-

The "second-look" financing partner for retail chains like Home Depot is offering $135.9 million of notes backed by card receivables in its first securitization.

By Glen FestJanuary 23 -

TD Bank joins RBC and Bank of Montreal in sponsoring U.S.-dollar securitizations of prime credit-card receivables from its managed portfolio. The market is still awaiting its first U.S. institutional deal.

By Glen FestJanuary 23 -

That's significantly wider than 121 basis points average for new CLOs backed by broadly syndicated loans that were issued in December.

By Glen FestJanuary 22 -

The $312 million transaction a 24-month reinvestment period, in which principal collections can be used to invest and acquire additional loans for the collateral pool.

By Glen FestJanuary 18 -

GoldenTree's $757 million CLO is the first deal seeking to price in the 2019 primary market, while Octagon Credit Investors is refinancing a $791.5M, 2014-vintage CLO (for a second time).

By Glen FestJanuary 18 -

The collateral for the $550 million transaction is slightly weaker than that of its prior deal, but rating agencies expect cumulative net losses to be in the same range.

By Glen FestJanuary 18 -

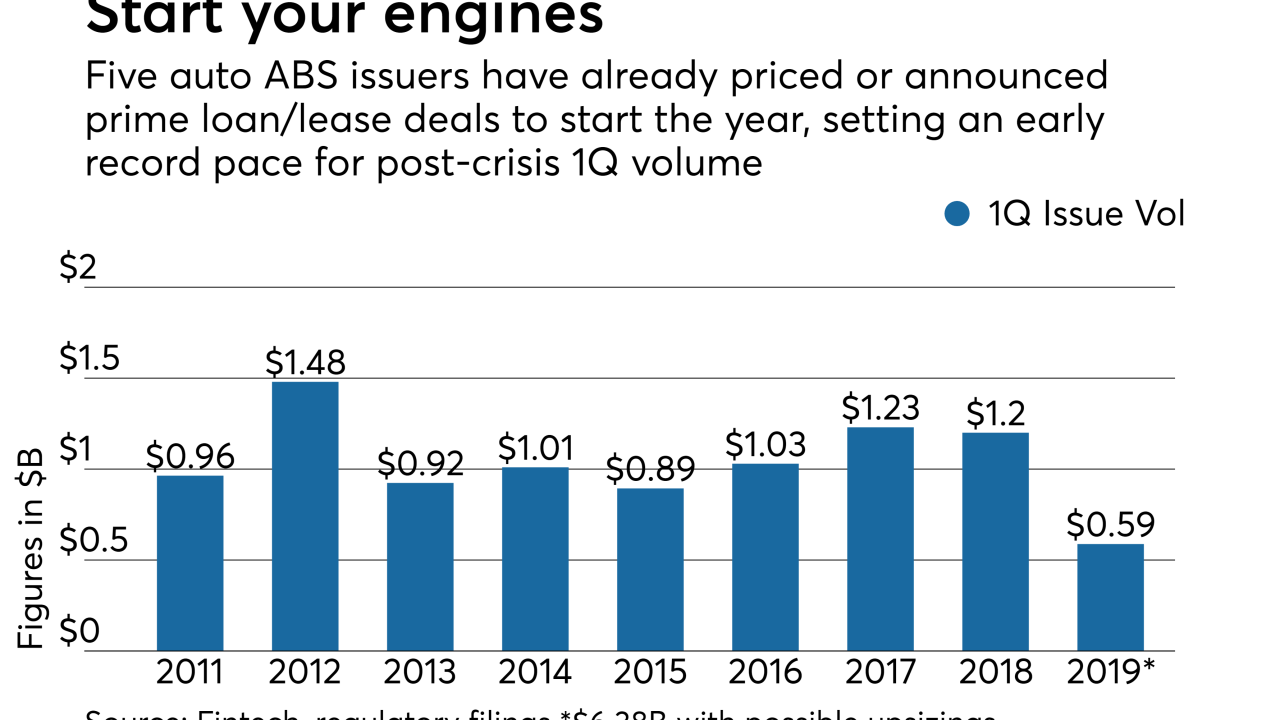

The two latest transactions will push announced deal volume at or above $6 billion for the first two weeks of 2019.

By Glen FestJanuary 17 -

Physicians account for 28.8% of borrowers in the collateral pool, up from 22% for SoFi's previous student loan securitization, according to Moody's Investors Service. Notably, fewer of these, 4.2% versus 7.8%, are in residency programs.

By Glen FestJanuary 16 -

The Japan Financial Services Agency is considering increasing capital requirements for holdings of securitizations if the sponsors do not have "skin in game."

By Glen FestJanuary 16 -

The deal is the first credt card securitization by anyone in 2019 and features two-year floating-rate notes from RBC's master trust.

By Glen FestJanuary 15 -

A few took advantage of deep discounts to scoop up collateral for new deals on the cheap; others swapped out some of their weakest credits for more highly rated loans.

By Glen FestJanuary 15 -

Ford Motor Credit added a one-time seven-year revolving period to its previous open pool of auto loan receivables.

By Glen FestJanuary 11 -

More than 45% of collateral for the $254.4 million CPSART 2019-A are either "preferred," "super alpha” or “alpha plus”; that's up from 42.4% of collateral for the prior deal.

By Glen FestJanuary 10 -

CarMax Superstores' first $1.2B-$1.5B prime loan securitization of 2019 has its lowest concentration to date of passenger vehicles in its nearly 20 years selling notes backed by receivables.

By Glen FestJanuary 10 -

The latest deal from the sponsor's DRIVE platform for deep subprime loans benefits from recent improvements in underwriting; both S&P and Moody's have lowered loss expectations.

By Glen FestJanuary 9 -

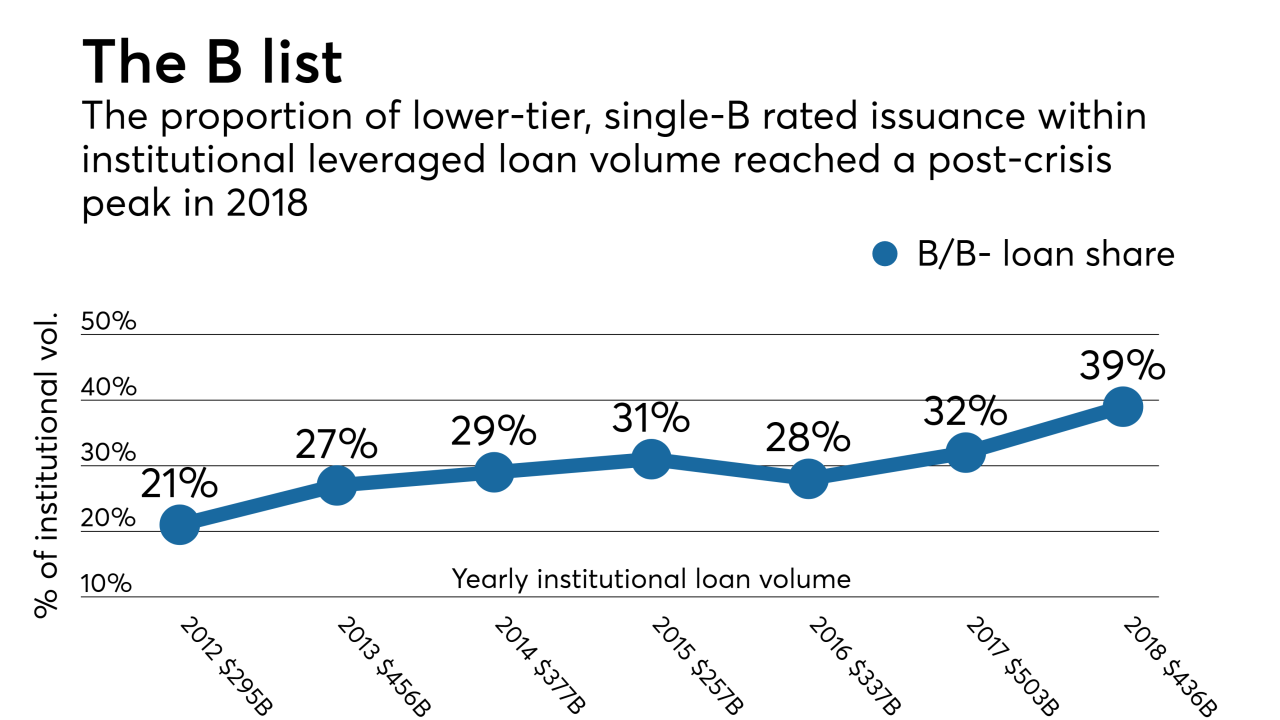

Z Capital's $350M CLO can hold up to 50% of its assets in risky triple-C rated assets, giving it a wide cushion to bulk up on the growing supply of single-B loans near the CCC-rating threshold.

By Glen FestJanuary 9 -

The market has not seen a prolonged period of widening spreads since an eight-month period before early 2016, which was the launching point for a nearly two-year run of AAA spread narrowing.

By Glen FestJanuary 8 -

New Residential acquired its latest pool of loans from five servicers, garnering a rare pledge of P&I advances on defaulted mortgages.

By Glen FestJanuary 4 -

The global asset manager is sponsoring its first post-crisis CLO in a €409.8 million transaction that priced through Barclays on Monday.

By Glen FestJanuary 3 -

The collateral for GMCAR Trust 2019-1 features a higher weighted average borrower FICO than any prior GM Financial deal; it also sports a lower projected cumulative net losses from Fitch Ratings.

By Glen FestJanuary 3