-

A pool of open-end vehicle fleet lease and loan contracts for cars, trucks and other vehicles provide the revenues to the bonds.

April 11 -

The Federal Reserve Board governor and frequent regulatory critic says it would be appropriate for the U.S. to deviate from the agreed-upon international standards to reflect "unique characteristics" of the American banking system.

April 10 -

There are four risk events that could stop cash flow into SMB 2024-R1's deal—missing overcollateralization targets, a stymied principal distribution and the deals do not exercise an optional clean-up call.

April 10 -

Wednesday's report adds to evidence that progress on taming inflation may be stalling, despite the Fed keeping interest rates at a two-decade high.

April 10 -

The memorandum creates channels for sharing information about nonbanks between the Federal Housing Finance Agency and the Conference of State Bank Supervisors.

April 10 -

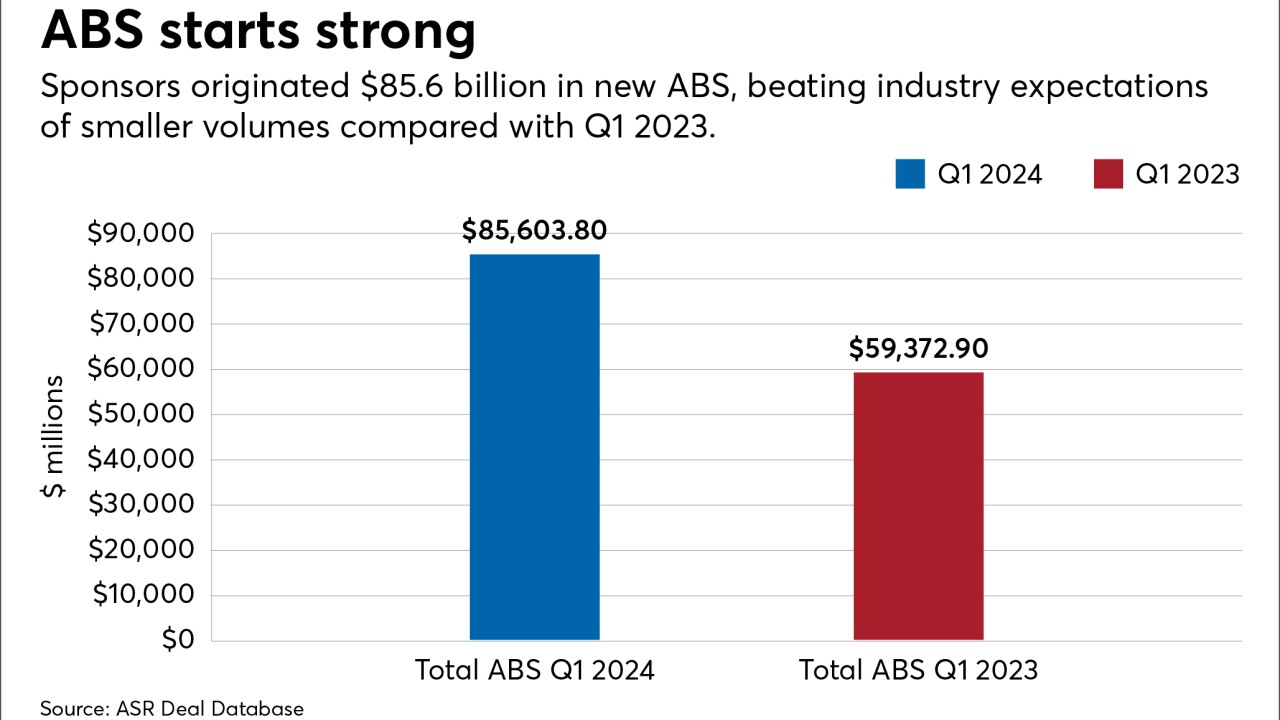

New originations exceeded last year's tally by 30.5%, despite concerns about how rates might impact consumer financial strength. Auto ABS production revved up overall performance.

April 9 -

A solid majority of decision-makers at these companies expect to expand their workforces again this year, a Citizens Financial survey found. Loan losses are normally low in eras of economic expansion.

April 9 -

Mortgage lenders offered more cash-out refinance programs at a time when consumers might be coming to terms with the rate environment.

April 9 -

Aside from overcollateralization and subordination, the notes get support from a reserve account representing 0.96% of the pool and an incremental reserve account maintain 1.00%.

April 9 -

Biden's "Plan B" would see loans reduced or wiped out for millions of Americans — including those whose debt exceeds their original principal amount.

April 8