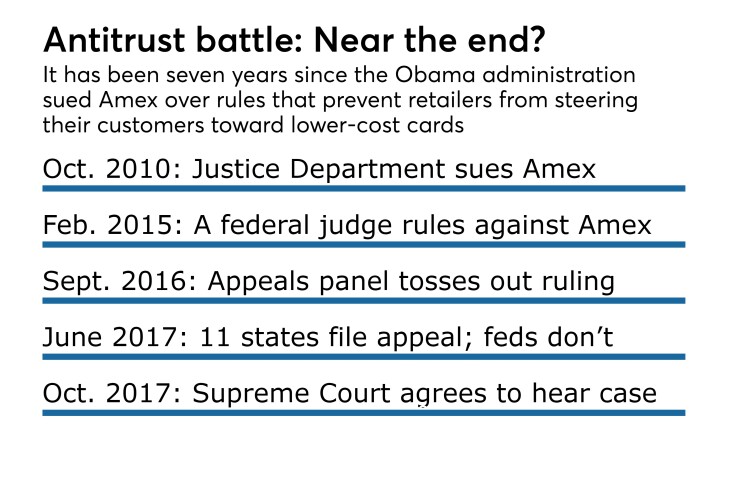

The government’s long-running antitrust case against American Express took a surprise turn Monday when the U.S. Supreme Court reopened a saga the New York-based card issuer hoped to put to rest.

The lawsuit, filed seven years ago by the Obama administration, challenges Amex’s practice of barring retailers that accept the company’s plastic from steering their customers to other card networks. Critics of such rules say they are bad for competition and have led to a cycle of higher and higher fees for merchants.

American Express charges some of the highest fees in the card industry, which has caused tension with retail chains including CVS and Rite Aid since they want to keep a larger percentage of their sales.

Last year, American Express prevailed in a decision by a three-judge panel of the 2nd U.S. Circuit Court of Appeals. And earlier this year, the Trump administration sided with Amex in advising the nation’s highest court not to take the case.

But the nine justices also heard from merchants and consumer groups that hope to see the anti-steering rules struck down, in addition to 11 states that were co-plaintiffs in the lawsuit, and their arguments for consideration prevailed.

“I am pleased that the U.S. Supreme Court has agreed to take on this case,” Ohio Attorney General Mike DeWine, a Republican whose office filed the appeal, said in a press release. “The issues in this appeal involve anti-competitive practices that hinder Ohio consumers and Ohio retailers and merchants.”

Shares in American Express fell by about 1% on Monday as investors digested the Supreme Court’s action.

“As we have stated previously, the earlier decision by the 2nd Circuit panel protects a consumer’s right to choose how they pay, prevents our card members from being discriminated against and promotes competition in the payments industry,” Amex said in a statement.

Court watchers interpreted the Supreme Court’s decision to hear the case as an indication that certain justices likely disagree with the lower court’s ruling.

It takes at least four votes out of nine for the court to hear a case, and there would seem to be little reason to hear the appeal if the lower court decided the case correctly.

“There’s a very strong chance the 2nd Circuit will be reversed by the Supreme Court,” said David Balto, an antitrust lawyer in Washington.

At an earlier stage in the litigation, Balto represented consumer groups that want the courts to allow steering by retailers. He argued Monday that the case will lead to a more competitive credit card market, and will ultimately reduce the prices paid by consumers.

Eric Grover, a payments industry consultant, takes a different view. He argues that the courts should consider the competitive effects of the anti-steering rules on consumers as well as retailers, and notes much of the revenue that card companies collect gets passed along to shoppers as reward points. This is the perspective that the 2nd Circuit Court of Appeals embraced.

If the Supreme Court ultimately overturns the appeals court ruling, big-box stores may start steering their customers to lower-cost cards, Grover predicted.

“I think that they’d love to, if they can make it work,” he said.

The hurdle that retailers will continue to encounter, even if their arguments prevail in court, is that some consumers may not respond well to steering. Retailers will be loath to encourage the use of lower-cost cards if those efforts cause a substantial falloff in sales.

Grover said that among the major U.S. card networks, American Express has the most to lose in the litigation, since its cards carry the highest average fees for retailers.

“It would be a negative for Amex,” he said. “It would be a negative, but a lesser negative, for Visa and Mastercard.”