-

Marlette sharply reduced the share of sub-700 FICO borrowers, while also tightening a trigger tied to cumulative loss rates to enhance investor protections.

By Glen FestNovember 5 -

While three deals matches 2017's output, the total $2.08B volume of 2018 issuance trails the 2017 level by more than $1B.

By Glen FestNovember 1 -

The firm's risk profile has not altered, executives said on a third-quarter earnings call Wednesday; it remains "appropriately cautious."

By Glen FestNovember 1 -

The deal comes a year after the captive finance company began excluding low-FICO loans from its primary auto loan ABS platform.

By Glen FestOctober 31 -

It's the first time any of the rating agencies has assigned an AAA for any securitization of consumer loans by a marketplace lender.

By Glen FestOctober 31 -

The Urban Institute's conclusion is based on estimates that one-year SOFR rates could be 25 to 50 basis points lower than the current Libor equivalent.

By Glen FestOctober 31 -

The €411 million deal puts it in the small club of UK managers that have completed three or more transactions in 2018.

By Glen FestOctober 31 -

The New York-based firm is adding 4.9 years to the reinvestment period of the $518.6 million Neuberger Berman CLO XVIII.

By Glen FestOctober 30 -

The REIT formerly known as Sutherland Asset Management is pooling loans with an average balance of $583,029 on primarily single-tenant and owner occupied properties.

By Glen FestOctober 29 -

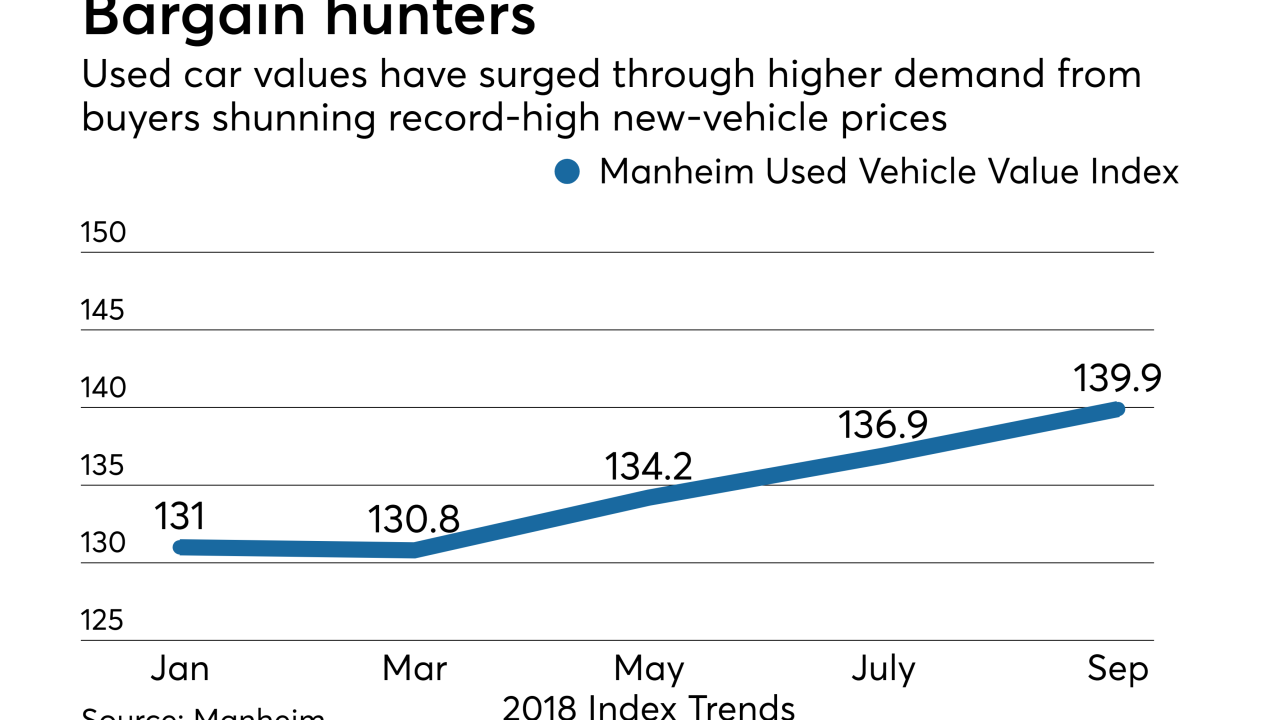

Sales of older vehicles are on the rise and prices are headed back up, so there's more collateral available and it is also performing better.

By Glen FestOctober 29 -

Toyota Motor Credit Co.'s fourth prime auto loan securitization of the year boosts its volume beyond $6 billion.

By Glen FestOctober 26 -

The Austin, Tex.-based lender has privately structured and placed an undisclosed number of commercial energy-efficiency and retrofit upgrades from 10 states into a privately placed ABS.

By Glen FestOctober 25 -

Even with advanced seasoning and lighter risk load, the bank's first auto-loan securitization of the year has much higher CE than a weaker 2017 pool.

By Glen FestOctober 25 -

The London-based manager is including two classes of fixed-rate notes, including a rare triple-A rated nonvariable-rate tranche, in its €412 million Contego VI DAC portfolio.

By Glen FestOctober 25 -

Turbo Finance 8 is a £375.5M static transaction that includes both hire purchase loan contracts and personal contract purchase, lease-like arrangements.

By Glen FestOctober 24 -

A "second look" finance partner for retailers like Home Depot and Sears Home Pro is offering $167.3M in bonds secured by receivables on high-interest cards and installment accounts.

By Glen FestOctober 24 -

It seems a lot of CLO managers who were worried about competing amid heavy supply in the fourth quarter have put issuance on hold until 1Q 2019.

By Glen FestOctober 23 -

Both S&P and Moody's have cut expected losses on $732 million deal, yet credit enhancement on the senior tranches is unchanged from the prior deal.

By Glen FestOctober 22 -

The credit quality of loans backing the Cailfornia-based lender's $183 million securitization is better than that of its inaugural deal, which was only rated 'A' by Kroll.

By Glen FestOctober 18 -

Managers surveyed by IACPM generall agree a downturn in the current global credit cycle is coming, but aren't yet "willing to put on the brakes."

By Glen FestOctober 18