-

Kubota Credit Corp.’s $800 million asset-backed transaction is not expected to generate any additional losses than forecast for the finance company’s previous ABS in 2018, according to presale reports.

By Glen FestMay 22 -

The transaction involves 14,337 leases and power-purchase agreements that financed photovolatic solar-panel installations in 13 states plus Guam and the District of Columbia.

By Glen FestMay 22 -

A Davis & Gilbert poll of market participants showed more expect delinquencies over the next one to two years, likely requiring credit enhancement in future deals.

By Glen FestMay 22 -

The $403.1 million Atlas Senior Loan Fund XIV will have seven classes of notes, as well as a combination securities tranche that will make up all or portions of three subordinate classes.

By Glen FestMay 21 -

The Lineage Logistics transaction is the largest single-borrower, large-loan deal since the Blackstone Group tapped the CMBS market for a $2.5 billion single-loan deal backed by 169 industrial properties and two data centers.

By Glen FestMay 21 -

The increase in investor scrutiny of managers like Värde Partners is building up as more firms are issuing actively managed pools of short-term CRE loans.

By Glen FestMay 20 -

The $161.5 million transaction backed by leasehold interests in the Jimmy Buffett-themed luxury hotel will include a $49.3M cash-out payment to the Denver-based PE firm.

By Glen FestMay 20 -

The company has struggled with flat store sales as well as an open revolt from its largest franchisee group that has called for new ownership and management of the 21-state regional chain.

By Glen FestMay 19 -

Proceeds from the new deal will pay down nearly $1.3 billion in outstanding debt from parent company Dine Brands Global's two prior securitizations.

By Glen FestMay 17 -

Both transactions are the second this year for each of the automotive captive-finance firms, and will build on a tally of 19 prime auto loan ABS pools to date this year totaling $21.44 billion.

By Glen FestMay 16 -

S&P Global Ratings forecasts lower losses in subprime lender American Credit Acceptance's next auto-loan securitization, citing the inclusion of performing loans transferred from a recently called deal.

By Glen FestMay 16 -

Social Finance is supplying lower levels of credit enhancement to its third consumer-loan securitization of 2019.

By Glen FestMay 16 -

The lender has not sponsored an asset-backed transaction since 2007, according to presale reports.

By Glen FestMay 15 -

Shawbrook's debut securitization of "buy-to-let" mortgages issued to UK landlords will pay coupons based on the sterling-based overnight index average benchmark, rather than Libor.

By Glen FestMay 14 -

After issuing five RMBS deals of prime jumbo loans in 2019, JPMorgan has gathered a pool of 919 investor-only properties for its next mortgage securitization.

By Glen FestMay 14 -

The 240 note classes under review from 24 issuers include several already holding high-risk triple-C ratings.

By Glen FestMay 14 -

After a slow takeoff in the first quarter, a third aircraft lease securitization has launched since April through a debut offering from six-year-old fleet management firm Goshawk Management.

By Glen FestMay 13 -

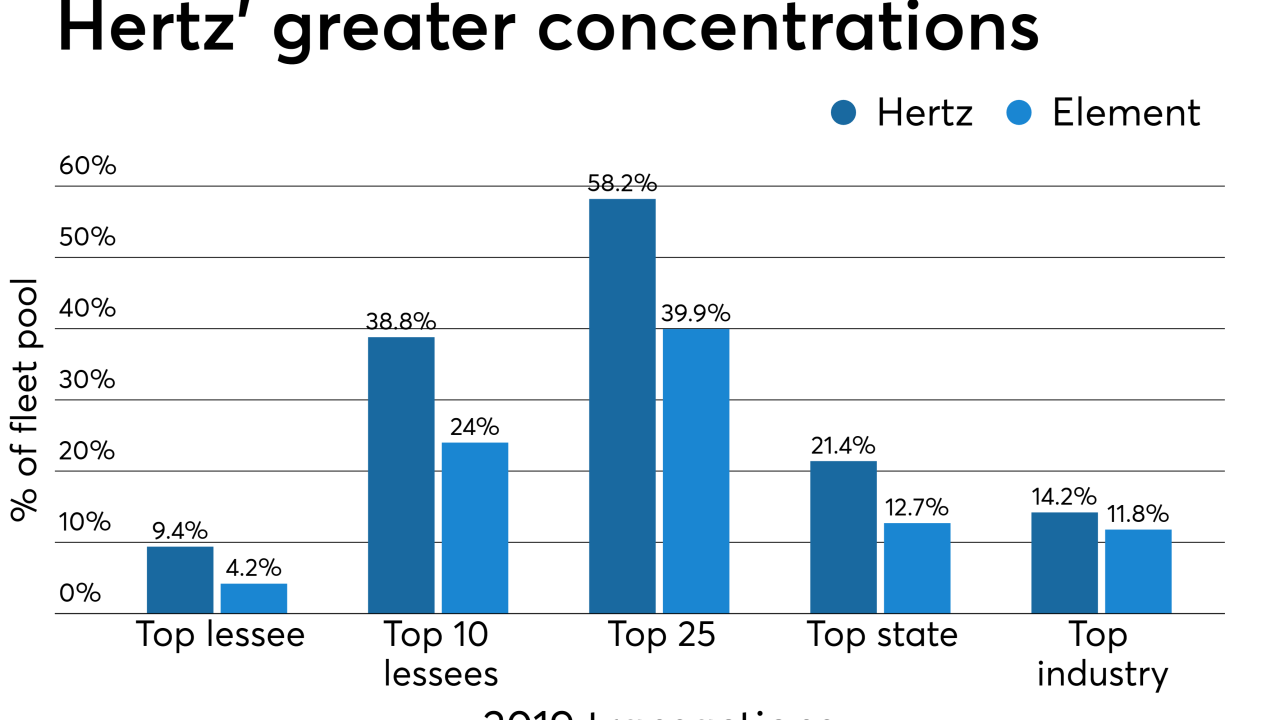

Energy industry clients make up 8.8% of the value of the latest pool from the master trust of Donlen Corp., a fleet management subsidiary of Hertz.

By Glen FestMay 10 -

GM Financial is sponsoring two series of notes totaling $1.2 billion with staggered revolving periods; Hyundai Capital America's deal is its first floorplan offering in three years.

By Glen FestMay 9 -

The loan pool includes a 9% share of Sheraton properties and 10% of Westin. MVW acquired both last September.

By Glen FestMay 8