The partial government shutdown could be good news for alternative lenders.

StreetShares, a Reston, Va., lender that caters to entrepreneurs with military backgrounds, is among the first nonbanks to actively offer bridge financing to businesses affected by the impasse in Washington.

Other nonbank lenders are positioning themselves to respond to a lapse in services from government agencies such as the Small Business Administration, industry experts said.

Troy Business Group, a Miami credit brokerage firm that works frequently with banks to place SBA loans, has been receiving more emails from alternative lenders in recent days, said Kris Henry, the company's director of operations.

“They want to make sure we know they’re open for business,” Henry said.

It is a balancing act for nonbanks that want to show they are available while avoiding any appearance that they're exploiting the shutdown.

“I don’t think they want to be seen as badmouthing the SBA,” Henry said.

Sebastian Rymarz, chief business officer at Fundbox in San Francisco, said his company

“It’s a bad thing,” Rymarz said, though he noted that he has approved overtime for loan officers and support staff to cover a spike in demand.

The three-week shutdown has put SBA lenders in a tough spot since the agency cannot process or approve applications.

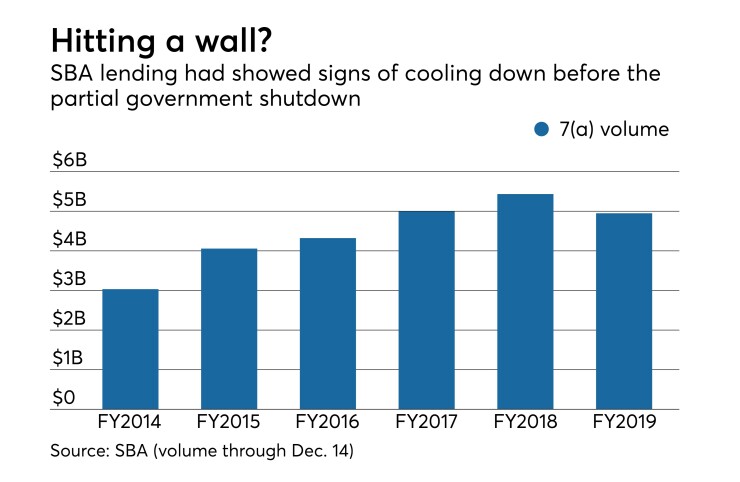

SBA activity was already cooling. Through Dec. 14, the number of 7(a) loans backed by the SBA in fiscal 2019 was down 14.1% from a year earlier, totaling 10,545.

Kevin Ferryman, director of SBA lending at the $915 million-asset Patriot National Bancorp in Stamford, Conn., said his group is doing what it can to help SBA clients, though that mostly involves ensuring clients have their loan packages ready to go once the government reopens.

“They don’t qualify for conventional financing,” Ferryman said. “SBA is kind of where the need to be with banks. … If it ends soon, we’ll be all set to get back to business, but every day it drags on it’s more impactful.”

Small businesses in desperate need of funding face a challenging decision: wait for the SBA or turn to a higher-cost alternative lender who can deliver now.

Troy had an SBA deal “locked and loaded” only to have the rug pulled out at the last minute by the shutdown, Henry said. The borrower ultimately turned to an alternative lender that offered a short-term loan that had a higher rates and significant closing costs.

The main beneciaries have been companies such as Fundbox, which has had record activity in recent weeks, Rymarz said. While much of the growth at Fundbox could be tied to an upgraded product set, he said the SBA shutdown has also played a role.

FundKite, an alternative finding site based in New York, has also seen a spike in demand.

“Businesses are seeking to grow into the visions they have for their companies but cannot, unfortunately, while the SBA is shut down,” said Alex Shvarts, FundKite’s founder and chief technology officer. “They’re seeking alternative sources of cash flow.”

While the SBA is “a key source of funding for small and midsize businesses,” Shvarts said, "some business owners have chosen not to keep their plans tied to the government."

It’s hard for Ferryman to fault borrowers who turn to alternative lenders while the SBA remains shuttered. Though Patriot and other banks that emphasize SBA lending can pivot to other business lines, borrowers don’t have as many choices.

“Maybe that’s the right option,” Ferryman said.