-

S&P Global Rating's London office made the rare move to downgrade the junior-most notes in a 2016 CLO issued by a Danish credit manager due to a deterioration in portfolio maintenance levels.

February 2 -

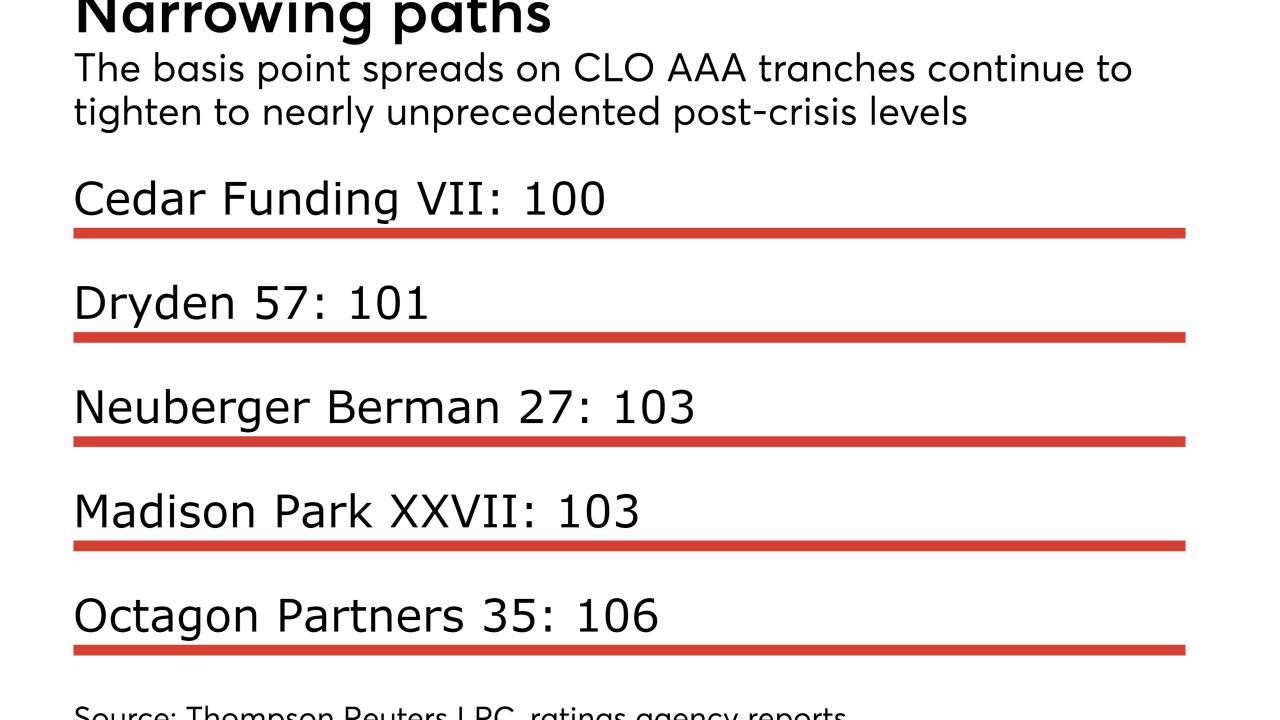

Aegon Asset Management's new Cedar Funding CLO VII is expected to price its senior triple-A notes at 100 basis points above Libor, carrying on a 2017 trend of tightening spreads.

January 31 -

While tightening down on cov-lite and subordinate loans, Marathon CLO XI's rules give the asset manager more room to trade in lower-credit and DIP loans.

January 31 -

Returns for equity investors are increasingly under pressure because of demand for the underlying loan assets, but strategies to boost returns can investors in other CLO securities at risk.

January 29 -

The $407 million Crown Point 4 is also the first CLO in nearly three years for Valcour, which was last in the market with the $400 million Crown Point III in March 2015.

January 26 -

Traditional refinancings are document intensive, time-consuming and costly; the SEC has given the green light to more efficient mechanism that resets coupons at periodic auctions.

January 22 Seward & Kissel’s Structured Finance and CLO Group

Seward & Kissel’s Structured Finance and CLO Group -

Previously a partner at Winston & Strawn, he brings more than 25 years of experience handling complex structured finance and specialty finance transactions.

January 19 -

The New York-based alternative asset manager is first out of the gate with a new-issue deal amidst a flurry of early reset/refinancing activity totaling $3.4 billion.

January 19 -

The Carlyle Group, Blackstone/GSO and Investcorp have reset or refinanced a trio of 2014 and 2015 vintage, euro-denominated deals.

January 17 -

The $165 billion of collateralized loan obligations that were refinanced in 2017 as a whole account for more than one-third of all U.S. CLO assets under management, according to Thomson Reuters LPC.

January 10