-

They join Blackstone/GSO, PGIM, Credit Suisse, Guggenheim Securities and the Carlyle Group in reopening a new-issue market that was dormant in December.

By Glen FestFebruary 2 -

Just 28% of vehicles backing the $400 million Avis Budget Rental Car Funding Series 2019-1 come with repurchase agreements from the manufacturers, including Ford, General Motors and Chrysler.

By Glen FestFebruary 1 -

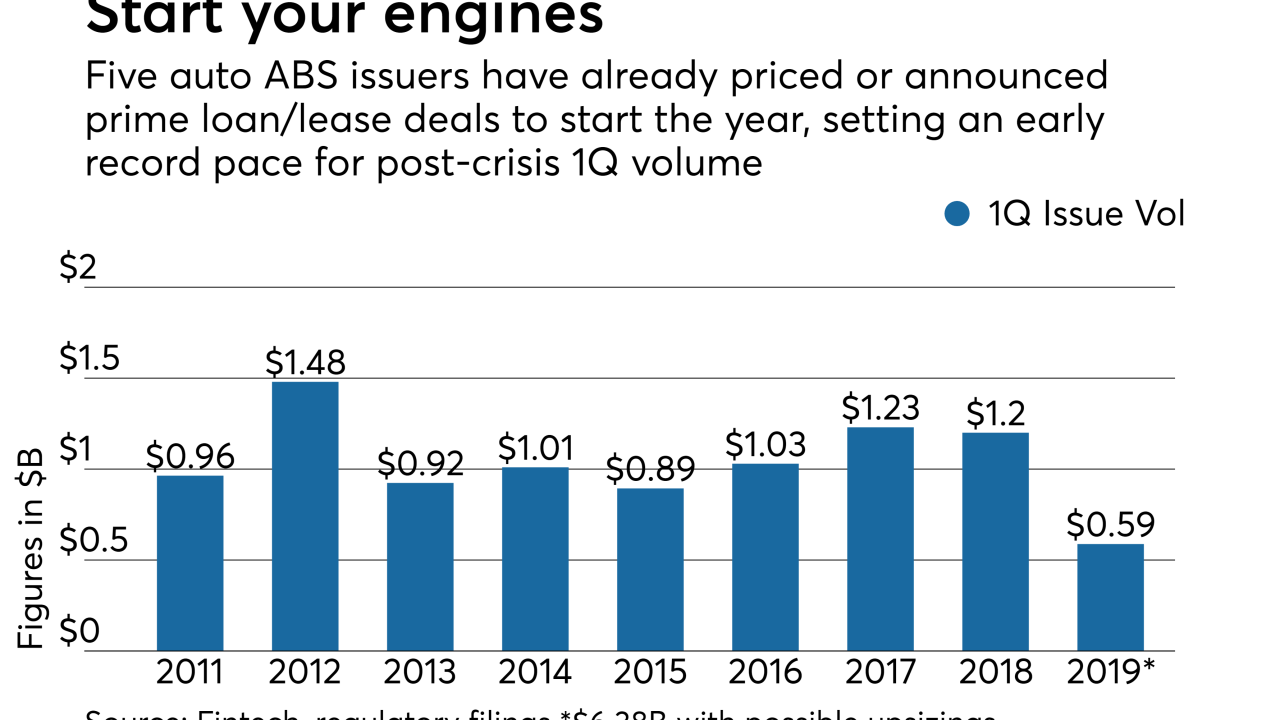

The three offerings launched Thursday add to the $3.9 billion of prime auto supply already issued this year by General Motors, Ford Motor Co. and CarMax.

By Glen FestJanuary 31 -

Both lenders are boosting originations to borrowers with near-prime loans, though the impact on the overall credit quality of the collateral for their deals is slight.

By Glen FestJanuary 30 -

At least 50% of the U.S. dollar-denominated fund's investments will be in triple-B tranches of U.S. and European CLOs.

By Glen FestJanuary 30 -

Risk retention rules that Japan's Financial Services Agency has proposed for securitizations may not apply to U.S. collateralized loan obligations after all, according to the LSTA.

By Glen FestJanuary 29 -

Guggenheim, Carlyle Group, Credit Suisse and Blackstone have launched four deals totaling €1.74 billion, all with AAA spreads of at least 100 basis points over Euribor.

By Glen FestJanuary 29 -

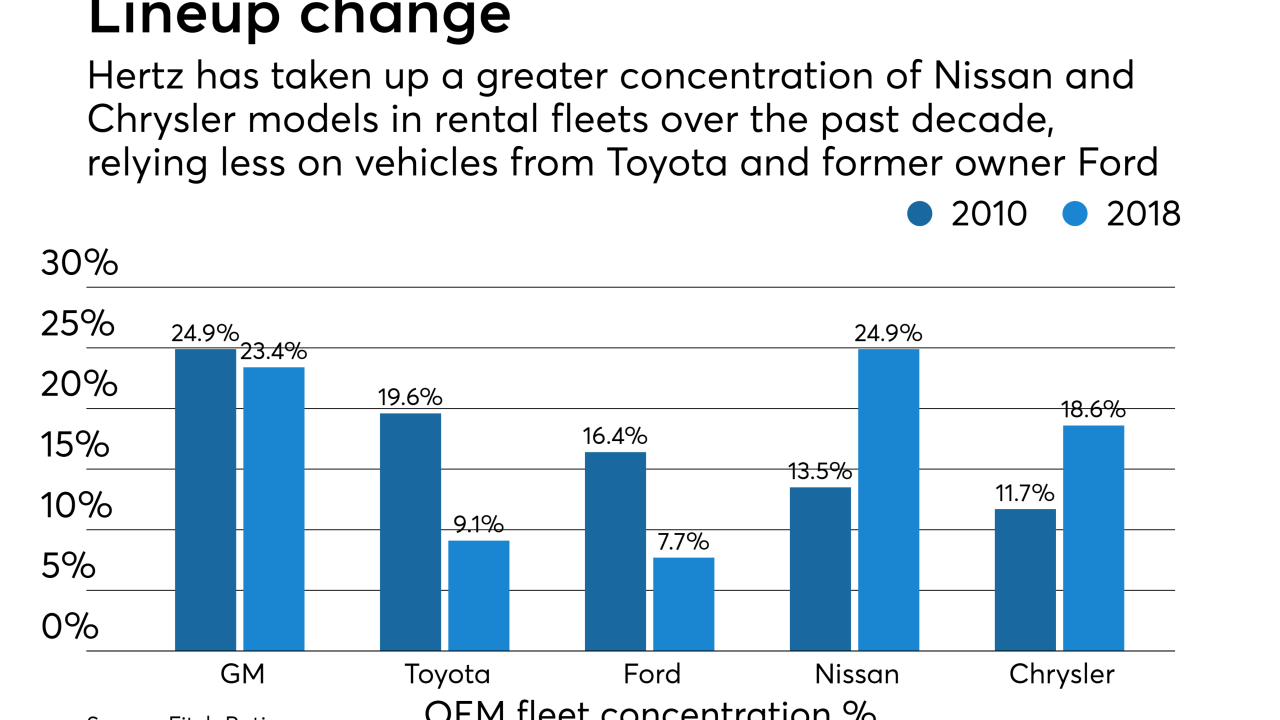

Hertz is issuing the deal following a performance turnaround that includes better returns on the resale value of older cars disposed from its fleet

By Glen FestJanuary 28 -

The rating agency has increased loss expectations for the lender's next securitization, saying trade volatility and tariffs, such as in the soybean sector, might stress some borrowers.

By Glen FestJanuary 25 -

Cadogan Square CLO XIII DAC will be Credit Suisse Asset Management's fourth euro-denominated CLO issued in the past 12 months.

By Glen FestJanuary 24 -

The "second-look" financing partner for retail chains like Home Depot is offering $135.9 million of notes backed by card receivables in its first securitization.

By Glen FestJanuary 23 -

TD Bank joins RBC and Bank of Montreal in sponsoring U.S.-dollar securitizations of prime credit-card receivables from its managed portfolio. The market is still awaiting its first U.S. institutional deal.

By Glen FestJanuary 23 -

That's significantly wider than 121 basis points average for new CLOs backed by broadly syndicated loans that were issued in December.

By Glen FestJanuary 22 -

The $312 million transaction a 24-month reinvestment period, in which principal collections can be used to invest and acquire additional loans for the collateral pool.

By Glen FestJanuary 18 -

GoldenTree's $757 million CLO is the first deal seeking to price in the 2019 primary market, while Octagon Credit Investors is refinancing a $791.5M, 2014-vintage CLO (for a second time).

By Glen FestJanuary 18 -

The collateral for the $550 million transaction is slightly weaker than that of its prior deal, but rating agencies expect cumulative net losses to be in the same range.

By Glen FestJanuary 18 -

The two latest transactions will push announced deal volume at or above $6 billion for the first two weeks of 2019.

By Glen FestJanuary 17 -

Physicians account for 28.8% of borrowers in the collateral pool, up from 22% for SoFi's previous student loan securitization, according to Moody's Investors Service. Notably, fewer of these, 4.2% versus 7.8%, are in residency programs.

By Glen FestJanuary 16 -

The Japan Financial Services Agency is considering increasing capital requirements for holdings of securitizations if the sponsors do not have "skin in game."

By Glen FestJanuary 16 -

The deal is the first credt card securitization by anyone in 2019 and features two-year floating-rate notes from RBC's master trust.

By Glen FestJanuary 15