-

Credit enhancement and expected loss levels in Upstart's 2019 securitization debut have risen from its previous deal last August.

February 14 -

Barclays, BMO, Citibank, Goldman Sachs and ING contributed to the online student lender, which last year made over $1 billion in loans.

February 14 -

The bureau wants to further remove the threat of legal liability for firms that test products benefiting consumers, but the attorneys general say the agency cannot provide immunity from state law.

February 12 -

The online lender founded by Renaud Laplanche contributed half of the collateral for the $226.9 million transaction. It's also retaining a 5% economic interest in the deal.

February 12 -

The installment lender, which bills itself as an alternative to payday lenders, targets underserved communities and operates through a network of retail partners.

February 12 -

GM Financial is front-loading the $1.2 billion deal with early maturities, according to presale reports; Hyundai Capital is also readying a $710 million transaction.

February 8 -

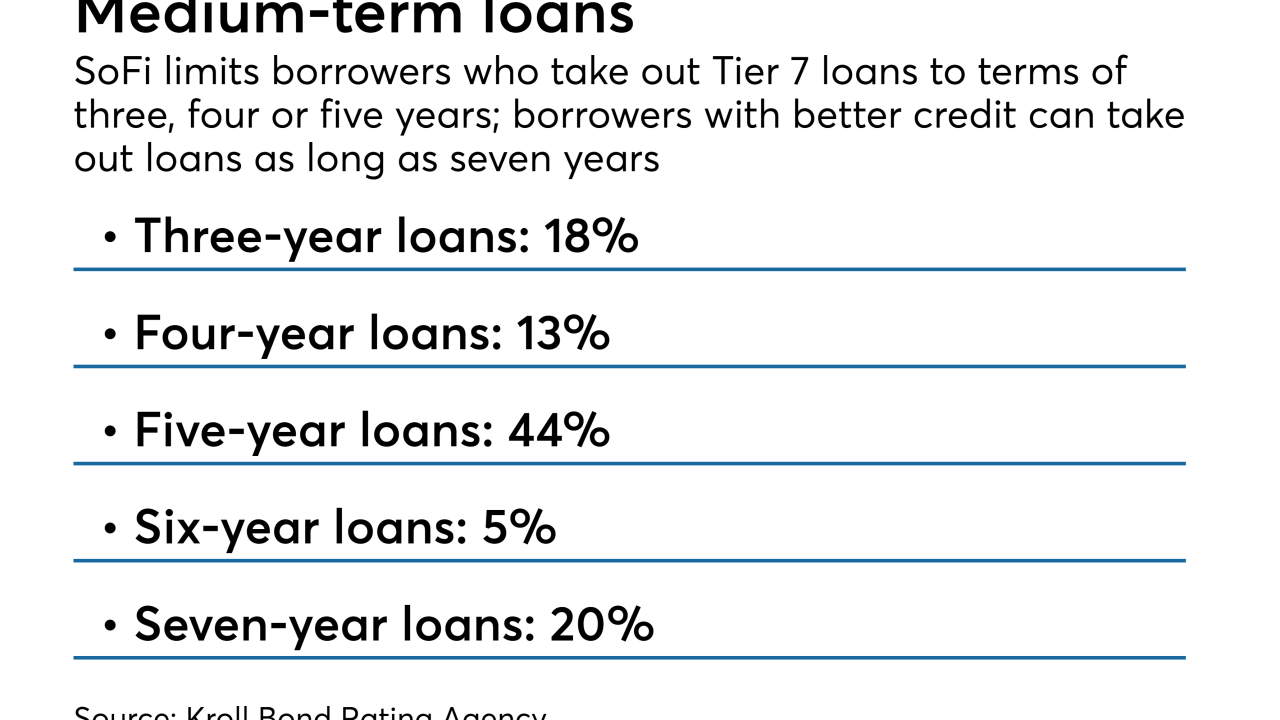

Tier 7 loans, which have lower limits on free cash flow and allow negative personal income, account for 7.26% of the collateral for the online lender's next transaction, according to Kroll.

February 8 -

In a major victory for small-dollar lenders, the agency plans to rescind underwriting requirements that were the centerpiece of the rule drafted by a Democratic appointee.

February 6 -

As the consumer lender announced its seventh consecutive profitable quarter, its CEO bragged that his company is better positioned than the likes of Goldman Sachs and LendingClub.

February 1 -

Lenders are glad the agency worked swiftly through a backlog of paperwork, but they're worried funds will get cut off if the government closes again.

February 1 -

The remainder of the collateral was contributed by Goldman Sachs, which is also holding onto 5% of the risk in the deal to comply with risk retention rules.

January 28 -

Despite a generally positive picture in the Shared National Credit report, regulators warned that underperforming loans in the portfolio remain elevated.

January 25 -

Federal regulators should consider applying guidance that is nearly two decades old to end uncertainty about the legality of particular bank partnerships.

January 17 Pepper Hamilton

Pepper Hamilton -

Some in the industry worry the Fed may balk at allowing OCC charter recipients into the payments system, but Otting downplayed those concerns.

January 16 -

The tricky part: raising awareness without appearing to take advantage of borrowers at a time when agencies like the SBA are out of commission.

January 11 -

This year saw elation over the rollback of risk retention for CLOs give way to concerns about leveraged lending, the 1st post-crisis downgrade of a subprime auto deal, the 1st AAA for commercial PACE, and much, much more.

December 31 -

Freddie Mac issued its first non-low-income housing tax credit forward commitment, providing financing for an affordable housing development in Minnesota.

December 28 -

The state has expanded the scope of ongoing legal actions against Avant and Marlette to include several securitization trusts and trustees.

December 27 -

The online lender will roll out the business early next year with a focus on loans of less than $100,000.

December 19 -

Live Oak Bancshares became an SBA juggernaut by making loans, selling them and making more. With economic conditions changing, it is retaining more credits.

December 14