-

Business owners are seeing their cash flow strained by the highest inflation in 40 years and mounting costs to borrow money.

By Jim DobbsJune 28 -

Most banks’ interest income will rise following the Fed policy shift. But the rate increase also boosts the likelihood of a recession that could hurt borrowers and drive up loan losses.

By Jim DobbsJune 16 -

An American Bankers Association panel of experts predicted much slower economic growth, but agreed that the U.S. economy will avoid a recession over the next couple of years.

By Jim DobbsJune 3 -

Increased interest income would boost lending profitability, but only if borrowers are confident enough in the economy to take out loans. And that's just one of the issues hammering banks' shares.

By Jim DobbsJune 1 -

Completion of U.S. Bancorp’s $8 billion acquisition of MUFG Union Bank, originally slated for June, has been pushed to the second half of 2022, the seller’s parent company says.

By Jim DobbsMay 16 -

Multiple factors have slowed residential sales, tightening the market for home loans for banks and credit unions.

By Ken McCarthyMay 5 -

Although small banks and credit unions are enjoying healthier loan portfolios, they are also bracing for potential setbacks due to higher interest rates and inflation.

By Ken McCarthyApril 26 -

Banking executives and analysts worry that the Federal Reserve's aggressive plan to raise interest rates will be insufficient to tame inflation and overcome economic fallout from the war in Ukraine.

By Jim DobbsMarch 21 -

Community bankers are excited that the Federal Reserve is poised to raise interest rates, which would make loans more profitable — unless rates rise so much they suppress demand.

By Jim DobbsJanuary 31 -

The San Francisco bank reported a 26% increase in its third-quarter earnings, thanks to robust single-family, multifamily and commercial real estate loan activity in New York, Boston and its home city.

By Jim DobbsOctober 13 -

Minnwest Bank, which focuses largely on agriculture lending, said it will “become more sophisticated" with its mortgage and consumer lending services by acquiring Roundbank.

By Jim DobbsAugust 16 -

The Arkansas bank has hired an 11-member team to develop its new operation. Much of the team joins from TCF Financial, which was sold to Huntington Bancshares in June.

By Jim DobbsAugust 10 -

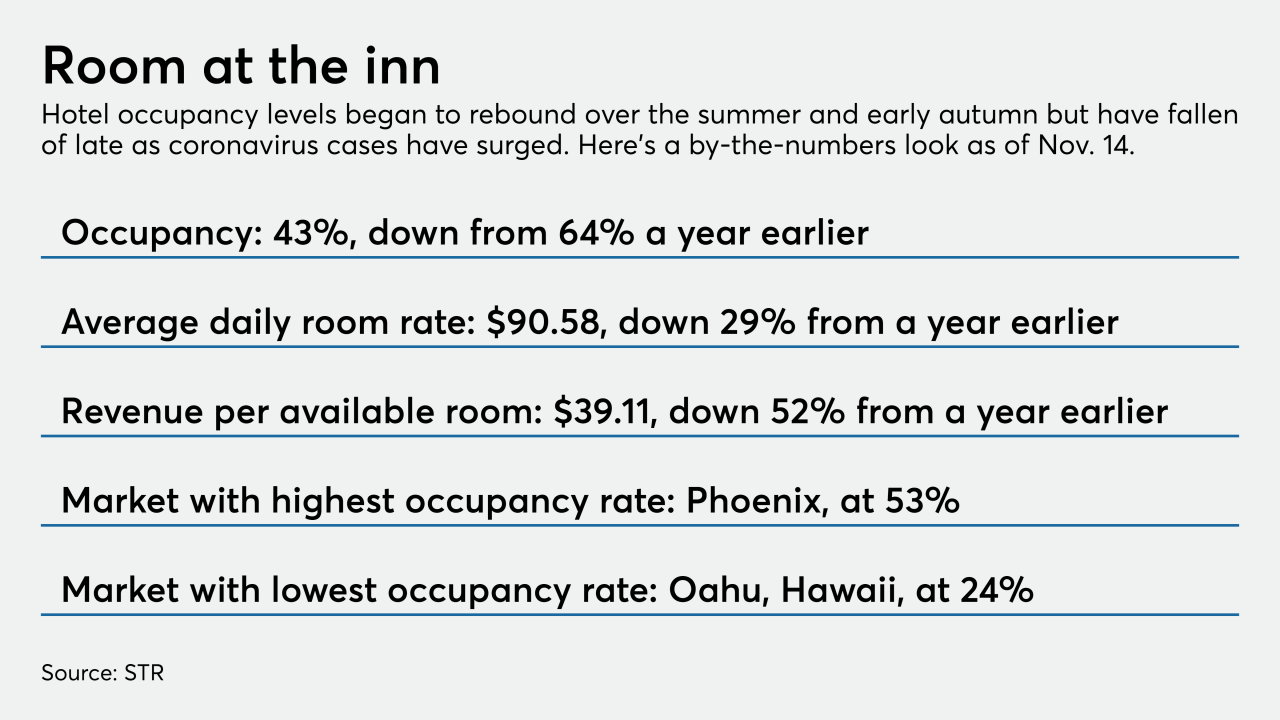

Consumers are booking rooms at levels not seen since early 2020 and loan delinquencies have fallen sharply as a result. Still, business travel remains sluggish and new COVID variants are spreading, threatening the hotel industry’s recovery.

By Jim DobbsJuly 19 -

Kerry Killinger, former CEO of Washington Mutual, says the asset bubbles and increased consumer debt that contributed to his company's failure are reappearing.

By Jim DobbsApril 30 -

Hildene Capital, which is pressuring CIB Marine to issue subordinated debt to redeem preferred stock, has nominated two individuals to stand for election to the company's board.

By Jim DobbsFebruary 24 -

Hospitality sector credits are coming out of forbearance just as coronavirus cases surge. Restructurings and charge-offs could mount unless vaccine distribution happens quickly enough to jump-start travel by mid-2021.

By Jim DobbsNovember 23 -

Commercial real estate loans are vulnerable as financial assistance for tenants winds down and might not be fully renewed. Late rent payments could rise, leading lenders to press landlords to pay up.

By Jim DobbsSeptember 23 -

More consumer and commercial borrowers are paying their loans, increasing the likelihood that charge-offs will be manageable for banks despite the ongoing pandemic.

By Jim DobbsSeptember 11 -

Community bank earnings are usually easy to understand, but loan deferrals and modifications as well as the complexities of the Paycheck Protection Program are skewing financial statements.

By Jim DobbsAugust 4 -

Bankers had asserted in April that they could handle a slump in oil prices tied to the coronavirus pandemic. Continued volatility, combined with declining collateral values and a rise in bankruptcies for exploration companies, is denting their confidence.

By Jim DobbsJuly 13