-

A program that lets firms bundle Small Business Administration loans is on hold while Congress spars over a new budget. The impasse is causing headaches for banks that rely on loan sales for fee income.

December 9 -

A trial to get underway this week over one of the biggest banking errors in recent memory will be closely watched on Wall Street, and its outcome could have a significant impact on the industry.

December 7 -

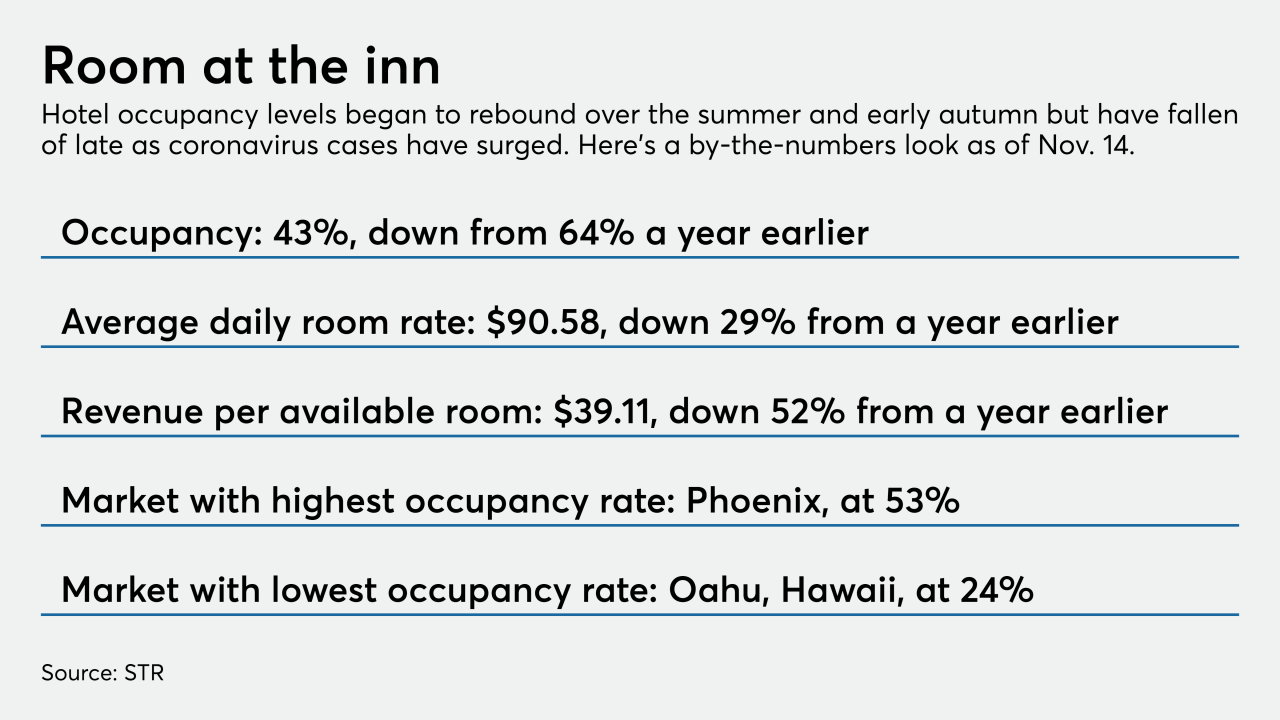

Hospitality sector credits are coming out of forbearance just as coronavirus cases surge. Restructurings and charge-offs could mount unless vaccine distribution happens quickly enough to jump-start travel by mid-2021.

November 23 -

The move comes a day after the Federal Reserve had balked at the Treasury Department's demand that it return funds meant for pandemic relief that have so far gone unused.

November 20 -

The Term Asset-Backed Securities Loan Facility was brought back to inject $100 billion into the pandemic-battered economy, but only a fraction has been disbursed. Yet experts, pointing to its calming effects on markets, recommend that it be extended into next year.

November 17 -

Demand trends were mixed in the third quarter, with consumers showing more willingness than businesses to take on new debt, according to the Fed’s most recent survey on bank lending practices.

November 9 -

After issuance dampened during the presidential election week, corporate bonds and loans are expected to roll out amid a large trove of post-election earnings reports.

November 9 -

Executives from a half-dozen major financial institutions avoided detailed commercial lending forecasts and gave a mixed outlook on consumer credit at an industry conference. And they called on Washington to pass an aid package targeted at the most troubled business sectors as soon as it can.

November 5 -

Brookfield and JV partner Swig Co. are refinancing debt and cashing out $200M in equity in the iconic, sloped-base midtown Manhattan office tower.

November 5 -

Rescuing malls will be unusually complicated because the properties have byzantine webs of financing that have only grown more elaborate with time.

November 4 -

Loan issuers in the hotel/leisure, oil and gas, retail and business equipment/services industries – which make up nearly a quarter of the S&P/LSTA Leveraged Loan Index – are expected to lead the default tally over the next 12 months, according to a report from S&P.

November 3 -

Bankruptcy filings hit a three-month high as investors brace for economic shifts from the U.S. election that could force more large corporations to seek protection from creditors.

November 3 -

And an uptick from second-quarter numbers is attributed to seasonality rather than any upswing in the economy.

November 3 -

Annualized returns have now exceeded double digits for the 10th straight year, despite early 2020 volatility related to the coronavirus pandemic.

November 2 -

Many eateries that relied on outdoor dining to survive the pandemic could see revenues plummet as the weather turns cold.

October 30 -

Lenders pushed back against the notion that city dwellers' pandemic-driven flight to suburbia would hurt them. They say fewer landlords have sought deferrals as vacancy rates remain low and rent collections have stabilized.

October 29 -

Property debt funds, including at Blackstone Group Inc., raised $14.1 billion from April through September, compared with $15.7 billion a year earlier, according to research firm Preqin Ltd. Yet the expected flood of deals has so far been just a trickle.

October 28 -

Bankruptcy filings are surging due to the economic fallout of Covid-19, and many lenders are coming to the realization that their claims are almost completely worthless. Instead of recouping, say, 40 cents for every dollar owed, as has been the norm for years, unsecured creditors now face the unenviable prospect of walking away with just pennies - if that.

October 26 -

With the COVID-19 pandemic creating unprecedented challenges for small businesses, American Express has increasingly targeted its investments in that niche.

October 23 -

investors need to remember that speculative-grade companies aren’t immune from going bust, no matter how wide open the debt markets might be.

October 21