-

The three new deals totaling $1 billion that priced in August, bringing issuance for the year-to-date to $8.3 billion., That matches 2016's full-year total.

August 22 -

Although challenges have accelerated for certain segments of the U.S. retail industry, the exposure to troubled retail in U.S. structured finance sectors is limited, posing small-to-modest risks for some asset classes.

August 16 -

In Europe, €1.6 billion of new collateralized loan obligations priced during the month July, taking issuance volume for the year to date to €10 billion across 25 deals. That's in line with the €9.7 billion issued during same period last year.

August 7 -

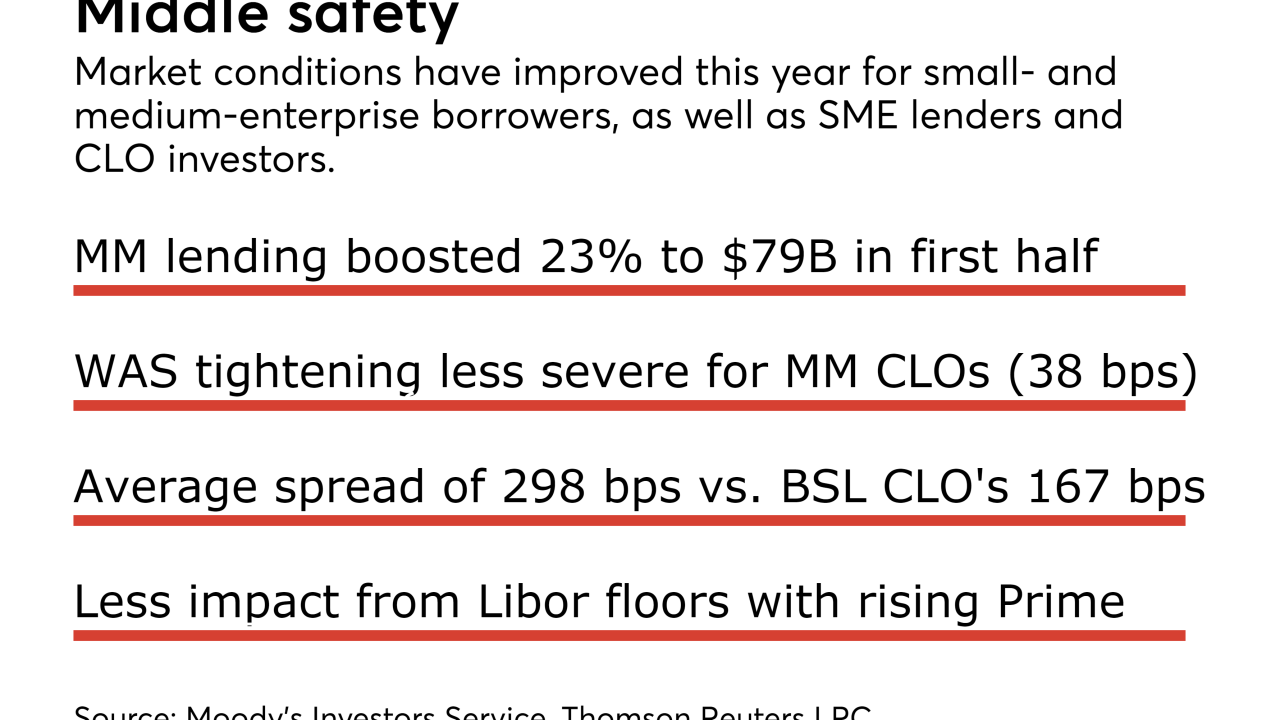

Tennenbaum is offering up its third middle-market CLO as market conditions ripen for SME loan portfolios

August 2 -

So-called transitional lending has traditionally been kept on balance sheet; but it’s become attractive to bundle the loans for transactions called (take a deep breath) commercial real estate collateralized loan obligations. Can investors stomach the features these deals sported before the crisis?

August 2 -

An affiliate managing the loan for the reinsurance giant's investment advisory arm will keep a horizontal equity strip of the deal for dual EU/US risk retention compliance.

August 1 -

While leveraged loans may use prime as a fallback, getting unanimous consent from collateralized loan obligation investors to use an alternative benchmark could be a challenge.

July 30 -

The alliance should help the asset registry and communications platform, accelerate its expansion beyond leveraged loans and structured finance and into more overseas markets.

July 20 -

Chinese banks and insurance companies represent a new and potentially large source of capital that could crowd out U.S. banks as investors in collateralized loan obligations.

July 11 -

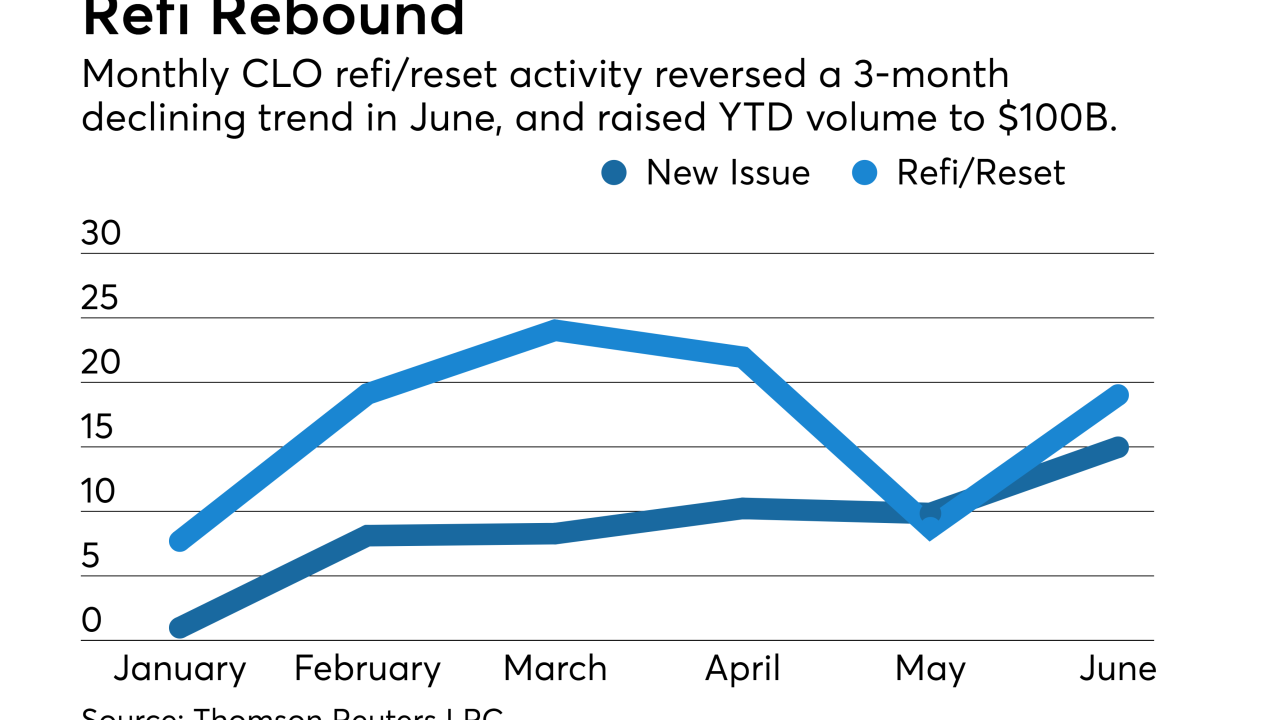

That was an increase of more than $5 billion, or 30%, from May's total, according to Thomson Reuters LPC, though it fell short of refinancing/reset activity, which rebounded to more than $19 billion.

July 10