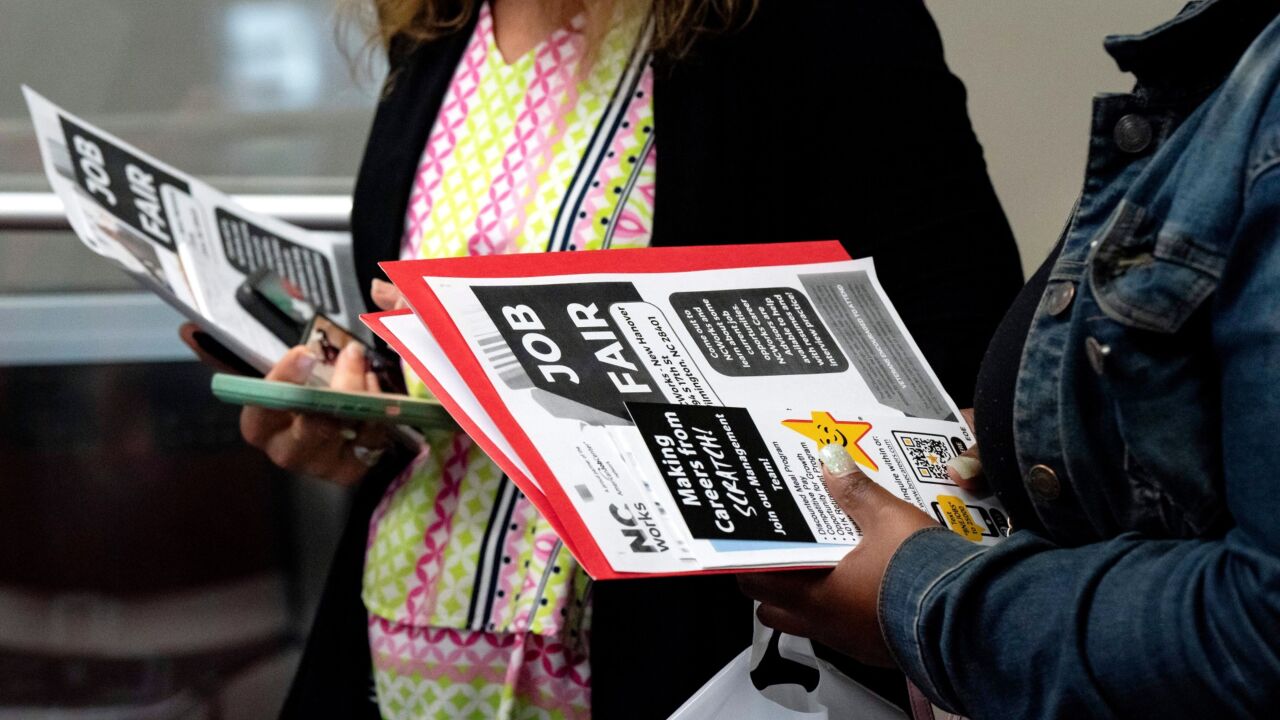

Traders ceased fully pricing in a Fed rate cut before September after the March employment report revealed that US payrolls expanded by the most in nearly a year.

April 5 -

In a study posted weeks after it raised concerns about "junk fees," the Consumer Financial Protection Bureau noted that the amount of borrowers paying discount points doubled from 2021 to 2023, with the increase larger among consumers with lower credit scores.

April 5 -

At the pool level, loans have a weighted average minimum liquid reserve of $5 million, and at the loan level the minimum for liquid reserves is $1 million for sponsors without a FICO score.

April 5 -

The Federal Reserve scored some important legal victories in lawsuits challenging its discretion to grant or deny applicants for master accounts. But whether those victories will last through the appeals process or scrutiny from Congress is uncertain.

April 4 -

BJETS 2024-1 has leases and loans on 31 business jets in the collateral pool, 12 from Gulfstream and 11 from Bombardier, the two largest contributors.

April 4 -

Industry stakeholders predict the bombshell allegations around how United Wholesale Mortgage does business will impact customer sentiment and could lead to more regulatory oversight.

April 4 -

He called the January and February inflation readings "a little bit concerning," and said he needs to see more progress on prices to gain confidence that they're moving toward the Fed's 2% target.

April 4 -

The Department of Housing and Urban Development agency warned in an online notice that issuers with prepayments exceeding certain limits could face sanctions.

April 4