You don’t need a credit history to get a federally guaranteed student loan, you just have to demonstrate eligibility. The interest rates are fixed, low, and, for those with the greatest financial need, may not have to be paid until the student graduates.

Private student loans, by comparison, are relatively expensive and generally have less flexible terms. They may require a co-signature from a parent, and repayment begins immediately. So borrowers generally only apply for them when the maximum federal student loan available (together with other forms of financial aid) is less than the cost of attending a school.

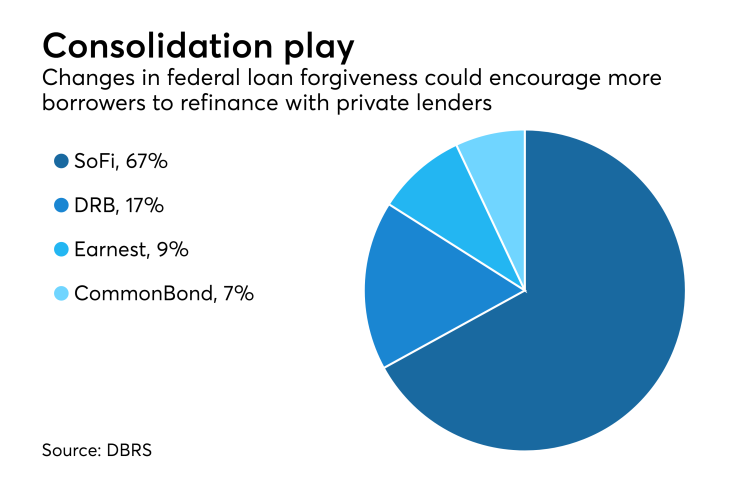

This gap has been widening over the past decade as the cost of getting higher education has escalated. Still, private loans represented just 7.7% of the $1.3 trillion in student debt outstanding as of the end of the first quarter, according to MeasureOne. But the industry anticipates that the role of the private sector will increase as President Trump asserts his agenda.

The biggest opportunity would likely come from limits to PLUS loans for parents and graduate students, something that is beyond the scope of regulators and would require congressional action. Notably, it was not included in the administration’s budget proposal. Nevertheless, industry participants say that political appetite for such action is increasing. Ken Ruggiero, chief executive of Goal Structured Solutions, told participants at ABS East that lowering borrowing limits for Grad PLUS loans could create the need for an additional $4 billion in private lending over four years.

And there are plenty of other things happening, both at the Department of Education and on Capitol Hill that could benefit both in-school lending, which is dominated by banks (SLM Corp. is the market leader, followed by Wells Fargo and Discover) and refinance lending, which was pioneered by marketplace lenders such as Social Finance and CommonBond.

Education Department ends partnership with CFPB

The Department of Education has ended a collaboration with the Consumer Financial Protection Bureau to share information about student loan complaints.

The CFPB has been one of the most aggressive regulators of for-profit schools and student-loan servicing companies in recent years. Early this year, it filed a lawsuit against Navient, accusing the company of adding $4 billion in student debt by failing to offer income-based repayment plans to struggling borrowers.

While private lenders have not been a target, they nevertheless feel encouraged.

In an Aug. 31 letter, the department accused the CFPB of overreaching and expanding its jurisdiction. Rather than turn over complaints from student borrowers to the department within 10 days as specified in their deal, the CFPB had intervened in those cases itself, the letter stated.

“Our goals are to ease the burden for borrowers and to enhance the efficiencies of our servicers — not to complicate the federal student loan process with potentially inaccurate and inconsistent directives,” wrote Kathleen Smith, acting assistant secretary for postsecondary education.

“The department entered into the [memorandums of understanding] in reliance on the CFPB’s commitment to helping each agency fulfill its respective duties. Instead, the CFPB is using the department’s data to expand its jurisdiction into areas that Congress never envisioned.”

“That’s a big deal, it signals a lot,” David Klein, CEO of CommonBond, said in a telephone interview.

He noted that people close to the Trump Administration say this data flow from the department into the CFPB “was feeding a regulatory overreach” on the part of the agency.

New Federal Student Aid Chief

In June, Department of Education Secretary Betsy DeVos named A. Wayne Johnson, a financial services executive, as chief of federal student aid. (James Runcie, his predecessor, resigned abruptly in May.) Johnson comes from the private sector: in 2012, he founded a company specializing in private student-loan refinance. He also holds a doctorate in academic leadership from Mercer University, where he authored a dissertation on private student loan indebtedness.

“If you understand who he is, why he got his doctorate at age 65 ... this could be nothing other than a very positive change,” Ruggiero said at IMN’s ABS East conference.

Ruggiero pointed to Johnson’s decision to scotch plans to move to a system where a single company would service all federal student loans, saying “it shows that there are much more practical things going on. That’s all good news for the private sector,” and “opens up opportunities.”

Revising loan forgiveness

Since the 1990s, certain borrowers have had the option of making minimum payments based on their level of income, but a series of changes beginning in 2007 have made the program more generous and more widely available. In his first budget request to Congress, President Trump proposed changes that, on balance, would benefit undergraduates, but would substantially reduce benefits for undergraduates. Grads would have to make payments under the plan for 30 years before their remaining debt is forgiven, up from 20 years currently.

This could encourage more borrowers to refinance with private student lenders once they complete their advanced degrees and secure a job, according to Robert Kelchen, assistant professor of higher education at Seton Hall University.

Currently, he said, some borrowers may avoid refinancing federal student loans with private lenders because they don’t want to lose access to the government’s income-based repayment options. With a longer loan forgiveness term, however, borrowers would have less to lose by refinancing with a private lender.

“Interest rates on Grad Plus loans are fairly high, so if you’re not going with income-based repayment, then refinancing makes a lot of sense,” he said in an interview. The proposed changes to IBR would be less favorable to graduate students if enacted, so “refinancing may make sense for more people.”

Employer contributions

Several bills have been introduced in recent months that would offer incentives to employers to help pay for their workers’ student loans. An employer would be able to provide employees with up to $5,250 per year in tax-exempt funds to repay debt. That’s much like an existing program that allows employers to provide tax-free tuition assistance.

While some employers already help their employees repay student debt, the bills would encourage more to follow suit.

Klein said the legislation could be a boon for consumers and employers. “It will have a dramatically positive effect on employees who will have a tax-free benefit on student loan repayment, and on employers who will have a competitive advantage in the war for talent,” he said.

The impact on student lending and student loan investors is less clear, On one hand, it will increase the likelihood a loan is repaid, but also eat into the balance of the loan, so it will not be outstanding as long. That will shorten the weighted average life of a lender’s loan portfolio, “which could be good or bad, depending on what investors want, and the degree of pay down,” Klein said.

There’s some skepticism about the bill’s prospects, however.

“I’d be surprised if that went anywhere,” said Jason Delisle, a resident fellow who specializes in higher ed finance at the American Enterprise Institute. “Tax breaks to an employer strikes me as providing a bigger benefit to those with highest incomes,” he said. “Most of student debt is government loans; all they have to do is pass a law that, instead of giving a tax break, changes the terms of loans.”

Limits to PLUS programs

Prior to the 2006-2007 academic year, students could only borrow up to $20,500 a year in federal loans. (There was also a lifetime limit.) But in 2006, that cap was lifted, allowing graduate students to borrow up to the cost of attendance as set by their universities, including living expenses.

Parents can also borrow up to the cost of attendance, although this represents a much smaller proportion of total higher ed finance.

This makes Grad PLUS and Parent PLUS programs easy targets for proponents of reducing the government’s role. Eliminating or reducing them would create a big opportunity for private lenders. “If Grad PLUS or Parent PLUS is capped, and students need more money to cover costs, it’s natural that they will look for other options,” Klein said.

“It feels like a cap on Grad PLUS/Parent PLUS borrowing is more likely than a total removal of the programs, but there’s real chatter on both.”

However there are both political and budget challenges to reducing the amount the government lends through these programs.

“It should be an easy thing to rally Republicans around,” said Delisle. “In fact, Republicans were the ones who created lending for graduates in 2006. There doesn’t seem to be a lot of political appetite for a reduction in the amount the government lends. If you look at the President’s budget, it didn’t’ include any reduction in the amount of borrowing. It’s not a fight they want to take on.”

There’s also the issue that, under budget rules in place, if you reduce the amount of student loans the government makes, it’s accost to the government, Delisle said.

“So if you’re a policy maker in Washington studying ways to change the student loan program to bring in private capital, first of all, your constituents will scream that you’re making it harder to get their kids through college, and second, the budget office is telling you you’ve just cost the government money,“ he said