-

The Railsplitter Tobacco Settlement Authority will price a $679 million current and advance refunding of tobacco bonds.

December 18 -

Two proposals, limiting deductibility of interest and like-kind exchanges, would make securitization uneconomical for auto and equipment lessors, according to the industry trade group.

December 15 -

The collateral for the $59.9 million transaction from DRB Capital includes life-contingent structured settlement receivables; when the beneficiary dies, the insurer stops making payments.

December 13 -

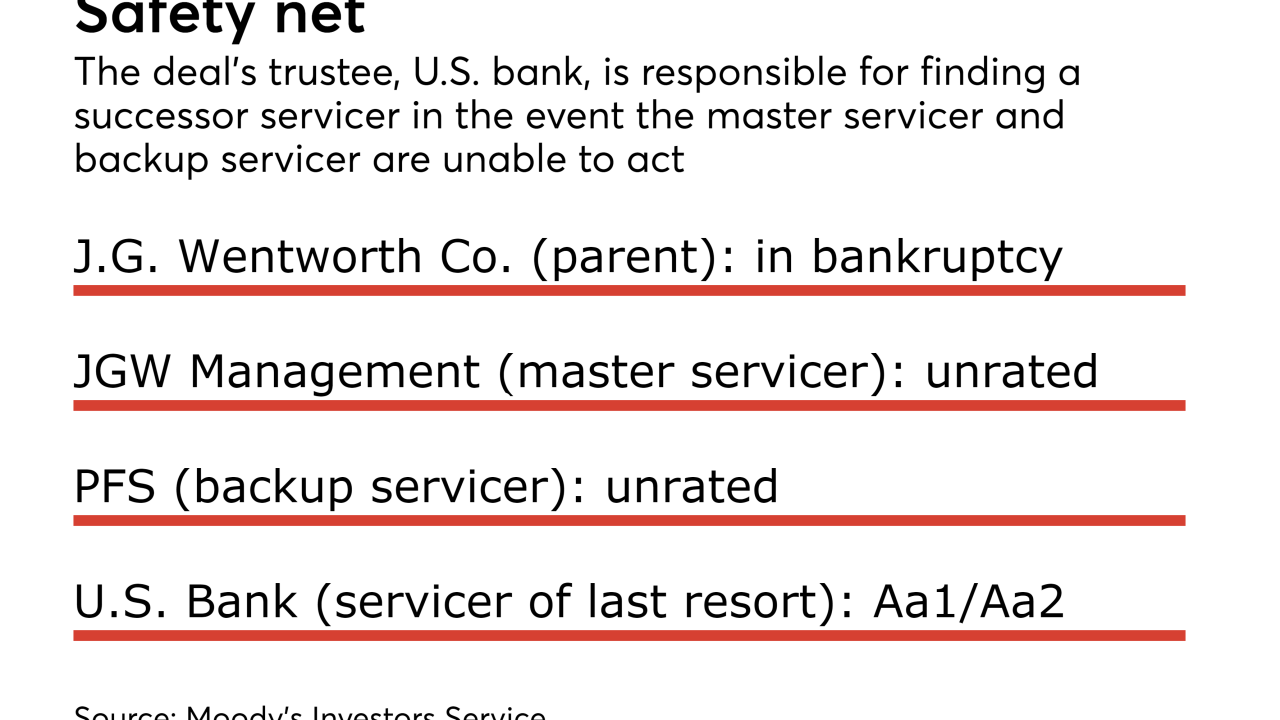

A prepackaged restructuring will not disrupt servicing of the company's assets-backeds because the servicing subsidiary is not part of the filing.

December 11 -

The $160 million cell tower deal is the first since T-Mobile and Sprint abandoned merger talks that could have reduced lease renewals.

December 5 -

The new deal is smaller, at $130.1 million, and the collateral is almost entirely of PV systems financed through third-party loan agreements.

December 5 -

The German-based transport finance company is marketing a $722.5 million transaction secured by lease proceeds on a portfolio of 36 mostly older passenger jets.

December 1 -

The Show Me State passed legislation enabling residential and commercial PACE financing in 2010; however, Renovate America only started funding assessments through the Missouri Clean Energy District three months ago, in August 2017.

November 27 -

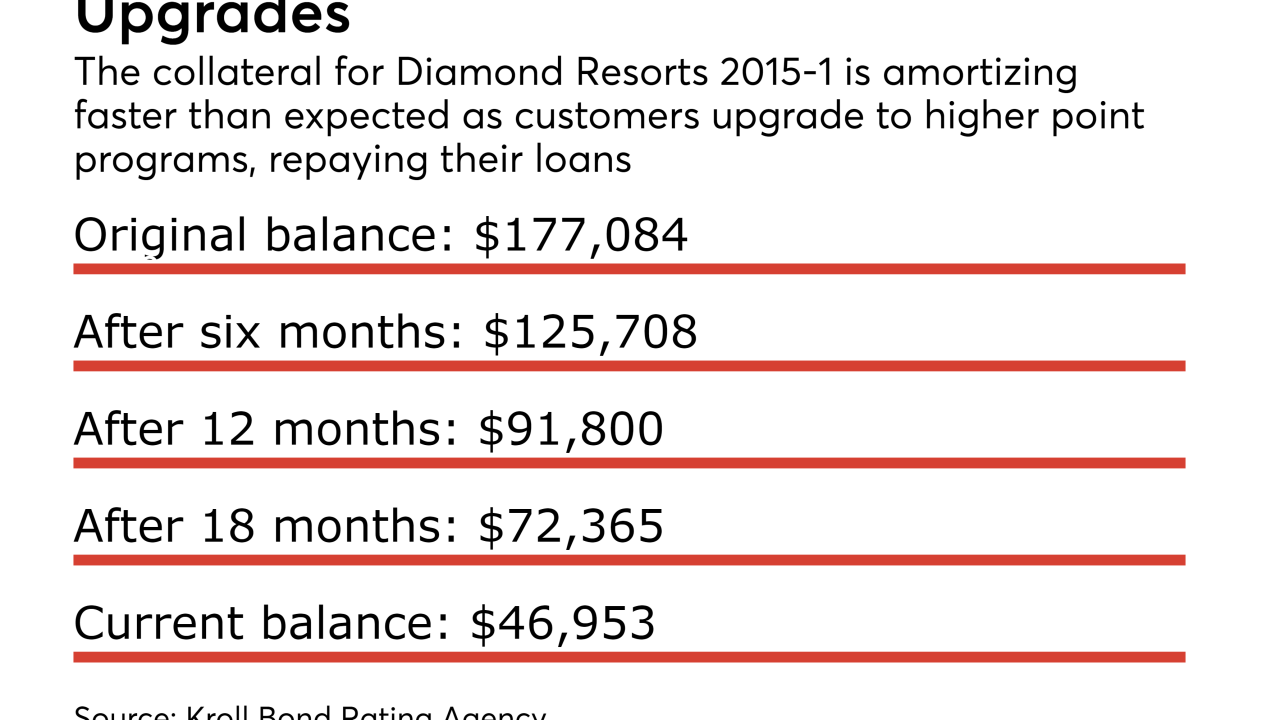

The move convinced Kroll Bond Rating Agency to upgrade $95 million of securities, some of which had been under review for a possible downgrade for over a year; Kroll affirmed the ratings of another $63 million of bonds.

November 20 -

The deal could put downward pressure on market lease rates and renewals in wireless tower ABS portfolios serviced by Crown Castle, American Tower, and SBA Communications.

November 20