-

Despite a large overcollateralization target and the elimination of no-interest loan programs, Conn's securitizations suffer high default levels that keep its Class A notes at a triple-B ratings cap.

December 8 -

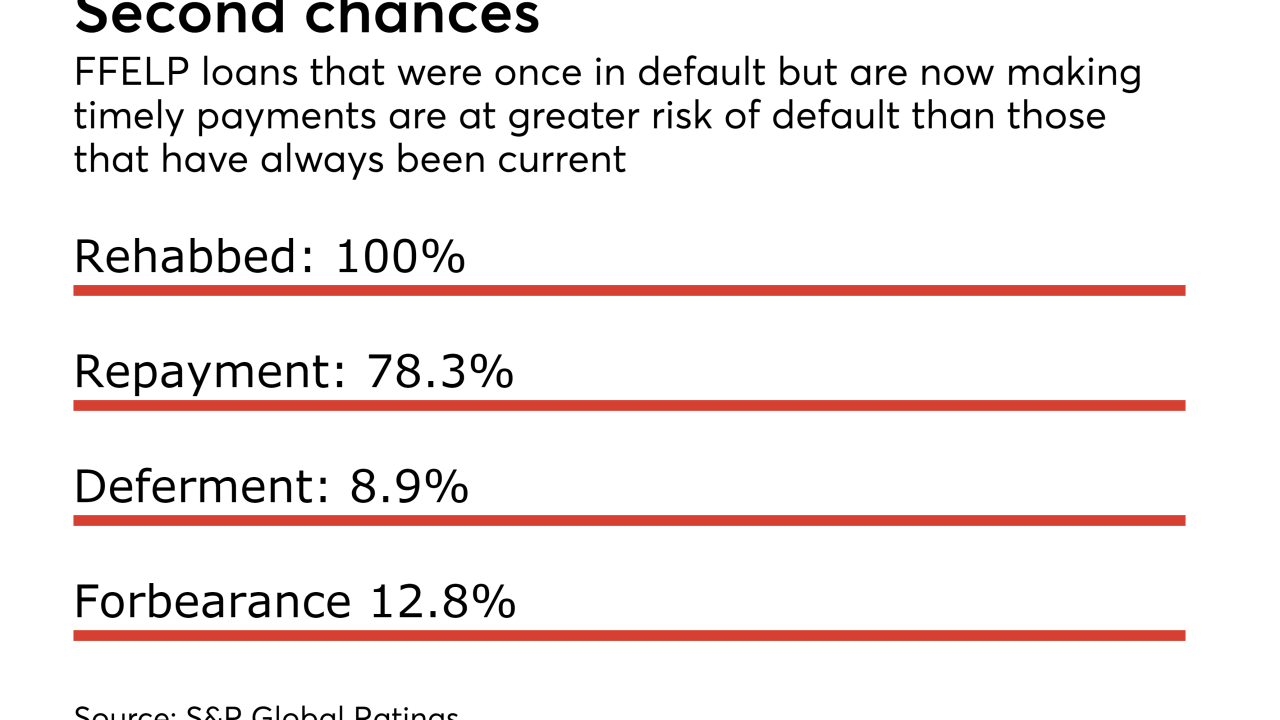

By comparison, rehabilitated loans accounted for just 19.5% of the collateral for the servicer’s July offering and 10% of its May offering.

December 6 -

The Spanish bank's German retail lending unit is securitizing a fifth pool of mostly unsecured personal loans from an €83.5 billion portfolio.

November 20 -

The securitization market is weathering risk retention and rising interest rates, though Fitch Ratings is keeping its eye on some consumer asset classes as the credit cycle lengthens.

November 15 Fitch Ratings

Fitch Ratings -

Four tranches of rated notes totaling $591 million were issued, resulting in an advance rate of 92% vs 88% for the previous deal; pricing also improved.

November 9 -

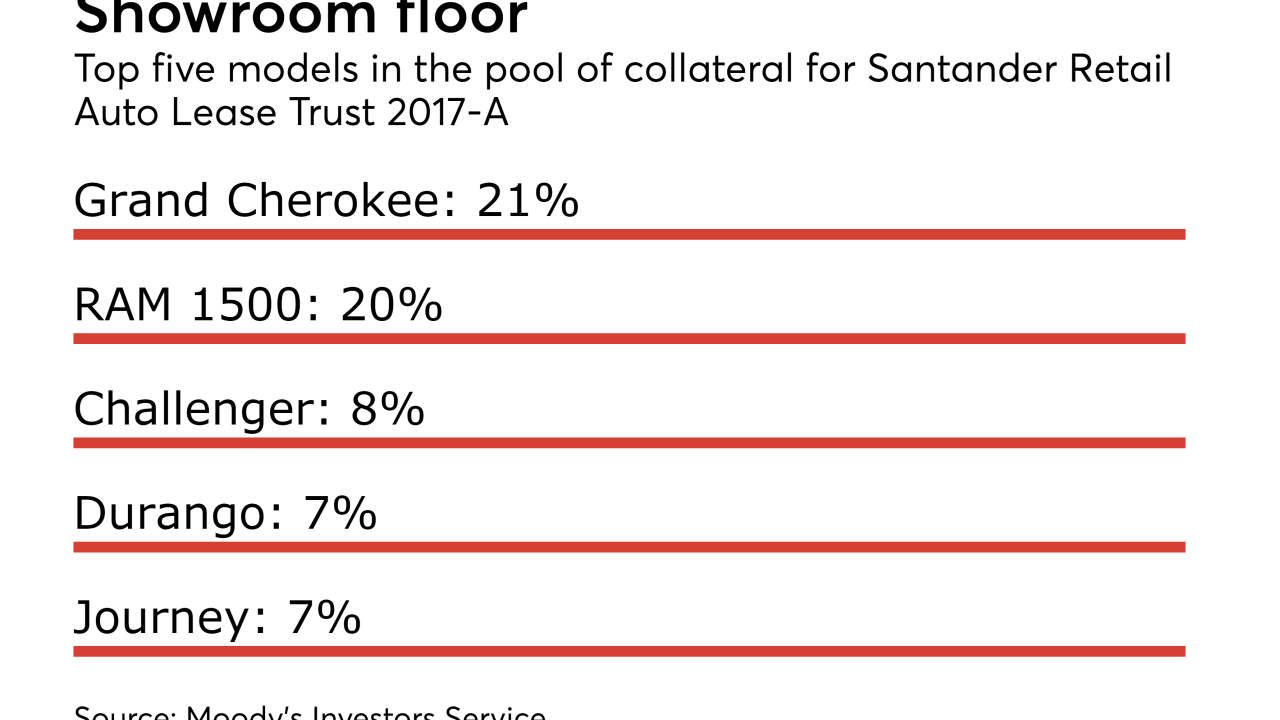

Unlike Santander’s existing retail auto loan platform, Santander Retail Auto Lease Trust 2017-A is backed by prime quality collateral. The leases were originated by its Chrysler Capital division, through dealers of Fiat Chrysler vehicles.

November 9 -

The San Francisco firm is the latest U.S. lender to tighten credit standards amid concerns that consumers are shouldering too much debt.

November 8 -

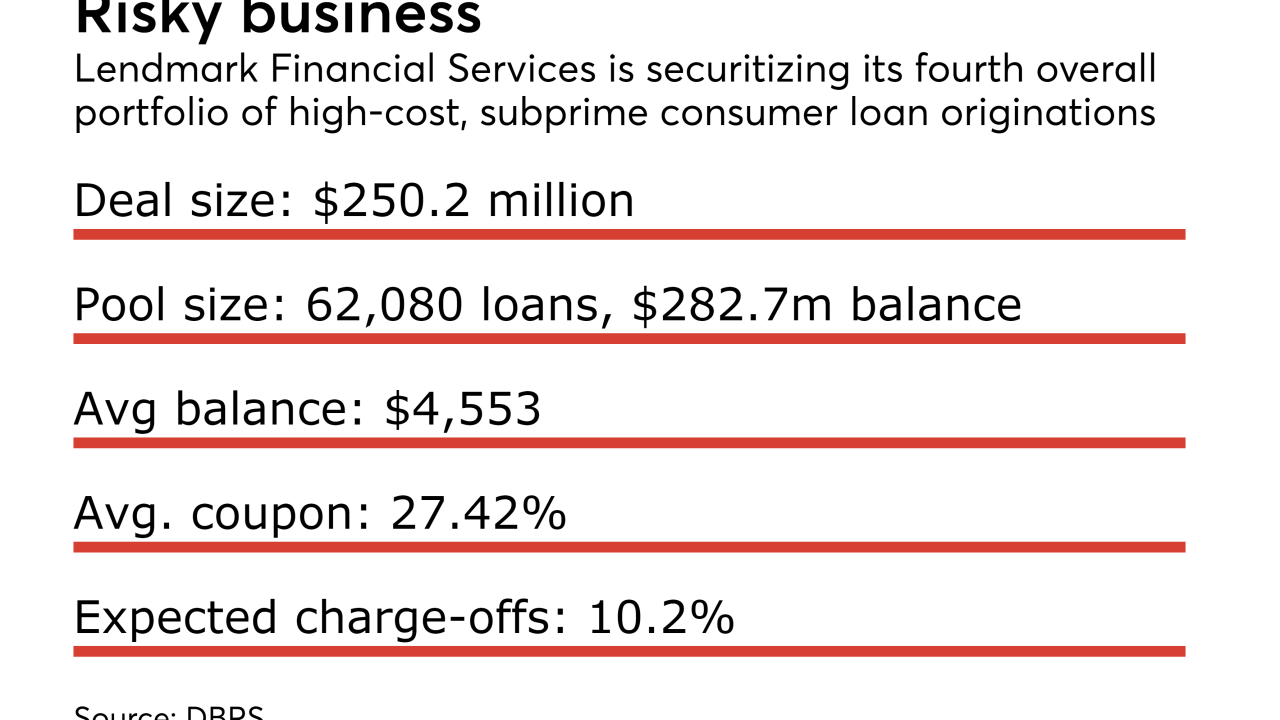

The company increased the concentration of sub-550 Beacon score borrowers to more than 13%, and cut the share of prime 700-plus loans by more than two-thirds from its prior deal.

November 8 -

A bipartisan coalition of AGs and officials representing 25 states sent a letter to Education Secretary Betsy DeVos today urging the department to reject what they said was a campaign to dismantle state oversight of the industry.

October 24 -

In a surprise move, the Supreme Court will decide whether Amex may bar merchants from steering customers to less expensive card networks. The card issuer will have to prove the consumer gain from its practices outweighs the merchant pain.

October 16