-

Nonbank servicers have been seeking more sources of cash since the coronavirus disrupted markets and elevated forbearance rates. These are some strategies they may be able to use.

June 26 -

Whatever path Fannie Mae and Freddie Mac take, the Mortgage Bankers Association would like to see them preserve many of the changes they made while in government conservatorship.

June 23 -

Potential sales last month rose compared with April as homes became more affordable due to low mortgage rates.

June 18 -

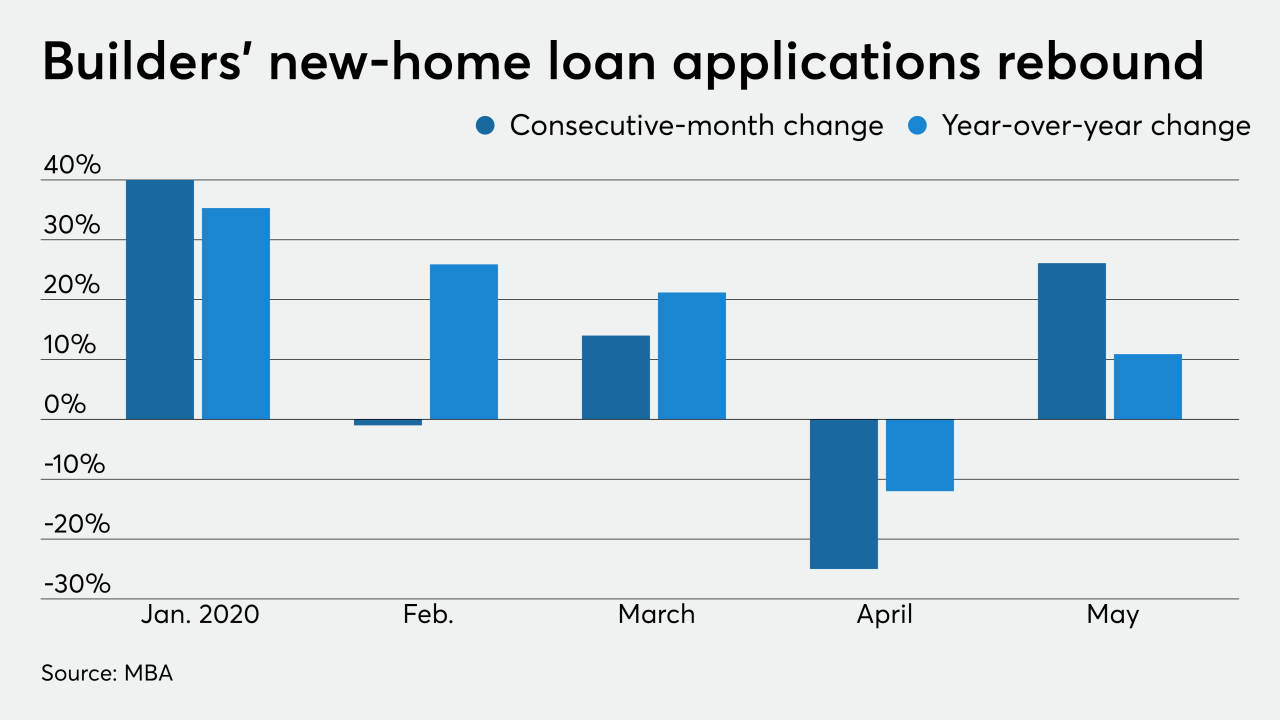

Purchase mortgage application volume was at its most in over a decade as consumer confidence continued to improve in the aftermath of the coronavirus shutdown, according to the Mortgage Bankers Association.

June 17 -

The availability of some loans used to build homes dried up due to the coronavirus. Opening up the economy may help if it doesn't lead to a spike in infections, and if consumer demand persists.

June 16 -

With no way of knowing just how many borrowers will need the mods after the coronavirus forbearance period ends, lenders are deploying artificial intelligence and servicing protocols to tame the ferocious piles of paperwork awaiting them.

June 2 -

Efforts to calm lenders’ fears about coronavirus-related forbearance may not offset tightening standards, and the FHA is less likely to boost volume than it was during the financial crisis.

April 21 -

Surging unemployment from COVID-19 shutdowns brought a rapidly rising tide of forbearance requests, according to the Mortgage Bankers Association.

April 20