-

Rule 15c2-11's public disclosure requirements could inhibit Rule 144A issuers unless addressed.

December 2 -

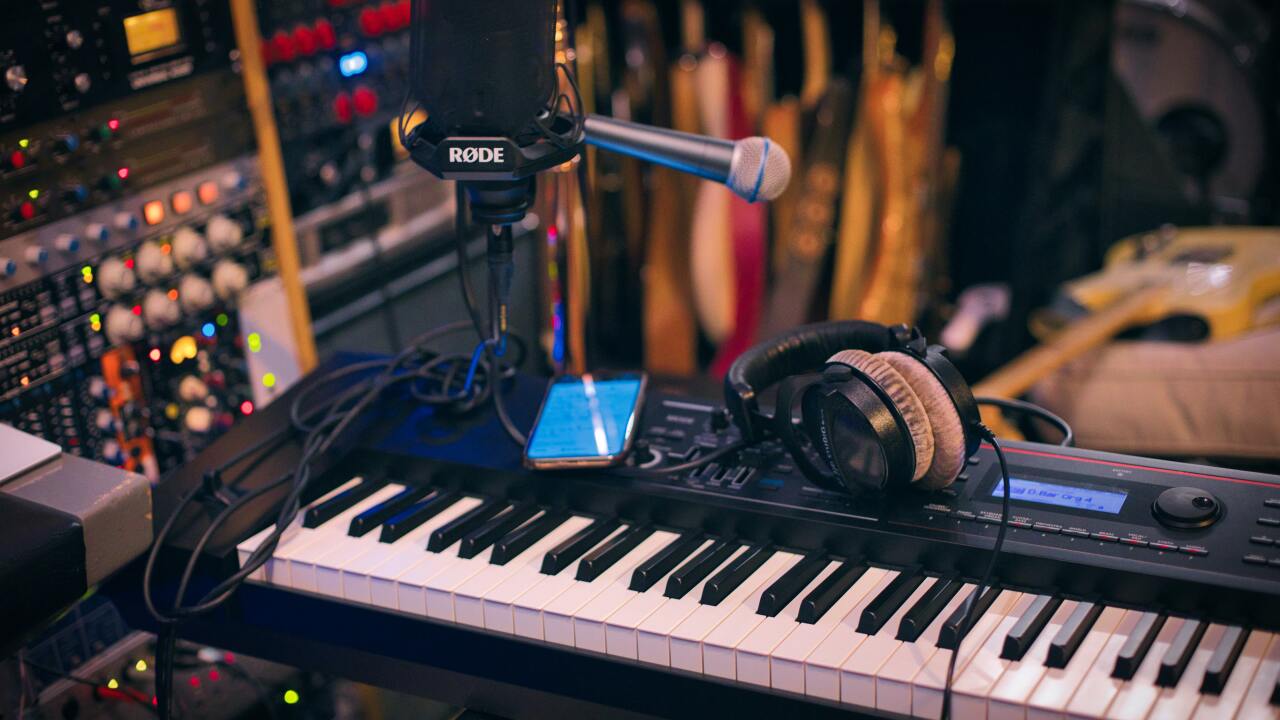

The catalog itself is valued at $4.1 billion, easily the largest portfolio value among the securitization industry's recent music royalty transactions.

November 30 -

The amended longstanding rule could drain liquidity from asset securitization markets, while a separate disclosure proposal is poised to burden CLOs.

November 15 -

Success could open up a major source of uncorrelated risk to structured-finance investors.

November 11 -

Should Libor become unavailable most CLO loans are already written to fall back to the prime rate. Managers will have to monitor their CLOs' legacy Libor loans.

November 3 -

Disclosure requirements have been in place since 2019, but until now it has been unclear whether the disclosures should adhere materially or exactly to templates.

October 19 -

Central banks' aggressive interest-rate hikes to tame inflation have increased the likelihood of borrowers' interest-rate coverage falling short.

October 13 -

The new law is expected to strengthen renewable energy market development, but ongoing supply-chain complications may hinder a jump in deals.

September 23 -

In the proposal, NAIC argues that an insurer purchasing every tranche of a CLO holds the same investment risk as purchasing the entire pool of loans backing the CLO.

September 12 -

The new loan forgiveness program should lessen maturity risk by lopping off a chunk of the student loans, accelerating payments to lenders.

September 1 -

Ali Ben Lmadani, ABL Aviation's founder and CEO, expects to see the values of mid-life aircraft fall from highs seen in 2017, when future values were booked too high.

August 23 -

The solar industry has made significant strides, and the related ABS market should continue under its own momentum, providing investors with attractive returns.

August 5 -

Amid reduced M&A activity, U.S. middle-market borrowers and investors in asset-backed securities are trying to reset and figure out where the right valuations levels are, says Sengal Selassie, CEO of Brightwood Capital Advisors, a lender and issuer of CLOs.

July 6 -

Questions remain around switching benchmarks that could result in unexpected refinancings

July 5 -

High hopes for 2022 crashed when Russia invaded the Ukraine, which left hundreds of aircraft stranded in Russia. But sector consolidation could lead to more deals.

June 17 -

The drop in CLO issuance from Q1 volume raised no alarms, coming off last year’s record $187 million issuance, and experts see strong production for 2022.

April 18 -

Despite perceptions that smaller companies are riskier, they pose less risk to investors. Realized loss rates are lower, and they deliver higher returns.

April 1 -

CLOs technically fall under the new disclosures and prohibitions for private-fund umbrella, but do not appear to be the proposed rule’s intended target.

March 21 -

The U.S. economy is relatively insulated from the events unfolding in Eastern Europe. Western Europe may be affected indirectly by higher energy prices.

March 14 -

The amendments effectively broaden the rule’s impact to include fixed-income securities, prompting several major industry groups to address SEC Chairman Gary Gensler.

February 28