-

All of the loans were originated by Greystone, an investment group based in New York that originated multifamily and health care facility loans for Fannie Mae, Freddie Mac, the FHA and various commercial mortgage-backed securities.

By Glen FestAugust 13 -

The decline in the share of "cured" delinquent loans is a potential signal for increased securitization losses in the months to come.

By Glen FestAugust 13 -

The increases are mostly at the junior debt levels of deals, according to the Refinitiv research unit.

By Glen FestAugust 12 -

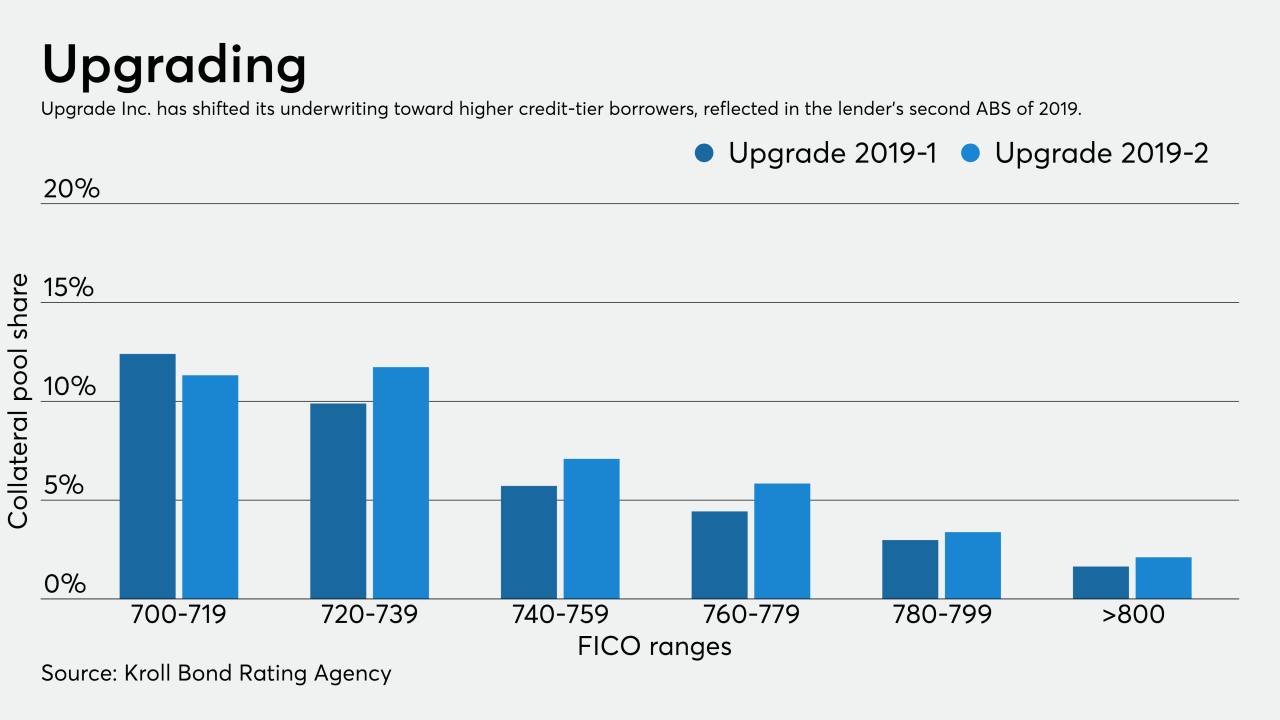

Online consumer lender Upgrade Inc. is including more higher-credit tier borrowers in its next securitization, reflecting the company’s focus this year on reducing lending to non-prime credit segments.

By Glen FestAugust 12 -

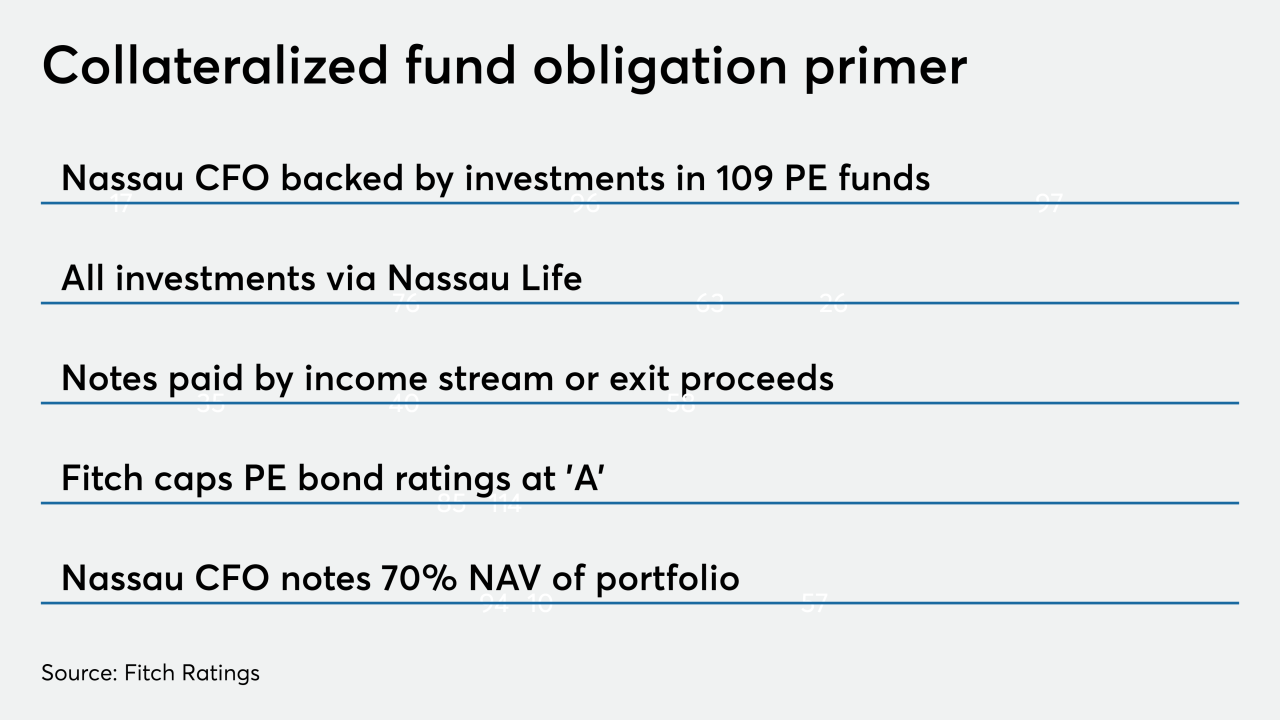

Nassau Financial Group is following the lead of a Singapore sovereign wealth fund into the fledgling asset-backed securities class of private-equity bonds.

By Glen FestAugust 12 -

Lighter seasoning compared to American Credit Acceptance's last loan portfolio issuance is the primary reason, say ratings agencies.

By Glen FestAugust 8 -

Regional Toyota captive finance lender World Omni has its highest-ever average FICO for a securitization of prime auto-lease receivables. But it also is pooling a portfolio of contracts that have a highly concentrated mix of lease maturities.

By Glen FestAugust 8 -

The online SME lender is marketing $198.45 million in notes backed by U.S. originations. Funding Circle has previously issued ABS deals backed by small-business loans in its native UK.

By Glen FestAugust 7 -

The deal coincides with that of another first-time whole-biz issuer this week, Primrose School Franchising Co. Primrose is marketing the franchise fees and revenues of its chain of early childhood education and day care centers.

By Glen FestAugust 6 -

Primrose School Franchising Co. is marketing $275 million in bonds backed by a whole-business securitization of royalties and revenues from the firm’s rapidly expanding 405-school franchised network of early childhood/pre-K education and day care centers.

By Glen FestAugust 5 -

PIMCO is resecuritizing a large swathe of mostly non-qualified home loans that were previously bundled in 2016-2017 mortgage-backed securities, according to presale reports.

By Glen FestAugust 5 -

“Buy here, pay here” auto lender Byrider’s improvements in recent ABS collateral performance and operational servicing changes are gaining favor with ratings analysts.

By Glen FestAugust 2 - LIBOR

According to Covenant Review, HPS Investment Partners is among the first CLO managers to plan on the use of a forward-looking SOFR term rate to price coupons if Libor benchmark rates disappear after 2021, as expected.

By Glen FestAugust 2 -

Hilton Resorts Corp. will add up to $21 million in additional collateral after the closing of its Hilton Grand Vacations Trust 2019-A transaction, its first of the year.

By Glen FestAugust 2 -

Moody’s said the Fed’s cuts – the first in a decade by the central bank – will boost real estate and consumer ABS collateral by helping lenders uphold underwriting standards and provide affordable debt options to borrowers.

By Glen FestAugust 1 -

Bank of America is tapping the commercial mortgage-backed securities market to refinance the debt on its namesake Manhattan office building, providing BofA and building co-owner The Durst Company with a hefty cash-equity payout.

By Glen FestAugust 1 -

The 14 deals priced the week of July 22 included 10-year deals that have bought 2019 volume to $73 billion, or just shy of the comparable $75 billion mark in 2018, which had record total volume of $129 billion.

By Glen FestJuly 31 -

S&P stated that as more loans stretch into 72 months or even 84 months as a result of rising new-vehicle prices, auto ABS investors must be mindful of increased credit risks that accompany extended-term loans.

By Glen FestJuly 30 -

Angel Oak Mortgage Trust 2019-4 involves 1,551 loans, according to ratings agency presale reports. Nearly 84% of the loans have borrowers who do not meet the CFPB’s qualified mortgage standard.

By Glen FestJuly 29 -

The deal follows Starwood Capital Group's first transaction in residential mortgage securitization in March.

By Glen FestJuly 29