-

That level is wide of the six new-issue CLOs that priced last week at triple-A spreads of 110 basis spoints; CLO senior notes have widened 10 basis points, on average, over the past three months.

By Glen FestJune 22 -

It's the sponsor's first transaction since risk retention rules took effect; proceeds from the new five-year and 10-year notes will be used to repay note issued from the master trust in 2010.

By Glen FestJune 21 -

It's another example of what appears to be tailoring tranches to meet the tenor and yield requirements of specific investors; the deal, GMS Euro CLO 2014-1, was also upsized to €508 million from €368.3 million originally.

By Glen FestJune 20 -

LTC Global is one of the market leaders in a "relatively new" esoteric asset class of acquiring and financing insurance commission assets of life and healthcare insurance products, says DBRS.

By Glen FestJune 19 -

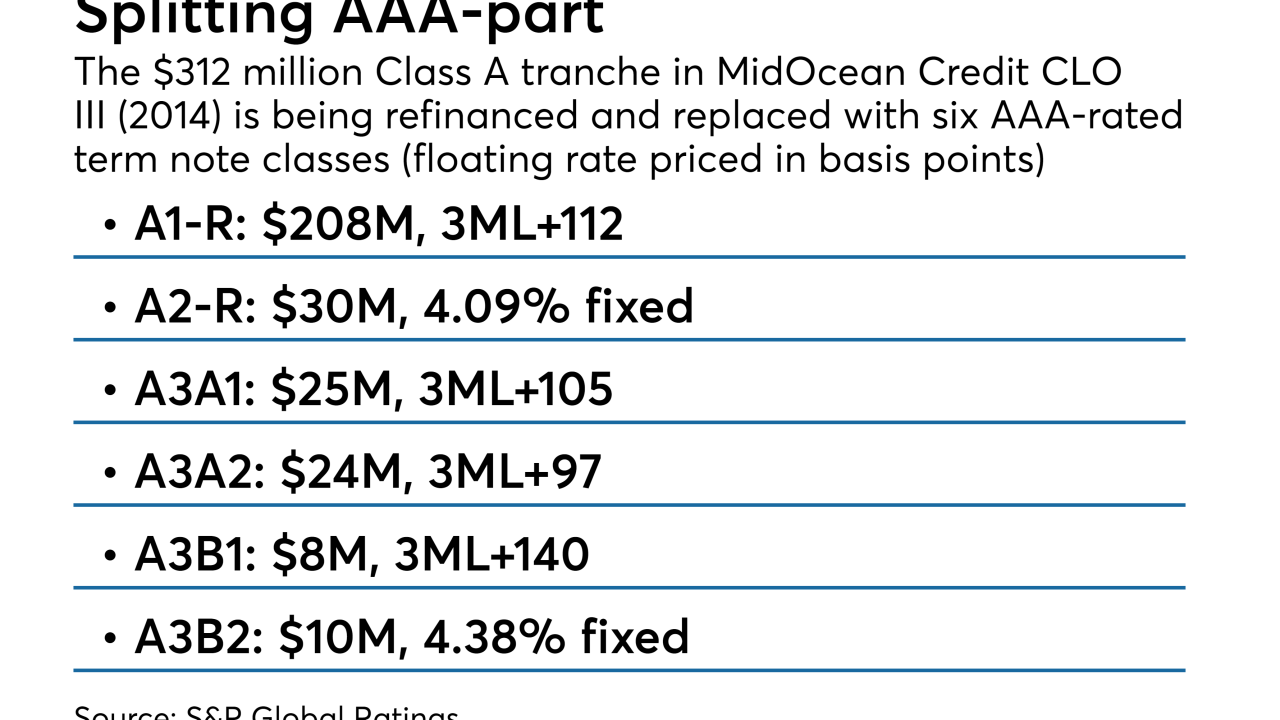

The original $312 million triple-A notes are being replaced with six separately priced Class A note tranches, including two fixed-rate securities classes

By Glen FestJune 18 -

The concentration of loans with terms of 73-75 months has breached 13%, after ranging from between 10-12% from five previous AART issues since 2016.

By Glen FestJune 18 -

The $100 million Series 2018-1 notes will rank on an equal basis with the $900 million of notes Coinstar issued from the same master trust in May 2017, all are collateralized by nearly 20,000 coin-counting kiosks located in major retail stores.

By Glen FestJune 15 -

In Santander Consumer USA's third subprime shelf offering of 2018, new cars represent 55.8% of the collateral. In previous deals dating to 2013 new-car concentrations did not exceed 40.9%.

By Glen FestJune 15 -

Five classes of notes will be issued in the transaction, BBVA Consumer Auto 2018-1, which is backed by a pool of well-seasoned loans on new and used cars that will revolve for an initial period of 1.5 years.

By Glen FestJune 14 -

CLO securities pay out interest pegged to the three-month London interbank offered rate, but loans used as collateral are increasingly switching to one-month Libor and the spread between the two benchmarks has widened significantly.

By Glen FestJune 14