-

Lenders including Barclays and Deutsche Bank have been left holding at least $1.5 billion of leveraged loans that they've struggled to sell over the past several months, according to people with knowledge of the matter.

October 24 -

No investor wants to touch the riskiest high-yield debt. The bank’s asset manager says it’s cheap enough that there are opportunities.

October 22 -

S&P's review of leveraged-loan deals across multiple sectors found only 17% of lenders have provisions that would disallow borrowers from transferring collateral assets to unrestricted subsidiaries outside lender reach.

October 21 -

The $5 billion financing package may also include around $1 billion of secured debt that would be sold to investors, as well as about $1.7 billion in letters of credit that would be split among participating banks

October 14 -

Kroll Bond Rating Agency has tracked rising levels of annualized net losses in marketplace-loan securitizations except for, ironically, the riskiest pools it tracks from unsecured subprime lenders: both losses and delinquencies for subprime lenders' outstanding securitizations have fallen from September 2018 levels.

October 11 -

The company has rolled out an online platform for firms considering marketplace loans as an asset class.

October 10 -

Barely noticed in a corner of the financial markets, leveraged loans originally worth about $40 billion are staging their own private meltdown.

October 9 -

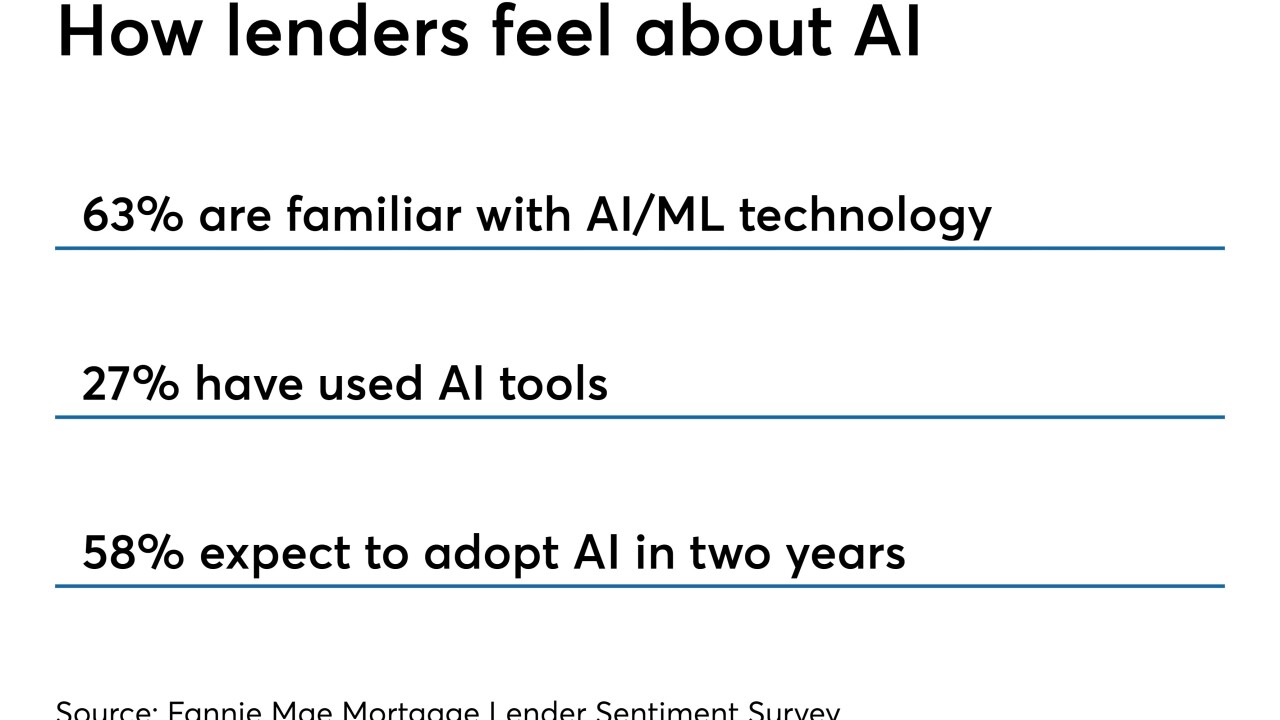

Freddie Mac's test of artificial intelligence to make lending decisions could be a significant turning point in broadening the use of the technology.

October 2 -

In the pool of 46,070 vehicles in the $1 billion pool or 59,863 in the $1.3 billion pool, none are equipped with diesel engines that were at the center of Volkswagen’s worldwide emissions scandal in 2015.

September 26 -

Digital-first lenders more than doubled their market share in the last four years, according to a report by Experian.

September 25 -

Members of the House Financial Services Committee cited leveraged lending, cybersecurity and the switch to a new interest rate benchmark among potential systemic risks that keep them up at night.

September 25 -

Digital loan underwriting has taken the lion's share of the volume of unsecured consumer lending, a sector with plenty of room for growth, according to DBRS.

September 23 -

The third issuance from the master trust has a higher average interest rate and greater expected losses than previous pools due to the inclusion of more higher-risk marketplace loans.

September 16 -

SoFi's fourth issuance of marketplace loans includes more contracts in the pool with terms of 24 months, 48 months and 60 months, and fewer 36- and 84-month loans.

September 13 -

It hasn't stimulated loan demand in ways banks hoped it might, and some CEOs fear future rate cuts might cause companies to hunker down.

September 10 -

The bureau issued three policies removing the threat of legal liability for approved companies that test new products.

September 10 -

The acquisition of Radius Intelligence fits with the online lender's existing focus on small commercial borrowers.

September 3 -

A year after the major credit bureaus agreed to strip tax liens and civil judgments from consumers' credit files, a new study says it is hampering lenders' credit decisions. But proponents of the move insist it was the right call.

September 3 -

Nonbank lenders Monroe Capital and MGG Investment Group have made a combined $115 million of loans to firms that make cannabidoil and supply products to the cannabis and hemp industries.

August 26 -

Blooma has developed a software product that combs databases to create property profiles for commercial real estate lenders. It can drastically cut origination costs and approval times and help banks identify safer loans, the company says.

August 23